Mapping Foreclosures: Geographic Insights

Foreclosure mapping transforms complex data into visual tools that highlight patterns and trends. By combining Geographic Information Systems (GIS) with real-time data, investors can identify areas with high potential or risks. Key takeaways include:

- Geographic Analysis: Maps reveal clusters of distressed properties, offering insights into market trends.

- Mapping Tools: GIS and web-based platforms integrate foreclosure data with demographics, crime rates, and economic factors.

- Real-Time Integration: Up-to-date overlays help track market shifts and predict foreclosure hotspots.

- Investment Strategy: Layered data analysis pinpoints undervalued properties and recovery zones.

This approach helps investors make informed decisions by visualizing data and understanding the factors behind property distress.

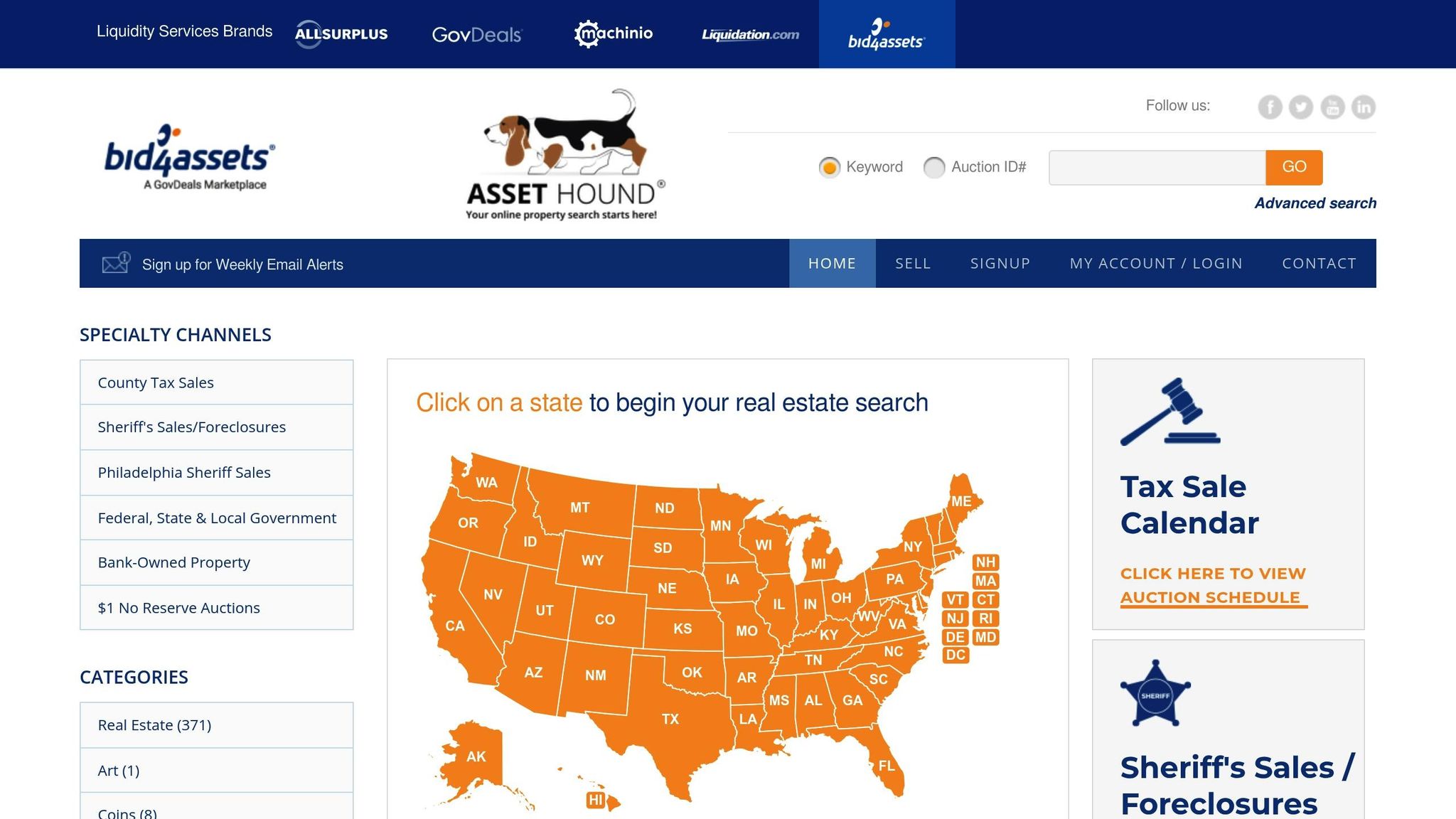

Due Diligence: A Guide to Researching Tax Sale Properties with Bid4Assets' CEO

Main Tools and Technologies for Mapping Foreclosures

The evolution of foreclosure mapping has brought real-time data processing to the forefront, giving investors instant insights into market conditions [3]. Tasks that once required weeks or even months can now be completed in moments, allowing for quicker responses to market changes and emerging opportunities. At the heart of this transformation are three crucial technologies: Geographic Information Systems (GIS), web-based visualization platforms, and data overlay capabilities. Together, these tools connect complex data analysis with user-friendly platforms, redefining how foreclosure data is accessed and utilized.

Geographic Information Systems (GIS)

GIS platforms are the cornerstone of advanced foreclosure analysis, offering tools that go far beyond basic mapping. These systems excel at visualizing patterns and integrating foreclosure data with socio-economic factors such as income levels, unemployment rates, and housing availability [1][2]. Instead of viewing properties in isolation, GIS provides a broader perspective, showing how foreclosures cluster and distribute across regions.

This layered approach enables investors to uncover the "why" behind foreclosure trends. GIS tools can identify patterns in property valuations, compare price-per-square-foot data, and flag anomalies that might signal unique opportunities or risks [2]. For example, they can highlight areas where foreclosures are disproportionately high or where market conditions are ripe for investment.

Cities like Cleveland and Boston have already implemented GIS-based systems for early warnings and coordinated interventions, helping both investors and local governments make informed decisions [4].

Web-Based Visualization Platforms

Web-based mapping tools have transformed foreclosure analysis by making geographic insights accessible to a broader audience. These platforms are designed with user-friendly interfaces that simplify complex data, making them valuable even for those without a technical background.

The mobility offered by these tools is a game-changer. Investors can access detailed foreclosure maps from any internet-connected device, whether they're evaluating properties on-site or presenting data to stakeholders. Many platforms also include intuitive filters, allowing users to sort properties by type, price range, foreclosure status, or location.

Additionally, these systems often integrate with real estate databases, providing a wealth of property-specific information. Users can view property photos, estimated market values, ownership history, and neighborhood statistics - all within the same interface. This seamless integration saves time and ensures that investors have all the information they need to make informed decisions.

Data Overlay and Real-Time Integration

Real-time data overlays take visualization to the next level, providing investors with up-to-the-minute insights into market dynamics. This capability is a significant leap forward [3]. By tracking changes as they occur, these tools allow investors to adapt quickly to shifting conditions.

The overlays go beyond basic demographics, incorporating economic indicators, property valuations, and even crime statistics [3][4]. This added context helps investors understand why certain areas face higher foreclosure rates and whether these trends are short-term fluctuations or more persistent challenges.

One of the most powerful applications of data overlays is their ability to predict foreclosure hotspots before they fully materialize [3]. By identifying these trends early, investors can target undervalued properties and implement strategies to mitigate risks. Law enforcement agencies have also adopted these tools; for instance, officers in Loudon and Fairfax Counties, Virginia, use foreclosure maps to monitor vacant properties during patrols [4].

Modern platforms combine these overlay features with real-time data feeds, giving investors a strategic edge. This proactive approach turns foreclosure investing into a forward-looking process, enabling users to anticipate market shifts and seize opportunities before they become widely apparent [3].

Geographic Factors That Impact Property Distress

Understanding the geographic factors behind property distress can offer valuable insights for investors. These factors, which operate on both neighborhood and regional levels, shape the conditions that lead to property instability. By identifying these patterns, investors can make smarter decisions about where to concentrate their efforts, leveraging data on demographics, local amenities, and broader economic trends.

Neighborhood-Level Demographics

Neighborhood demographics play a significant role in predicting foreclosure risks. Key factors include income levels, job stability, age distribution, and education. For instance, areas with lower incomes and seasonal or unstable jobs tend to face higher foreclosure risks. Similarly, younger populations often experience more financial strain, as they typically have lower savings and higher debt-to-income ratios. In contrast, neighborhoods with middle-aged, established residents tend to show greater housing stability.

Employment diversity is another critical factor. Neighborhoods with a mix of industries or a strong presence of government jobs are generally more resilient to economic downturns. On the other hand, areas heavily reliant on industries vulnerable to layoffs or with a large gig economy workforce often see higher foreclosure rates when economic conditions worsen.

Education levels also influence foreclosure trends. Neighborhoods with higher percentages of college-educated residents tend to have lower foreclosure rates. This reflects the link between education, earning potential, and financial literacy, all of which contribute to homeowners’ ability to maintain their properties.

Proximity to Amenities and Disamenities

The location of a property in relation to amenities and disamenities can significantly impact its value and stability. For example, homes near high-quality schools, public transportation, and essential services are more likely to retain their value and experience fewer foreclosures. School quality, in particular, is a powerful stabilizing factor. Properties in highly-rated school districts tend to hold their value better, even during economic downturns.

Access to public transit also plays a stabilizing role by reducing transportation costs and expanding employment opportunities for residents. Similarly, the presence of commercial amenities like grocery stores, healthcare facilities, and retail centers adds convenience and boosts a neighborhood’s overall appeal. In contrast, neighborhoods lacking these essentials - such as those in "food deserts" - often see higher levels of property distress, as residents may choose to relocate to areas with better access to services.

On the flip side, proximity to disamenities like industrial zones or high-crime areas can depress property values and increase foreclosure risks. Environmental concerns or safety issues can drive residents away, further destabilizing neighborhoods.

Local Economic and Development Trends

Regional economic trends and development patterns also shape property distress. Areas with diverse job markets, urban renewal projects, and strong infrastructure investments tend to show lower foreclosure rates. For example, metropolitan areas undergoing revitalization often see reduced foreclosure rates in previously distressed neighborhoods. At the same time, some suburban areas are now grappling with new challenges tied to shifting demographics and employment patterns.

Infrastructure improvements, such as new transportation links, utility upgrades, or public facility investments, can stabilize property values and reduce foreclosure risks. Population growth trends also play a role - regions with steady growth typically maintain stronger housing markets, while areas experiencing population declines often face weaker demand and increased property distress.

The financial health of local governments further influences foreclosure patterns. Municipalities with budget challenges may cut public services or raise property taxes, both of which can contribute to higher levels of property distress. Conversely, well-funded local governments can invest in infrastructure and services that help stabilize neighborhoods.

sbb-itb-fc184bb

Using Geographic Analysis in Investment Strategies

Geographic analysis transforms foreclosure data into actionable insights, helping investors make smarter decisions about where to allocate their resources. By analyzing geographic patterns and neighborhood trends, investors can uncover both risks and opportunities in the market. Building on the mapping tools highlighted earlier, this approach provides a clear direction for crafting effective investment strategies.

Finding High-Opportunity Areas

Investors often turn to Geographic Information Systems (GIS) to evaluate how different neighborhoods respond to economic downturns. This helps them identify areas that may be more susceptible to economic shifts [1].

By layering foreclosure data with other critical datasets - like income levels, unemployment rates, and housing supply - investors gain a well-rounded perspective on the factors contributing to property distress. This allows them to identify neighborhoods that might rebound as economic conditions improve [1].

Clusters of foreclosures often indicate underlying issues such as rising unemployment or falling property values [1]. However, these same areas can present opportunities for recovery and growth once the economy stabilizes, making them attractive for long-term investment [1].

Using foreclosure maps, investors can zero in on undervalued properties and neighborhoods with recovery potential during stabilization periods [1]. These insights pave the way for incorporating AI-driven data to refine investment decisions even further.

Improving Geographic Insights with AI-Driven and Verified Data

Blending AI analysis with human verification has transformed mapping tools, making foreclosure analysis both more accurate and efficient. This combination allows automated systems to assign objective distress scores, while expert human reviews ensure reliability. Together, they create a system that not only saves time but also provides deeper insights, setting the stage for smarter investment decisions.

The Benefits of AI-Driven Insights

AI technology simplifies the traditionally labor-intensive process of analyzing foreclosure data. Take LeadList.Pro, for example. By leveraging Google Street View, the platform assigns objective distress scores to properties based on visible conditions. This automated scoring helps prioritize leads, allowing investors to focus on properties with the most potential without wasting time on less promising options.

LeadList.Pro: Verified Preforeclosure and Probate Data

LeadList.Pro showcases how AI and manual verification can work hand in hand for Massachusetts-based investors. The platform delivers real-time preforeclosure and probate leads sourced directly from local court records, ensuring timely and reliable information. While AI assigns distress scores using property images, a dedicated team verifies ownership details and contact information.

This verified data integrates seamlessly with mapping tools, offering a clear view of geographic trends in property distress. Investors can tailor their searches to specific counties, and flexible subscription plans make it easy to access the data. Weekly CSV deliveries ensure smooth integration with CRM systems and mapping tools, further enhancing geographic analysis.

"The leads are accurate (no non-owners, no hospitals, etc.), and the distressed scores have been a huge help in figuring out which ones to go after first. Plus, it's way less expensive than other services."

– Samuel S., SRS Cash Home Buyers

Combining Real-Time Data with Geographic Analysis

LeadList.Pro’s verified data becomes even more powerful when paired with mapping tools. Investors gain a competitive edge by accessing court-verified information as soon as it’s available. Manual verification ensures that any discrepancies or uncertainties are resolved by experts, a critical step when dealing with complex foreclosure data. This "Human-in-the-Loop" approach ensures accuracy and reliability, giving investors the confidence to act quickly in fast-moving markets.

"Looking back at the last 12 months, my number one source of opportunity has been, without a doubt, deals I've found from probate lists. The added AI-insights is the cherry on top."

– Devon T., Telegraph Hill Home Buyers

Conclusion: Using Geographic Insights for Better Investment Results

Geographic insights are reshaping the way real estate investors approach foreclosure opportunities. By combining mapping tools and data integration methods, investors can now make more strategic, data-driven decisions. The transition from traditional methods to Geographic Information Systems (GIS) and real-time analytics has created new possibilities for those who know how to use these tools effectively.

By mapping foreclosure density and layering it with demographic and economic data, investors can identify high-potential areas before competition heats up. This detailed analysis helps pinpoint markets with strong recovery and growth potential, offering a clear advantage [3][5].

Geographic analysis also plays a key role in reducing risks. Spotting environmental challenges, understanding regulatory restrictions, and evaluating proximity to essential amenities allow investors to avoid costly errors while focusing on properties with strong fundamentals [5]. Additionally, tracking live foreclosure trends by zip code and demographic data provides a clearer picture of market saturation and highlights fresh opportunities [3].

For investors in Massachusetts, access to real-time preforeclosure and probate leads, paired with AI-generated distress scores, further enhances the ability to identify promising investments. This combination of geographic insights and verified data sharpens decision-making and uncovers emerging opportunities.

Diversifying investments across various locations not only protects against regional economic shifts but also boosts exposure to markets poised for recovery. By blending geographic analysis with reliable data, investors can act quickly and with confidence. This approach minimizes risks while uncovering high-value investments.

Ultimately, success in foreclosure investing depends on understanding the geographic factors that influence long-term property value and market recovery. Mastering these insights equips investors with a powerful edge, enabling them to identify tomorrow’s opportunities and refine their strategies for sustained success in the foreclosure market.

FAQs

::: faq

How can mapping tools help investors analyze foreclosure trends?

Mapping tools like Geographic Information Systems (GIS) are game-changers for investors looking to analyze foreclosure trends. They provide detailed visualizations that clearly show where foreclosures and preforeclosures are concentrated, making it easier to spot geographic patterns and areas with significant activity.

These tools go beyond just mapping - they offer insights into spatial trends, helping investors connect the dots between location and foreclosure data. This information is invaluable for strategic planning, assessing risks, and uncovering opportunities in specific neighborhoods or regions. :::

::: faq

How does real-time data help identify foreclosure trends and hotspots?

Real-time data is a game-changer when it comes to identifying foreclosure trends. It provides current insights into property conditions, market shifts, and neighborhood developments, helping investors act quickly and confidently.

With real-time analysis, you can spot patterns such as rising preforeclosure activity in certain locations or changes in local economic conditions. This kind of information is key for crafting strategies that zero in on promising opportunities while keeping potential risks in check. :::

::: faq

How can combining demographic and economic data with geographic insights improve foreclosure investment strategies?

Analyzing demographic and economic data alongside geographic trends gives investors a clearer picture of areas more likely to experience foreclosures. By examining details such as income levels, age distribution, and local economic conditions, investors can spot neighborhoods that may be under financial strain or poised for growth.

This method supports smarter decision-making, helping investors concentrate on markets with strong potential while keeping risks in check. Recognizing these patterns plays a key role in crafting strategies that improve the odds of successful investments. :::