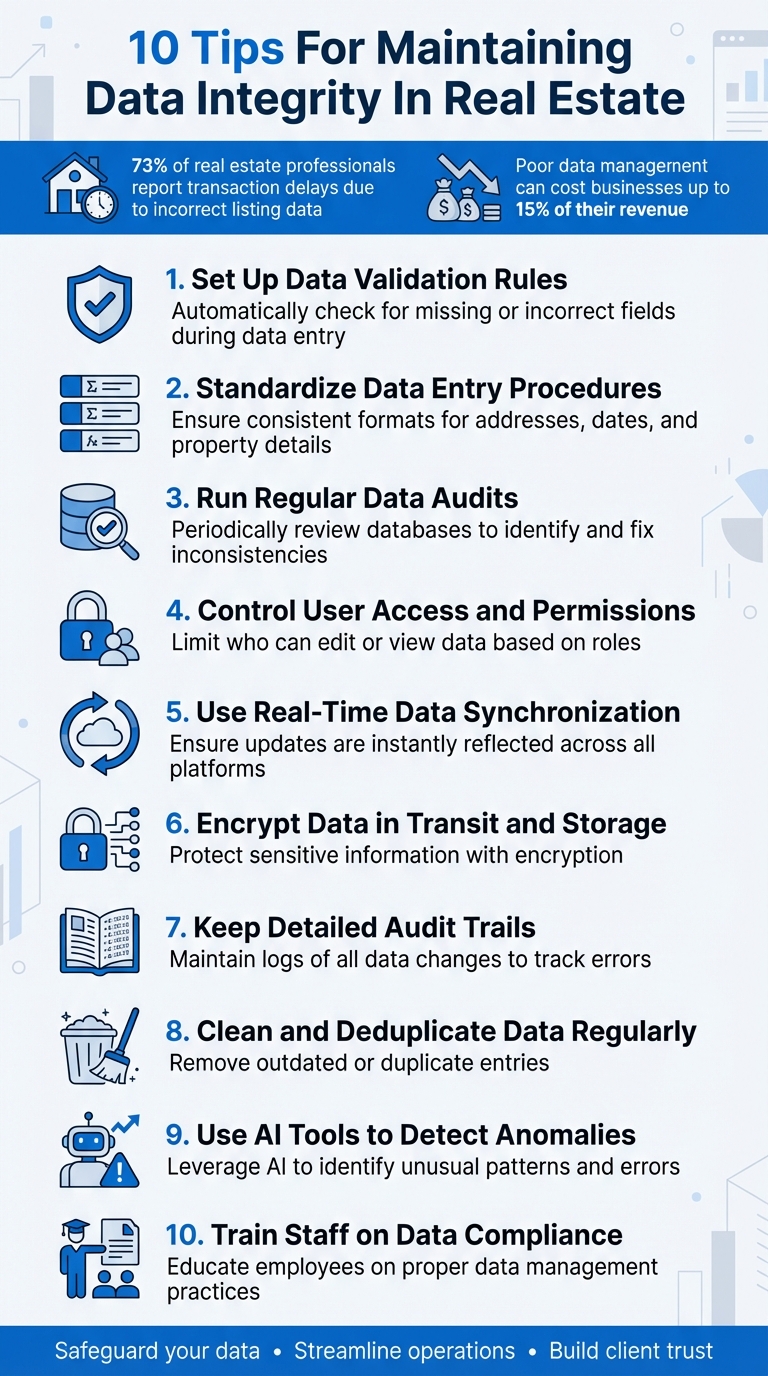

10 Tips For Maintaining Data Integrity In Real Estate

Maintaining accurate data in real estate is critical to avoid transaction delays, incorrect valuations, and legal issues. Errors in property data can lead to lost revenue, wasted time, and reduced buyer trust. To prevent these issues, here are 10 actionable tips:

- Set Up Data Validation Rules: Automatically check for missing or incorrect fields during data entry to catch errors early.

- Standardize Data Entry Procedures: Ensure consistent formats for addresses, dates, and other property details across systems.

- Run Regular Data Audits: Periodically review databases to identify and fix inconsistencies or outdated information.

- Control User Access and Permissions: Limit who can edit or view data based on roles, and use multi-factor authentication for security.

- Use Real-Time Data Synchronization: Ensure updates are instantly reflected across all platforms to avoid discrepancies.

- Encrypt Data in Transit and Storage: Protect sensitive information with encryption to prevent breaches and maintain accuracy.

- Keep Detailed Audit Trails: Maintain logs of all data changes to track errors and unauthorized modifications.

- Clean and Deduplicate Data Regularly: Remove outdated or duplicate entries to streamline operations and improve reliability.

- Use AI Tools to Detect Anomalies: Leverage AI to identify unusual patterns, errors, or inconsistencies in large datasets.

- Train Staff on Data Compliance: Educate employees on proper data management practices to reduce errors and improve accuracy.

Key Fact: 73% of real estate professionals report transaction delays due to incorrect listing data, and poor data management can cost businesses up to 15% of their revenue. By implementing these tips, you can safeguard your data, streamline operations, and build trust with clients.

::: @figure  {10 Essential Tips for Maintaining Data Integrity in Real Estate}

:::

{10 Essential Tips for Maintaining Data Integrity in Real Estate}

:::

How Can You Prevent Data Discrepancies In Property APIs? - CountyOffice.org

1. Set Up Data Validation Rules

Data validation rules act as gatekeepers for your real estate database, ensuring all inputs meet specific criteria and formats before they’re accepted. For example, when an agent uploads a new property listing, the system automatically checks for issues like blank fields, missing information, or mismatched data - such as text in a price field or an invalid ZIP code. If any errors are detected, the system immediately alerts the user [1]. This process lays the groundwork for improved accuracy, efficiency, and consistency across your entire system.

Accuracy in Real-Time Property Updates

By catching errors as they happen, you prevent incorrect data from spreading across multiple platforms. A great example of this is CRMLS, which in February 2025 introduced tools that flagged issues like "Missing Tax ID" during uploads. Agents were given a 20-day window to fix these errors, ensuring the accuracy of updates across their vast service area [1].

Efficiency in Detecting and Resolving Data Discrepancies

Validation rules are designed to identify and address common errors in real estate databases, such as incomplete property measurements, incorrect bedroom counts, missing tax IDs, or duplicate entries. Automated checks can cross-reference millions of property records with county databases to verify details [8]. As Salesforce explains:

Data validation rules are crucial for enforcing accuracy by checking data inputs against predefined criteria and formats. They prevent incorrect, incomplete, or inconsistent data from entering the system [3].

This level of precision builds trust and supports timely decision-making - both critical elements in the fast-moving real estate world.

Consistency in Data Formatting and Entry

Adopting industry standards, like the RESO Data Dictionary, ensures your property data speaks the same "language" across various platforms [4]. This means details like square footage, listing statuses, and property features are uniformly represented - whether viewed in your CRM, on an MLS platform, or through a third-party app. When paired with real-time synchronization, these validation rules ensure that once an update is validated, it instantly reflects across all connected platforms. This eliminates the risk of conflicting information for the same property [1]. In turn, this consistency enhances the reliability of your data and supports seamless collaboration across systems.

2. Standardize Data Entry Procedures

Building on validation rules, having standardized data entry procedures ensures consistency across the board. This means your team follows the same format for critical details like dates, addresses, phone numbers, and property information - reducing the chances of errors.

Consistency in Data Formatting and Entry

Adopting the RESO Data Dictionary helps align key property details such as square footage, listing status, and bedroom counts across platforms like CRM, MLS, and transaction management systems [4]. When all systems use the same standard, you eliminate mismatched records. For instance, a property address should look identical whether it's accessed in your ERP system or your CRM [7].

In June 2022, MassGIS rolled out Version 3.0 of the Standard for Digital Assessor Parcel Files. This update required all Massachusetts cities and towns to use a "LOC_ID" - a unique identifier based on X and Y coordinates - to connect parcel polygons with assessing database records. Neil MacGaffey, Director of MassGIS, highlighted the impact:

Standardizing the Commonwealth's assessor parcel mapping has substantially upgraded the statewide quality of assessor parcel mapping and associated assessor records [10].

This initiative became a widely-used resource, accessed over 2,000 times per business day in 2022 [10].

Accuracy in Real-Time Property Updates

Standardized procedures also help avoid errors in property data updates. Tools like the RESO Web API allow property data to sync in real time across systems, ensuring updates are immediate and accurate [4]. When paired with standardized entry methods, these APIs prevent discrepancies that occur when agents manually input the same data into multiple platforms.

Efficiency in Detecting and Resolving Data Discrepancies

When everyone uses the same formats, identifying issues becomes much simpler. Audit logs can pinpoint when changes were made and by whom, making it easier to resolve discrepancies - like when a property is marked "Active" in one system but "Pending" in another [3].

A great example of the power of standardization comes from Clint Turner and his team at Learn.Land. Throughout 2024, they used the ChatGPT API to process hundreds of thousands of pages of PDF court dockets. By applying specific prompts, they extracted standardized data points - such as account numbers, tax amounts, and deceased status. This approach led to over $1 million in net profit from distressed property deals, all with a marketing budget under $30,000 [11]. Even when working with unstructured data, standardization can significantly boost both efficiency and accuracy.

3. Run Regular Data Audits

Even with validation and standardization in place, mistakes can still slip through the cracks. That’s where regular data audits come in - they act like routine checkups for your data system, catching inconsistencies early and keeping your property records dependable. These audits are essential for maintaining efficiency and accuracy every step of the way.

Efficiency in Detecting and Fixing Errors

Audit logs are your best friend when it comes to identifying and resolving discrepancies. These logs track every change with a timestamp, showing exactly when and by whom adjustments were made. For example, imagine a property listed as "Active" in your CRM but showing as "Pending" in your MLS. With audit logs, you can quickly trace the error to its source and correct it.

A real-world example of this approach in action comes from February 2025, when the California Regional Multiple Listing Service (CRMLS) showcased its robust auditing system. CRMLS employs a team of Compliance Analysts who investigate every data alert flagged by the community. These analysts categorize violations and issue warnings, fines, or require agents to complete learning sessions. Agents are given a 20-day window to address and fix errors, ensuring the database remains accurate for the thousands of professionals relying on it daily [1].

Ensuring Real-Time Property Updates

Audits don’t just catch errors - they ensure that updates happen smoothly and consistently across all platforms. Whether it’s a price adjustment or a status change, regular audits verify that these updates are reflected in real time. This is critical, especially considering that in 2022, 73% of real estate professionals reported transaction delays due to incorrect listing data [1].

Maintaining Consistency in Data Formatting and Entry

Audits also play a crucial role in keeping data properly formatted and standardized. Take the example from April 2024, when the Massachusetts Bureau of Local Assessment (BLA) introduced updated standards requiring communities to maintain a rolling 10-year inspection schedule for real property. As part of this process, assessors must submit detailed "Visit History" reports in Excel, adhering to strict formatting rules with eight specific data columns (e.g., Unique Identifier, Street Name, Land Use Code). These audits flag entries that don’t meet the criteria, such as "drive-by" inspections, which are deemed insufficient for fair taxation purposes [12].

Steve McCarthy, a Bureau of Local Assessment Field Advisor, highlighted the importance of these measures:

Property inspection and accurate documentation are critical processes in creating fair and equitable property assessments. Following these procedures will help to ensure this is achieved [12].

Audits can also uncover unusual activity patterns, such as repeated download requests from the same user ID but from different IP addresses. These anomalies often indicate unauthorized access, like password sharing, and can be flagged for further investigation [6].

4. Control User Access and Permissions

Managing who can access property data is crucial to preventing errors and misuse. Role-Based Access Control (RBAC) is a practical way to assign permissions based on specific job duties. For instance, a listing coordinator might handle updates to property descriptions, while senior brokers would be the only ones authorized to approve pricing changes [13][17].

Protection Against Unauthorized Access

Adding an extra layer of security, Multi-Factor Authentication (MFA) requires users to verify their identity using a one-time code or security token. This step significantly reduces the risk of hacking - by as much as 99% [14]. Beyond digital precautions, real estate firms are also adopting identity verification methods like video calls or traditional ID checks before allowing clients access to sensitive transaction details [15].

Physical security is just as important. Limiting access to server rooms and workstations through surveillance and access logs can help prevent hardware breaches [17]. Experts also advise using strong passwords - 12 to 14 characters long, combining letters, numbers, and symbols - and updating them at least once a year [14].

Efficiency in Detecting and Resolving Data Discrepancies

Audit trails that track user permissions are a key tool for spotting unusual activity. For example, if system logs show multiple downloads from the same user ID across different IP addresses, it could signal unauthorized credential sharing [6]. To combat this, some MLS organizations use data seeding, which involves inserting fake "seed" listings into downloads to trace the source of any leaks [6].

Andrew Campagnola, Director of Product Management at Kastle Systems, explains how access control is evolving:

Real estate groups across the market are increasingly using access control not just to secure space, but to activate it. It's no longer just about keeping people out. It's about creating opportunities to invite the right people in [16].

Regularly reviewing and updating access permissions ensures they align with current job roles. This practice also helps revoke access quickly when employees leave the organization [13][17]. By keeping permissions in check and conducting consistent reviews, firms can maintain system integrity and ensure that property updates remain secure in real time.

5. Use Real-Time Data Synchronization

Accuracy in Real-Time Property Updates

When it comes to real-time property updates, accuracy is everything. Any delay or mistake can throw off the speed and trustworthiness of transactions. If a listing changes, those updates need to show up everywhere immediately. Real-time synchronization ensures that updates are pushed across all platforms instantly, so buyers and agents aren’t left with conflicting information. Real estate expert Laura Perez puts it this way:

Real-time syncing... updates changes across platforms without delay. That reduces the chance of two different sources displaying two sets of data for the same property [1].

Take APIs like RealEstateAPI, for example. They track property IDs to immediately reflect changes like a property going off-market, entering foreclosure, or being removed entirely [18]. This kind of speed is critical - 73% of real estate professionals have reported transaction delays caused by incorrect listing data. In larger markets, even one error can spread quickly across multiple platforms [1].

This rapid synchronization also lays the groundwork for catching errors faster, which leads to smoother operations.

Efficiency in Detecting and Resolving Data Discrepancies

Automated validation tools built into synchronization workflows are game-changers. They flag issues - such as missing fields, incomplete records, or mismatched details - right at the point of entry. Instant alerts and audit logs make it possible to fix errors before they spread [1][3]. RealEstateAPI highlights the importance of this process:

It's not just getting the data that matters, but getting the most up to date data to help equip your business or users with the most actionable and reliable insights [18].

This approach works hand-in-hand with the validation and auditing practices discussed earlier, creating a robust system for maintaining data quality.

Consistency in Data Formatting and Entry

Real-time synchronization doesn’t just need speed - it also requires consistency. Data from different platforms often comes in varied formats. One system might call a field "Listing Price", while another labels it "Ask Price" or "Offer Price." To avoid confusion, synchronization processes map these differences into a standardized format, like "List Price", ensuring uniformity [19]. Industry standards, such as the RESO Data Dictionary and Web API, act as a universal framework for keeping data consistent as it flows between systems [4][19].

| Data Sync Method | Description | Impact on Integrity |

|---|---|---|

| Custom API Integration | Direct partnerships pulling data from specific APIs. | High accuracy but challenging to scale due to custom transformation needs [19]. |

| Shared Database | Combines data from multiple MLSs into one repository. | High consistency; delivers a unified, timely, and accurate dataset [19]. |

| Reciprocal Access | Users log into each other’s systems to view data. | Low efficiency; prone to errors due to manual entry and separate logins [19]. |

Donna Halfpenny, a licensed real estate broker and certified residential appraiser, underscores the risks of poor data entry:

When data is input incorrectly or missing relevant details, it skews statistical and search results, which impacts CMAs, BPOs and appraisals [5].

Using RESO-certified APIs ensures that data shared between MLSs or platforms stays consistent and interoperable [4][19].

6. Encrypt Data in Transit and Storage

Keeping data secure is critical for maintaining accuracy, especially when dealing with fast-moving property updates.

Protection Against Unauthorized Access

Encryption plays a key role in safeguarding sensitive data by converting it into an unreadable format that only someone with the right decryption key can access. For real estate professionals managing tenant records, financial documents, or investor details, this is a must. Even if encrypted data is intercepted, it’s useless without the decryption key.

Under the NY SHIELD Act, failing to use proper encryption can lead to hefty penalties. In New York, real estate businesses generating more than $3 million in annual revenue or employing at least 50 people are required to implement strong cybersecurity measures. Additionally, about 25 U.S. states mandate data security protocols for personally identifiable information (PII) [20].

To meet these standards, opt for CRM systems that offer end-to-end encryption and comply with regulations like GDPR or ISO 27001. Look for platforms with features such as strong encryption, two-step verification, and VPN requirements for remote access. The National Association of REALTORS® emphasizes:

Use encrypted email, a transaction management platform, or a document‑sharing program to share sensitive information [9].

By securing data in this way, you ensure that property updates remain accurate and protected as they move between systems.

Accuracy in Real-Time Property Updates

Encryption doesn’t just protect confidentiality - it also ensures data integrity during transmission. Secure protocols like SSL/TLS defend against man-in-the-middle attacks, which could intercept or alter property data such as pricing, listing status, or square footage. This means real-time updates stay accurate and trustworthy.

For added security, combine encryption with multi-factor authentication and maintain separate backups to recover data quickly if needed. One expert advises:

Ensure that PII is encrypted, both at rest and before it is shared electronically [20].

Avoid using public, unsecured Wi-Fi for sensitive transactions, and adopt the "least privilege" principle by limiting access to sensitive data to only those who need it. Additionally, regularly clean out email accounts and store important, encrypted communications securely in an off-site location. This layered approach helps protect your data and ensures its accuracy at every step.

7. Keep Detailed Audit Trails

Detailed audit trails are a key addition to your data integrity framework, working alongside data validation and regular audits to strengthen your system's reliability.

Efficiency in Detecting and Resolving Data Discrepancies

Audit trails create a comprehensive log of every change made to property data, from price adjustments to deleted details [22]. If something unexpected happens - like a sudden price change or missing property information - these logs can answer critical questions: Who made the change? What was altered? When did it happen? With this chronological record, administrators can quickly resolve issues, reconstruct events after data corruption, or address system failures [3]. As Salesforce puts it:

"An audit log lists the events and changes that happen in your systems and the time they happen. An audit trail is a series of audit logs" [3].

Despite the importance of these tools, only 39% of IT decision-makers currently use backup and restore solutions, leaving a significant gap in data recovery capabilities [3].

Protection Against Unauthorized Access

Audit trails also play a crucial role in identifying and preventing security threats. By recording user IDs and IP addresses, these logs can flag suspicious activity, such as repetitive download requests from a single user across multiple IPs - an indicator of possible credential sharing [6]. Todd Costigan from the National Association of REALTORS® explains:

"A review of your logs can tell you if the same user is reviewing every property on the site. When this happens, it's likely a bot - an automated user scraping (copying and stealing) listing information" [6].

When such patterns emerge, blocking the offending IP address forces the user to contact your team, giving you the opportunity to address the breach directly. To focus on meaningful activity, prioritize logging HTTP methods that modify data (POST, PUT, PATCH, DELETE) rather than those that only involve viewing. This approach reduces noise and makes it easier to spot unauthorized changes [21].

Accuracy in Real-Time Property Updates

Audit trails timestamp every property update, creating a verifiable history of changes. This real-time tracking allows administrators to monitor data downloads as they occur, making it easier to detect automated scraping attempts [6]. To ensure the integrity of these records, make your audit logs immutable - granting users read-only access while preventing any deletion or alteration of the change history [21][22]. This unchangeable record bolsters the reliability of real-time property updates, ensuring transparency and trust in your system.

8. Clean and Deduplicate Data Regularly

Keeping your property records accurate and up-to-date is essential for maintaining a professional image and ensuring smooth operations. Regularly cleaning and deduplicating your data works hand-in-hand with tools like validation rules and audit trails to keep your system running smoothly. Outdated listings and duplicate entries not only waste time but can also damage your credibility. When clients encounter old properties or conflicting details, it raises doubts about your reliability. Let’s dive into how data cleaning supports instant and accurate property updates.

Accuracy in Real-Time Property Updates

Data cleaning plays a crucial role in ensuring your property updates are timely and accurate. By removing outdated listings, you eliminate the risk of appearing out-of-touch with current market trends [23]. A streamlined database allows real-time syncing across platforms, reducing the chance of discrepancies - like showing one price on your website and a different one on your MLS feed for the same property [1]. Deduplication also ensures critical decisions, such as underwriting models, are based on accurate and reliable data, not corrupted or redundant entries [2]. As Matt Carrigan from Dealpath puts it:

Dirty data, or inaccurate reporting stemming from miskeyed information and technology inconsistencies, has plagued the commercial real estate industry for decades [2].

Efficiency in Detecting and Resolving Data Discrepancies

Automated deduplication tools can save your team significant time by preventing them from chasing duplicate leads or contacting clients who’ve already closed deals [24][25]. Schedule a full database audit at least once per quarter - if your firm handles high volumes of data, a monthly cleanup might be more effective to catch errors before they escalate into bigger problems, like failed closings [24][25]. The cost of bad data is no small matter, with companies losing an average of 15% of their total revenue due to inaccuracies [2].

Consistency in Data Formatting and Entry

Standardizing formats for names, phone numbers, and addresses during the cleaning process ensures your data remains searchable and functional across various systems [25]. Small inconsistencies - like "St." versus "Street" or varying phone number formats - can confuse automated tools and lead to duplicate records, causing inefficiencies and redundant efforts. Instead of deleting old leads, consider archiving or tagging them as "Dormant" - this keeps your active database lean while preserving valuable information for future remarketing campaigns [25]. As PropTechBuzz notes:

A clean CRM doesn't just help you work faster - it helps you sell smarter [25].

9. Use AI Tools to Detect Anomalies

Accuracy in Real-Time Property Updates

AI-powered anomaly detection is a game-changer for managing the sheer volume of daily updates in the real estate industry. For instance, between August and December 2025, Relos in San Francisco utilized AI to process over $100 million worth of real estate transactions. The result? They achieved an impressive 99.5% accuracy across 120+ transactions while slashing contract processing costs from $300–$1,000 per transaction to around $100 [26]. Automated Valuation Models (AVMs) play a key role here, analyzing factors like market trends, occupancy rates, and debt coverage to update property values quickly and minimize human bias [28]. As Charles Fisher, Risk Analytics Director at JLL, puts it:

AVMs are meant to complement traditional valuations, not eclipse them. It is really meant to expand our reach... The idea is to become faster, more accurate and more efficient but not remove the human component [28].

These advancements not only improve accuracy but also streamline the resolution of discrepancies.

Efficiency in Detecting and Resolving Data Discrepancies

Manual data extraction often leads to errors exceeding 10%, but AI-powered lease abstraction has pushed accuracy rates to between 95% and 99.5% [26]. This is critical because real estate analysts currently spend about 40% of their time validating data instead of focusing on deeper analysis [2]. Westland Real Estate Group, which manages 14,000 units, adopted AI to process over 2,000 utility bills each month, cutting the total processing time by more than 50% [26]. AI tools that link data points directly to their sources make anomaly verification instantaneous [26]. To further enhance reliability, companies can pilot AI integrations and maintain audit logs to track and resolve discrepancies [27][29].

Consistency in Data Formatting and Entry

AI doesn’t just improve accuracy and efficiency - it also ensures data remains consistent. AI-driven data ingestion services extract information directly from investment Offering Memorandums (OMs) and Confidential Information Memorandums (CIMs), eliminating the risk of manual transcription errors [2]. RXR in New York provides a compelling example: they onboarded their entire retail and office portfolio of 73 assets using AI. This effort involved processing over 100,000 documents - representing 1 billion square feet - to create "living abstracts" that automatically update as lease terms change [26]. By employing semantic data layers and universal data models, AI standardizes disparate data sources into a unified format, ensuring real-time updates remain consistent across all systems [26]. Platforms like LeadList.Pro combine AI-driven insights with manual verification to maintain consistent data formatting for probate and preforeclosure leads, reducing discrepancies in property records and contact details. These AI-driven approaches are essential for maintaining data integrity in real-time property management.

10. Train Staff on Data Compliance

Training your team is the final, crucial step in ensuring data integrity. When combined with strong validation, standardization, and audit practices, it creates a powerful foundation for maintaining accurate and reliable property data.

Accuracy in Real-Time Property Updates

Proper training equips staff to handle property data with precision. When employees understand data governance rules, they know exactly who can view, edit, or delete specific information [3]. This clarity minimizes unauthorized changes, protecting the accuracy of real-time updates. Staff should be trained to carefully review every field in an MLS listing, ensuring all details are correct and relevant [5]. As Donna Halfpenny, a Licensed Real Estate Broker and Certified Residential Appraiser, highlights:

Getting MLS data right is an essential part of providing good service - and critical to everyone who depends on the MLS to make smart, data-driven decisions [5].

Training on the RESO Data Dictionary provides staff with a "universal language" for property data, ensuring seamless transfers between platforms [4]. Since the NAR settlement in August 2024, reporting seller concessions has become a key focus to help appraisers adjust comparable sales accurately [5]. Employees also need to distinguish between owned and leased solar systems, as this distinction directly affects a property's market value [5].

Protection Against Unauthorized Access

Cybersecurity training is essential to prevent breaches that could compromise sensitive property data. Key topics include creating strong passwords with phrases, symbols, and numbers, and updating them approximately every six months [6][9]. Two-factor authentication (2FA) should be mandatory for accessing property databases [6][9]. Under the NY SHIELD Act, real estate businesses face penalties ranging from $5,000 to $250,000 per security incident if they fail to protect personally identifiable information [20]. Employees should also be trained to avoid using public, unsecured Wi-Fi for business activities and to rely on encrypted email or transaction management platforms for sharing sensitive client information [9].

Efficiency in Detecting and Resolving Data Discrepancies

Training helps staff quickly identify and correct data errors, reducing the risk of costly mistakes. For example, in 2025, California Regional MLS (CRMLS) used Compliance Analysts and automated validation tools to maintain listing accuracy. They also offered weekly and monthly webinars to teach agents how to properly enter critical fields like property measurements and tax details [1]. This structured approach even allowed agents to contest penalties within a 20-day review window [1]. Employees must be trained to verify essential data points using established protocols and, when necessary, consult licensed appraisers. The stakes are high: 73% of real estate professionals have experienced transaction delays caused by incorrect listing data [1]. A well-trained team can significantly reduce these delays, supporting real-time data accuracy.

Consistency in Data Formatting and Entry

Training reinforces consistent data entry standards across the board. Employees should be familiar with standardized terminology, such as distinguishing between "walk-out" and "walk-up" basements or understanding "townhome" as a style versus a form of ownership [5]. Data validation rules at the point of entry ensure inputs meet predefined criteria, preventing errors before they occur [3]. Tools like LeadList.Pro combine manual checks with AI-driven insights to maintain uniform formatting for probate and preforeclosure leads. This shows how effective training, paired with robust verification protocols, can ensure reliable and consistent data entry.

Conclusion

Maintaining accurate data is a cornerstone of successful real estate transactions and sound business decisions. Consider this: 73% of real estate professionals have faced delays because of incorrect listing data [1], and unreliable data costs companies an average of $12.9 million annually, with some losing up to 15%–25% of their yearly revenue [30]. These numbers highlight just how critical data accuracy truly is.

The ten strategies discussed in this article provide a strong framework for minimizing data errors. From validation rules and standardized workflows to real-time synchronization and AI-driven anomaly detection, these practices strengthen the foundation of data governance. Regular audits, encryption, detailed audit trails, and comprehensive staff training further enhance your defenses against potential pitfalls.

As Matt Carrigan from Dealpath aptly puts it:

Dirty data, or inaccurate reporting stemming from miskeyed information and technology inconsistencies, has plagued the commercial real estate industry for decades [2].

To get started, focus on your most pressing challenges - whether that’s duplicate records, access control gaps, or inconsistent data entry. Tackling these issues first can help you avoid the legal and financial setbacks that even minor data errors might cause.

For additional support, tools like LeadList.Pro offer reliable, real-time property data to guide informed decision-making. By integrating these best practices and leveraging the right technology, you can protect data integrity and ensure every transaction runs smoothly.

FAQs

::: faq

How do data validation rules help ensure accurate real estate transactions?

Data validation rules are essential for ensuring accuracy in real estate transactions. These rules work by automatically checking details such as zip code and state alignment, APN (Assessor's Parcel Number) formats, and price ranges against established standards. This helps catch errors, inconsistencies, or missing information early in the process, ensuring that property and loan data are accurate, consistent, and complete.

By minimizing mistakes, reducing the risk of fraud, and preventing delays, these rules play a key role in making transactions smoother and more reliable. For real estate professionals, having strong validation rules in place is a critical part of maintaining data integrity and keeping operations running efficiently. :::

::: faq

How does AI help identify errors and inconsistencies in real estate data?

AI has become a game-changer in maintaining data accuracy, especially in the real estate industry. By analyzing massive amounts of data, it can spot irregularities that might otherwise go unnoticed. For instance, it cross-checks public records - like tax assessments and foreclosure filings - against historical trends and neighborhood data. This helps identify issues such as unusual sale prices, incorrect property details, or mismatched parcel identifiers.

Take tools like LeadList.Pro as an example. These AI-powered platforms review weekly probate and pre-foreclosure leads, calculate distress scores, and highlight inconsistencies in court-record data. The result? Fewer errors and more reliable insights, enabling real estate professionals to make informed, timely decisions. :::

::: faq

Why is training your team important for maintaining accurate data in real estate?

Training your team plays a key role in maintaining accurate and reliable data in real estate. It ensures that agents, brokers, and staff know how to properly input and update property details, follow MLS rules, and catch errors before they escalate. When everyone understands workflows and deadlines, it minimizes mistakes and keeps listings accurate and compliant.

A well-trained team also appreciates the impact of data accuracy on business success. Precise data drives smarter pricing strategies, sharper market analysis, and stronger client trust - all crucial for boosting revenue and staying competitive. By committing to regular training, your organization can sidestep costly mistakes, stay compliant, and strengthen relationships with both clients and partners. :::