Hidden Assets in Probate: Common Red Flags

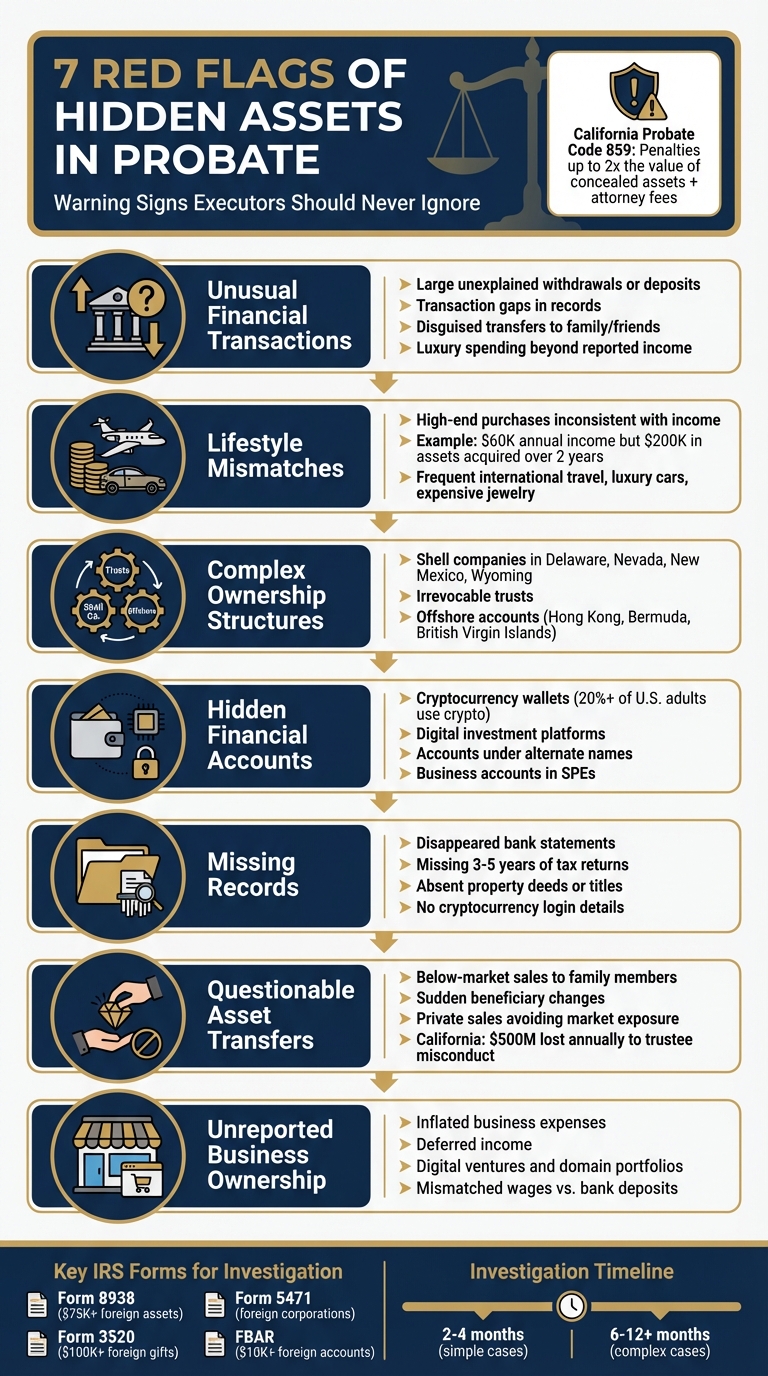

When someone passes away, hidden assets can disrupt probate, leading to inaccurate estate valuations, unpaid taxes, and disputes among heirs. Executors must identify all assets to avoid legal penalties, including paying double the value of concealed items in states like California. Common signs of hidden assets include:

- Unusual financial activity: Large, unexplained withdrawals, disguised transfers, or sudden gaps in transaction records.

- Lifestyle mismatches: High spending inconsistent with reported income, such as luxury purchases or frequent travel.

- Complex ownership structures: Use of shell companies, trusts, or offshore accounts to obscure ownership.

- Hidden financial accounts: Cryptocurrency wallets, digital investments, or accounts registered under alternate names.

- Missing records: Disappearing financial documents or incomplete inventories.

- Questionable transfers: Undervalued asset sales or sudden changes in beneficiaries.

- Unreported business ownership: Concealed income streams or hidden business interests.

Forensic accountants, private investigators, and tax records are key tools for identifying these red flags. Executors must act diligently to ensure accurate estate reporting and fair distribution to heirs.

::: @figure  {7 Red Flags of Hidden Assets in Probate Estates}

:::

{7 Red Flags of Hidden Assets in Probate Estates}

:::

How To Locate A Hidden Trust Will Or Assets

1. Unusual Financial Transactions

Unusual activity in financial records is often a major clue when it comes to uncovering hidden assets. For instance, large withdrawals or deposits with no clear justification can hint at attempts to move money into accounts that aren't listed in the estate inventory. Similarly, gaps in transaction records might signal funds being funneled into hidden accounts or investments [1]. These irregularities often point to intentional efforts to obscure asset transfers.

"Financial records are a significant culprit when betraying malpractices in estate reporting. So, unexplained large deposits and withdrawals, transaction gaps, or vague explanations are reasons to fret." - RecordClick [1]

Another common tactic involves disguised transfers. These can include money sent to friends or family members under the guise of "gifts" or "loans", with the understanding that the funds will eventually be returned. Executors might also delay business payments or issue checks to nonexistent employees, or even pay relatives inflated wages for work they didn’t actually perform [4][5]. One particularly crafty method is overpaying the IRS intentionally, creating a large tax refund that arrives after probate has closed [5].

Spending habits can also reveal hidden assets. If bank statements show luxury travel, extravagant hobbies, or other high-end purchases that don’t align with the decedent’s reported income, it’s a strong indicator of undisclosed revenue streams [1][5]. Notably, similar tactics in bankruptcy fraud cases can result in severe penalties, including fines up to $250,000 and prison sentences of up to 20 years [7].

Lifestyle inconsistencies often go hand-in-hand with these financial anomalies, offering further evidence of concealed assets.

2. Lifestyle That Doesn't Match Reported Income

Lifestyle inconsistencies can be a major red flag when it comes to uncovering hidden estate assets. When someone’s spending habits far exceed their reported income, it raises questions about undisclosed sources of funds. For example, if a decedent was living lavishly - taking frequent international trips, driving luxury cars, and wearing expensive jewelry - despite reporting a modest income, it hints at the possibility of hidden assets.

"If their behavioral pattern does not match their financial profile, there might be alternate sources of earnings and income." – Hudson Intelligence [3]

Another clue lies in personal expenses that don’t align with the decedent’s documented income or net worth. Imagine someone reporting an annual income of $60,000 but acquiring assets worth $200,000 over a two-year period. Such a mismatch strongly suggests the existence of unreported funds or hidden wealth. These spending patterns often go hand-in-hand with the financial irregularities mentioned earlier.

It’s also important to look for signs of third-party payments masking ownership of assets. For instance, utility bills, mortgage payments, or property taxes might be registered under the names of children or associates, while the decedent retained actual control. Similarly, luxury cars titled to family members could be another tactic used to conceal assets [1].

California Probate Code 859 addresses these issues directly. Those found guilty of hiding estate assets may be required to reimburse the estate double the value of the concealed assets, along with covering attorney’s fees and court costs [2]. Examining these lifestyle discrepancies is essential to ensure an accurate estate valuation and to safeguard the rights of heirs.

3. Complicated Ownership Arrangements

Complex legal setups can make identifying the true owner of assets a challenging task. Tools like shell companies, trusts, and offshore accounts are often used to shield ownership from both heirs and creditors.

Shell companies are particularly effective at obscuring ownership. States such as Delaware, Nevada, New Mexico, and Wyoming permit the formation of limited liability companies (LLCs) without requiring the disclosure of the owner's name in public records [3]. Properties bought through these entities - frequently purchased with cash to avoid bank scrutiny - can essentially vanish from public view. Even if a property deed lists only the LLC name, you might uncover the decedent's connection by checking utility accounts, building permits, or homeowners' association (HOA) records [3].

Beyond shell companies, trusts and offshore accounts add another layer of complexity to asset tracking.

"The lack of transparency of trusts makes them ideal instruments for concealing assets." – Hudson Intelligence [3]

Irrevocable trusts, for example, transfer assets out of the grantor's legal ownership and into the trustee's control. Since trust agreements are private, this makes discovering the assets within them much harder [3]. Offshore accounts further complicate matters by routing funds through international jurisdictions like Hong Kong, Bermuda, or the British Virgin Islands. These jurisdictions often employ nominee services to mask the actual owner, making tracing assets even trickier [3].

When investigating a decedent's financial history, reviewing their tax returns can reveal foreign asset interests. Certain IRS forms are required for reporting international financial activity. For instance, Form 8938 must be filed for foreign financial assets exceeding $75,000, while Form 3520 is necessary for reporting foreign gifts or bequests over $100,000 [4]. If these forms are missing but there’s evidence of international transactions, it could signal the need for deeper investigation.

Here’s a quick breakdown of key IRS forms that help uncover foreign asset interests:

| IRS Form | What It Reveals | Reporting Threshold |

|---|---|---|

| Form 8938 | Foreign financial accounts or assets | $75,000+ [4] |

| Form 3520 | Receipt of foreign gifts or bequests | $100,000+ [4] |

| Form 5471 | Interest in foreign corporations | Officer, director, or shareholder [4] |

| FBAR (FinCEN 114) | Foreign bank account reporting | $10,000+ aggregate |

These forms can serve as valuable clues when piecing together a decedent’s financial puzzle.

4. Hidden Financial Accounts

Hidden financial accounts, often tied to complex ownership structures, are a major red flag in estate investigations. These accounts - whether bank, investment, or digital - can significantly impact the valuation of an estate. They may be scattered across institutions, registered under alternate names, or exist solely online. For instance, over 20% of U.S. adults, particularly high-income earners, have engaged in cryptocurrency or digital token transactions [3]. Such assets frequently go unreported during probate proceedings.

The scope of hidden financial accounts goes far beyond traditional banking. Digital assets like cryptocurrency wallets, payment apps, and online investment platforms often escape notice due to their lack of physical documentation. Business-related accounts, sometimes held under shell companies or Special Purpose Entities (SPEs), further obscure ownership.

"Bank and investment account records are treasure maps of sorts. They reveal where money has been deposited, transferred, or invested." – Alden Law Firm [6]

To uncover hidden assets, reviewing three to five years of 1040 tax forms can reveal discrepancies in reported interest, dividends, or capital gains [6]. IRS Form 8938, mandatory for foreign financial assets exceeding $75,000 [4], and FBAR (FinCEN Form 114) filings can also point to offshore accounts. Bank statements deserve close attention - unexplained withdrawals, suspicious gaps, or recurring unknown payments may hint at concealed accounts [6].

Digital clues are equally important. Searching devices for password managers, wallet apps, or confirmation emails can unearth hidden accounts. State unclaimed property databases might reveal forgotten assets, while contacting banks linked to the decedent’s known accounts could uncover dormant ones [9]. Previous loan applications, which often require full asset disclosure, can also provide valuable insights [10].

5. Missing Records and Lack of Cooperation

When financial documents mysteriously disappear, it often points to attempts at hiding assets. Commonly missing items include wills, trust paperwork, bank statements, tax returns from the past three to five years, property deeds, vehicle titles, life insurance policies, and even login details for cryptocurrency or online investments. These gaps in documentation often suggest intentional efforts to keep certain assets out of sight.

Just like unusual financial transactions, missing records can be a major clue. Executors or heirs might intentionally discard or withhold important documents to make asset tracking more difficult. This can happen during estate administration, where some individuals may even divert assets for their own benefit.

"When a family member takes an heirloom for emotional reasons, even though it belongs to the estate, they are robbing the estate creditors, beneficiaries and heirs of property belonging to them." – RMO Lawyers

In some cases, uncooperative parties submit incomplete inventories, conveniently leaving out digital assets or known financial accounts. A striking example is the 2006 case Harrison v. Harrison in Lenoir County District Court. Here, a wife delayed responding to interrogatories for eight months, and when she finally did, the records were incomplete and disorganized. The court responded by imposing a $50-per-day fine until she provided proper answers [5].

When faced with missing records or deliberate obstruction, legal measures can help. Beneficiaries have the right to demand a formal accounting from the executor, which includes a detailed and sworn inventory of all transactions. Subpoenas can also be used to compel banks and brokerage firms to release records directly. In California, anyone found guilty of hiding or stealing estate assets may face penalties, including paying double the value of the loss and covering attorney's fees [2].

6. Questionable Asset Transfers and Low Valuations

Selling assets below market value - especially to family members, close associates, or shell companies - can be a clear attempt to reduce an estate's apparent value [12][13].

These aren't just hypothetical concerns; real cases highlight the impact of such practices. Take the Peterson Ranch Trust case, for instance. Over 18 months, a trustee sold three commercial properties appraised at $4.2 million for just $2.8 million to entities he controlled. The courts stepped in, awarding $1.9 million in compensatory damages and an additional $600,000 in punitive damages [12]. Similarly, in the McKenna Trust case, a trustee sold a $750,000 rental property to his daughter for $350,000. When an independent appraisal revealed repair costs were only $50,000, the court voided the transfer and imposed damages exceeding $600,000 [12].

"Inheritance theft is like termites in a house's foundation. By the time you notice obvious signs of damage, significant harm has often already occurred beneath the surface." – Nicholas D. Porrazzo, Partner, Gokal Law Group [14]

Be alert for sudden changes in beneficiaries on insurance policies or bank accounts, private sales that bypass market exposure, or unexpected gifts and loans that deviate from typical behavior [11][14]. In California alone, beneficiaries lose an estimated $500 million annually due to trustee misconduct [12]. To safeguard against these losses, insist on independent appraisals for significant assets instead of relying on valuations provided by parties with a vested interest [12]. Spotting these discrepancies early is essential before using advanced tools to uncover additional hidden assets.

7. Unreported Business Ownership and Income Sources

Unreported business ownership can often point to hidden probate assets. When someone's lifestyle - like owning luxury cars, frequent international travel, or pricey memberships - doesn't match their reported income, it raises questions about potential undisclosed income streams [1][4][10]. These inconsistencies often lead to further investigations, especially when paired with other warning signs.

Tax returns are a critical tool in uncovering hidden assets. As Stange Law Firm highlights:

"Probably the best tool for tracking down cash and other hidden assets is tax returns" [4].

By reviewing three to five years of Form 1040 returns, along with Forms 5471 and 8865, you can identify foreign or international business holdings [4][6].

Business records can also reveal signs of concealment. Attorney Lina Guillen notes:

"People can hide business income in all sorts of ways, including by inflating expenses and deferring income" [10].

Look for red flags like mismatched wages, discrepancies between bank deposits and invoicing, or sudden payment delays aimed at deferring income [4].

Digital ventures can be another area to investigate. Websites, domain portfolios, and digital wallets might hold unreported income. Even email accounts can provide clues, such as bank notifications or updates on investments that hint at hidden business interests [1][6].

Unreported business income can significantly impact the accuracy of an estate inventory. In California, under Probate Code 859, anyone caught concealing business assets could face penalties of up to double the value of the hidden assets, plus attorney's fees [2]. If you suspect unreported business ownership, demand a thorough estate accounting and compare the decedent's spending patterns with their reported income to uncover hidden revenue [2][15].

Tools and Services for Finding Hidden Assets

Once red flags are identified, specialized professionals and advanced tools can help uncover hidden assets. Forensic accountants act as financial detectives, diving into bank records, tax returns, and business documents to piece together the financial puzzle. As NSKT Global puts it:

"Forensic accountants serve as financial detectives who can sort through the mess and figure out what really happened with someone's assets before and after they died" [8].

These experts often hold certifications like CFE (Certified Fraud Examiner) or CFF (Certified in Financial Forensics). They use methods like lifestyle analysis to compare reported income with spending habits. A typical investigation might take 2–4 months for simple cases, but more intricate situations - such as those involving multiple businesses or uncooperative parties - can extend the timeline to 6–12 months or longer [8].

Private investigators (PIs) bring a different set of skills to the table. They conduct physical searches of properties, review storage units, and interview key contacts to locate undisclosed assets. Some PIs specialize in cryptocurrency tracing, holding certifications like Cryptocurrency Tracing Certified Examiner. This expertise is increasingly relevant, given that over 20% of U.S. adults - mainly high-income earners - have engaged in cryptocurrency transactions [3]. Meanwhile, heir researchers and genealogists focus on locating missing heirs and estates. They leverage extensive networks and provide court-recognized reports, often aided by digital tools that streamline data collection and analysis.

Data platforms also play a critical role. For example, LeadList.Pro offers verified probate leads, detailed property data, and AI-driven distress scores. Their service provides real-time Massachusetts probate data, including information on decedents and property addresses, all formatted in CSV files for easy use. This level of detail helps professionals identify discrepancies between reported assets and actual holdings, potentially simplifying complex cases.

In addition to professional expertise, public records and legal discovery tools can fill in the gaps. Property tax receipts, building permits, and UCC financing statements often reveal ownership details, even when assets are hidden in trusts [1]. Tools like the NAIC Life Insurance Policy Locator can uncover forgotten policies, while tax return reviews may expose additional concealed assets [4][6]. Together, these resources provide a comprehensive approach to asset discovery.

Wrapping It Up

Uncovering hidden probate assets is about more than just finances - it’s about respecting the decedent’s wishes and ensuring their estate is distributed as intended. When assets go unnoticed, whether by accident or on purpose, the consequences ripple far beyond monetary loss. As Scott Rahn, Founding Partner at RMO Lawyers, puts it:

"Concealed assets can undermine the decedent's intentions and prevent heirs from receiving their rightful inheritance, adding unnecessary complexity and emotional strain to an already emotionally taxing and time-consuming process" [2].

The warning signs discussed - like unusual financial activity, mismatched lifestyles, complex ownership structures, hidden accounts, missing records, suspicious transfers, and undisclosed business interests - are critical to recognize. Even spotting one of these clues should prompt further investigation. Executors who overlook assets not only risk legal trouble but also fail the beneficiaries they’re meant to serve. These red flags demand immediate attention and professional expertise.

Forensic accountants and private investigators play a key role in uncovering what’s hidden, blending financial analysis with field investigations. For those handling estates in Massachusetts, tools like LeadList.Pro provide verified probate data and AI-driven insights to help identify potential issues.

To ensure the decedent’s estate is handled correctly, executors should dive into multi-year tax returns, insist on formal accounting when suspicions arise, and bring in specialists when necessary. Proper asset discovery benefits everyone involved and ensures the estate reflects the decedent’s true intentions.

FAQs

::: faq

What can executors do to find hidden assets during probate?

When handling probate, executors have to dig deep to identify any hidden assets. Start by going through the deceased’s financial paperwork, such as bank statements, tax returns, investment portfolios, and insurance documents. These can often point to assets that aren’t immediately apparent. Don’t overlook public records either - property deeds and mortgage filings might reveal real estate or other holdings that weren’t initially disclosed.

It’s also important to consider less obvious avenues like digital assets, offshore accounts, and trusts, which are sometimes used to obscure wealth. If things don’t add up, bringing in experts like forensic accountants or private investigators can make a big difference. Watch out for red flags, too - things like gaps in financial records or family members being oddly secretive could signal hidden assets. A detailed, step-by-step approach is essential to make sure nothing slips through the cracks. :::

::: faq

How do complex ownership structures hide assets in probate cases?

Complex ownership structures can make tracking down all assets in an estate a real puzzle. These setups often use shell companies, trusts, or special purpose entities to separate assets from the individual, making them much harder to trace. For example, real estate might be tucked away under multiple entities, or funds could be funneled into offshore accounts or digital wallets.

What makes it even trickier is the multiple layers of ownership involved. Assets might be transferred between family members, friends, or even third parties, creating a web that's hard to untangle. This can lead to estate values being underreported, which has a direct impact on both how the estate is distributed and how taxes are calculated.

To uncover hidden assets, you need to dig deep into financial records, trusts, and corporate structures while staying sharp to common concealment tactics. Spotting these red flags is essential to revealing the estate's actual worth. :::

::: faq

What legal risks arise from not disclosing hidden assets in probate?

Failing to disclose hidden assets during probate can lead to serious legal trouble. Executors, beneficiaries, or anyone involved could face accusations of fraud or concealment, which might result in hefty fines, removal from fiduciary roles, or even criminal charges if the concealment is proven to be intentional.

Beyond legal risks, the probate process itself can become more complicated. Delays are common, legal fees can pile up, and disputes among heirs may spiral into full-blown litigation. Courts might step in to demand a full accounting of all assets, adjust how inheritances are distributed, or impose penalties on those obstructing the process. Transparency is key - not just to avoid these issues, but to preserve trust and ensure the estate is handled fairly. :::