Real Estate Impact of Probate Court Will Rulings

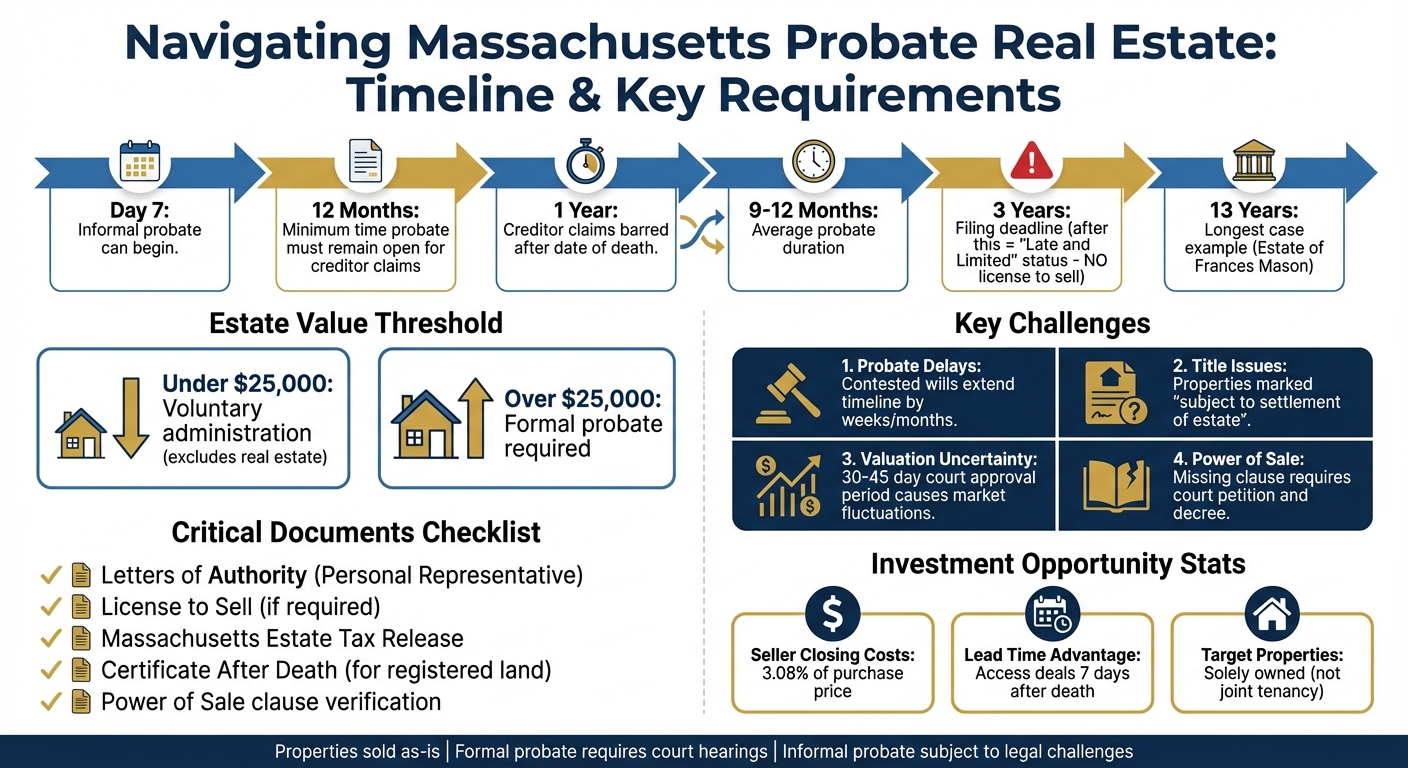

When someone passes away, their real estate often goes through probate - a legal process to validate wills, settle debts, and distribute assets. This can delay property transactions for months or years, creating challenges for heirs, buyers, and investors. Key takeaways include:

- Probate Delays: Contested wills or lack of a "Power of Sale" clause can freeze assets, prolonging sales.

- Title Issues: Properties may face liens or unresolved creditor claims, complicating transfers.

- Valuation Challenges: Market fluctuations during probate can affect property values and tax liabilities.

- Massachusetts-Specific Rules: Estates valued over $25,000 require formal probate, with unique procedures for registered land and creditor claims.

Investors and professionals can navigate these hurdles by understanding probate laws, leveraging tools like real-time court data, and working with experienced agents. Early appraisals, securing vacant properties, and verifying legal documents are critical steps to streamline transactions and maximize opportunities.

::: @figure  {Massachusetts Probate Real Estate Timeline and Key Requirements}

:::

{Massachusetts Probate Real Estate Timeline and Key Requirements}

:::

Probate Real Estate Legal Processes, Court House Visits and more!

Real Estate Challenges During Probate

Probate delays can create significant hurdles for real estate transactions. For real estate professionals and investors, understanding these challenges is key to navigating the process efficiently.

Property Sale and Transfer Delays

In Massachusetts, informal probate can begin as soon as seven days after death. However, contested wills require formal probate, which can stretch the timeline by weeks or even months [4].

Statutory waiting periods further complicate matters. For instance, creditor claims are generally barred one year after the date of death. If a property is sold or a new title is issued during this period, it remains "subject to the settlement of the estate", making immediate sales tricky [2]. For registered land, the Land Court adds another layer of complexity, requiring formal probate proceedings to issue a "Certificate After Death" [2].

"The Land Court will require, for registered land, FORMAL probate proceedings for a Complaint for Certificate After Death whether they are testate or intestate."

– Christina T. Geaney, Chief Title Examiner, Massachusetts Land Court [2]

Timing is another critical factor. If probate isn’t initiated within three years of death, the estate enters "Late and Limited" status. In this case, the personal representative cannot obtain a license to sell the real estate but can only confirm ownership of probate assets for the successors [4].

"A late and limited appointed personal representative can't get a license to sell the decedent's real estate. The personal representative can only confirm ownership of probate assets in the successors."

– Massachusetts Probate and Family Court [4]

Additionally, when a will lacks a clear "Power of Sale" clause, the representative must petition for a court decree. The deed then has to align precisely with the court's terms [2].

Beyond delays, title complications present another set of challenges for real estate transactions during probate.

Title Problems and Liens

Probate often leads to title issues that can stall property transfers. For example, if a new Certificate of Title is issued within a year of death or while creditor claims are unresolved, it may include a note stating it is "subject to the settlement of the estate." This notation can only be removed by filing another complaint, which can delay future sales or financing [2].

Another hurdle is the Massachusetts estate tax release, which is required to obtain a court decree allowing the property to be sold free of debts [2].

"One of the advantages of obtaining a Probate and Family Court Decree ('Decree' or 'license') is that the property will be sold free of debts of the deceased, costs of administration, legacies, and Massachusetts estate taxes."

– Christina T. Geaney, Chief Title Examiner, Massachusetts Land Court [2]

Real estate professionals should also determine whether the probated will includes a clear "Power of Sale." This clause can simplify sales to third parties by eliminating the need for a separate court license, though it doesn’t apply to distributions to heirs [2].

Property Valuation Uncertainty

Market value fluctuations during probate add another layer of complexity. Since probate can last anywhere from a few months to over two years, the property's value may change significantly between the initial appraisal and the final sale. These shifts can impact tax reporting and investment decisions [6].

Even after an offer is accepted, the required 30–45-day court approval period leaves room for further market changes, which can lead to valuation inaccuracies and potential tax complications for beneficiaries [6][1]. In some cases, courts require bidding, making it even harder to predict final costs [6]. Meanwhile, ongoing expenses - like taxes, insurance, and maintenance - can pile up, reducing the estate's overall value, especially if the property remains vacant [6].

"Probate in real estate is the legal transfer of asset ownership or selling of the estate that was previously owned by a deceased homeowner."

– Miriam Moore, Division President of Default Services, ServiceLink [6]

To address these challenges, executors should arrange appraisals for high-value assets early on to determine tax liabilities and set realistic listing prices based on current market trends [5]. Partnering with agents experienced in probate sales can also help navigate state-specific regulations and bidding requirements [6]. Additionally, securing vacant properties by changing locks and maintaining insurance can prevent damage or theft, preserving the property's value over the extended probate timeline [5].

Probate Rulings and Real Estate: Case Examples

Probate cases often highlight the complexities real estate professionals face when navigating court decisions. These real-world examples shed light on the financial and legal hurdles that can emerge during probate proceedings.

Case 1: Delayed Asset Distribution

In the Estate of Frances Mason, a property in South Yarmouth was tied up in probate for an astonishing 13 years. The delay stemmed from a TEFRA lien tied to Medicaid benefits. Although Mason passed away in August 2008, probate proceedings didn’t begin until June 2017. It wasn’t until September 2021 that the property was finally sold [7].

The Massachusetts Supreme Judicial Court ultimately invalidated the lien because the property wasn’t sold during Mason’s lifetime. However, the state retained the right to pursue claims against other assets in the estate. This case highlights how delayed probate filings can leave real estate in limbo for years, creating significant uncertainty for both heirs and potential buyers [7].

Case 2: Contested Property Ownership

The Furnas v. Cirone case from November 2023 illustrates how partition agreements can impact joint tenancy rights. Anthony Cirone and Jane Furnas co-owned a home in East Longmeadow as joint tenants. When Furnas filed for partition in December 2016, they eventually reached an agreement in August 2018: Anthony would vacate the property, and Furnas would refinance or sell it by 2020 [8].

Before the sale could be finalized, Anthony passed away in June 2020. Furnas claimed sole ownership of the property through survivorship rights. However, the Massachusetts Supreme Judicial Court ruled that the partition agreement had severed their joint tenancy when Anthony moved out, allowing his estate to enforce the sale [8].

"A joint tenancy is severed when any one of the four unities is destroyed, including due to a unilateral act of one of the parties."

– Justice Cypher, Massachusetts Supreme Judicial Court [8]

Lessons for Real Estate Professionals

These cases emphasize the importance of thorough preparation and attention to detail in probate-related transactions. Here are key takeaways:

- Verify partition agreements to ensure joint tenancy status remains intact.

- Check probate filing timelines, as estates opened more than three years after death may face restrictions on property sales.

- Review MassHealth liens carefully, as they may dissolve after the property owner’s death but still leave room for state claims against other estate assets [7] [8].

Investment Opportunities in Probate Properties

Building on the challenges already touched upon, investing in probate properties offers a pathway to uncovering opportunities that can be both lucrative and strategic.

Finding Probate Leads

Probate properties in Massachusetts present a distinct investment angle, but locating these opportunities requires tapping into real-time court data - ideally before the properties hit the open market. Many probate deals remain off-market, giving investors a clear edge over the competition [9].

The trick lies in targeting solely owned properties - those listed exclusively in the deceased's name. Properties held in joint tenancy or by tenants by the entirety are generally not suitable for this strategy [11][12]. In Massachusetts, estates valued over $25,000 must go through formal probate, a process that typically spans 9 to 12 months [10].

For investors looking to streamline their search, LeadList.Pro offers a solution. This service provides weekly probate leads directly from Massachusetts probate courts. It includes AI-generated distress scores, verified property details, and organized CSV files containing decedent information, property addresses, mailing addresses, and even attorney contacts. With access to real-time data, investors can identify potential deals as early as seven days after a decedent's passing, when informal probate orders can first be issued [13]. Subscription costs range from $99 to $249 per month, depending on the level of access.

This kind of detailed lead data sets the foundation for making well-timed investment decisions.

When and How to Invest in Probate Properties

Timing is everything when it comes to probate property investments. The most motivated sellers are often heirs who live out of state and are overwhelmed by the responsibilities of maintaining a property. These sellers typically prefer quick cash offers over waiting for full market value [9]. Additionally, many of these properties carry significant equity due to low or nonexistent mortgage balances, allowing investors room to make competitive offers [9].

It’s important to confirm that the property isn’t held in a trust or under joint tenancy agreements [11][12]. Formal probate filings can also signal motivated sellers, particularly in cases involving contested wills or unclear terms. These situations often lead to complex disputes, making heirs more inclined to sell quickly [4].

Probate properties are usually sold as-is, which makes them ideal for fix-and-flip strategies. However, investors should be aware of Massachusetts law, which requires probate cases to remain open for at least 12 months to allow creditors to file claims [12]. On average, seller closing costs amount to about 3.08% of the property’s purchase price. Additional expenses - such as probate bonds, appraisal fees, and court filing fees - should also be factored into the overall investment [10].

Using Data to Make Better Investment Decisions

Accurate and timely data is a cornerstone of successful probate investing. Keeping an eye on the three-year filing deadline is essential to avoid complications with late or limited proceedings [4][3].

AI-driven insights can be a game-changer in navigating the challenges of probate real estate. These tools help investors steer clear of title issues and delays. For example, LeadList.Pro’s distress scores combine property condition data from AI Street View Analysis with court filing information. This allows investors to identify properties with clear titles while avoiding those encumbered by liens or other financial roadblocks that might diminish net equity [14][15].

Understanding the type of probate proceeding is equally critical. Informal probate orders, which can be issued just seven days after death, offer a quicker route - though they may be subject to legal challenges. On the other hand, formal probate involves court hearings and typically takes longer to resolve [13][4]. Estates valued under $25,000 qualify for voluntary administration, but this process cannot be used for estates that include real estate [4][10].

Finally, networking can provide valuable insights into the probate market. Attending events hosted by the National Real Estate Investors Association (REIA) in Massachusetts is a great way to connect with probate attorneys, contractors, and wholesalers - key players who can help navigate this niche market [9].

Conclusion

As we've explored, understanding the intricacies of probate is essential for navigating real estate transactions effectively.

Key Takeaways for Real Estate Professionals

Probate rulings, especially in cases involving contested wills, present unique hurdles and opportunities in Massachusetts real estate. The type of probate proceeding - whether formal or informal - can significantly influence transaction timelines and the authority to sell property.

It’s crucial for real estate professionals to verify that the Personal Representative has valid Letters of Authority and, if required, a court-issued License to Sell before moving forward with any transaction [17][2]. Estates opened beyond the three-year deadline, known as "Late and Limited", are ineligible for a license to sell [4][2]. Additionally, creditors typically have one year from the decedent's date of death to file claims against the estate [2][16].

These considerations provide a framework for strategic decision-making by both investors and agents.

Practical Steps for Investors and Agents

Given these challenges, there are actionable steps to successfully navigate the probate market. Focus on estates valued above $25,000, as smaller estates under voluntary administration often exclude real estate [4].

Tools like LeadList.Pro offer real-time probate leads sourced directly from Massachusetts courts. Their AI-driven distress scores combine property condition data with court filings, helping investors pinpoint properties with clear titles while steering clear of those with liens or title complications. Weekly CSV files with details like decedent information, property addresses, and attorney contacts allow investors to connect with motivated sellers as early as seven days after a decedent's passing [13].

Building relationships with probate professionals can also provide valuable insights into the market. By pairing verified court data with thorough due diligence, investors and agents can confidently navigate the complexities of probate real estate transactions.

FAQs

::: faq

How do probate delays impact real estate transactions in Massachusetts?

Probate delays in Massachusetts often create hurdles for real estate transactions, particularly by holding up the sale or transfer of property within an estate. Before any property can change hands, the court must appoint a personal representative or executor, and in many cases, the sale also needs court approval. This process can be time-consuming, especially if disputes or other complications arise within the estate.

Such delays can lead to increased expenses, lost investment opportunities, and significant frustration for beneficiaries who are left waiting to access the estate's assets. Taking steps toward thorough estate planning can help minimize these setbacks and make the process more efficient for everyone involved. :::

::: faq

How can real estate investors address title issues during the probate process?

Real estate investors navigating title issues during probate need to approach the process with care to ensure everything goes smoothly. The first step is understanding the probate process in the specific state where the property is located. Each state has its own rules for distributing assets and transferring titles, so knowing these details is essential. Confirming that the estate has completed probate and that the title is clear is another critical step. Often, this can be verified through court records or legal filings.

It’s also important to stay alert for potential title disputes, like contested ownership or conflicting claims. Partnering with legal professionals who specialize in probate and estate law can help address these challenges and minimize risks. Building connections with probate attorneys or estate executors can also be incredibly helpful, as they can provide insights and updates about the estate’s status.

Lastly, using trustworthy resources to check property details and understanding the local standards for title transfers can make a big difference. These practices help investors handle probate-related title issues with confidence, ensuring secure and successful transactions. :::

::: faq

How do changes in the real estate market during probate affect property value and taxes?

Market shifts during probate can significantly influence a property's value and the taxes tied to it. Typically, the property's worth is determined through appraisals that reflect the current state of the market. If property values dip, the assessed value might drop as well, which could reduce estate taxes. Conversely, if the market heats up and values climb, the property's appraisal may rise, resulting in higher tax obligations.

These market changes also play a role in decisions about selling probate properties. In a declining market, heirs might opt for a quicker sale to avoid further losses. On the flip side, a strong market could encourage holding onto the property to benefit from potential appreciation. Beyond estate taxes, these valuation changes can also impact capital gains taxes, especially if the property gains significant value during the probate process. Navigating these dynamics is essential to managing the financial outcomes of probate real estate dealings effectively. :::