How Historical Trends Predict Probate Market Shifts

Probate real estate offers unique opportunities for investors by combining predictable timelines with motivated sellers. Here's what you need to know:

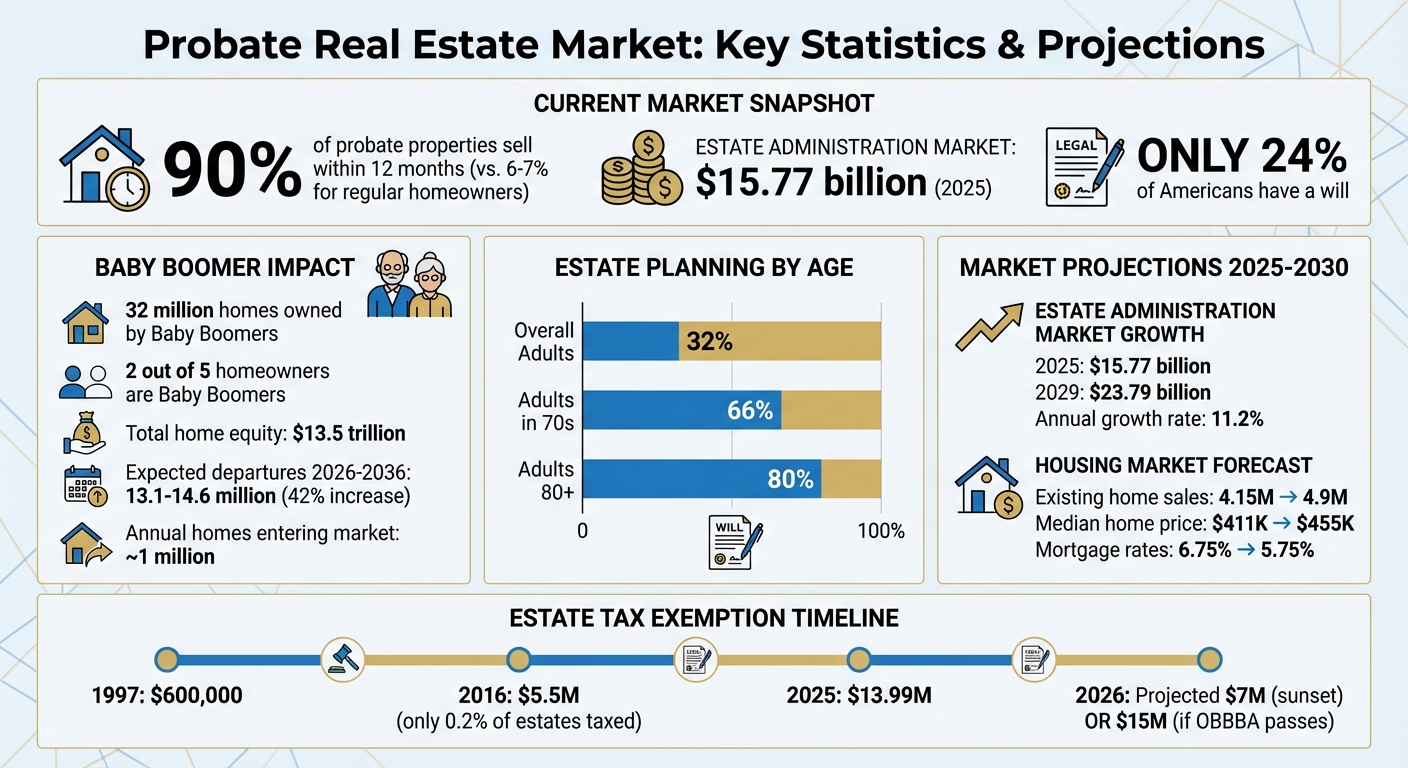

- Fast Sales: 90% of probate properties sell within 12 months, compared to just 6–7% for regular homeowners.

- Market Growth: The estate administration market is valued at $15.77 billion in 2025, projected to grow to $23.79 billion by 2029 (11.2% annual growth).

- Aging Demographics: The Baby Boomer generation, owning 32 million homes worth $13.5 trillion, is driving a steady rise in probate listings.

- Estate Planning Gap: Only 24% of Americans have a will, pushing more properties into probate court.

Investors can leverage historical data, demographic trends, and AI-driven tools to identify high-equity properties before they reach competitive markets. With legal obligations often expediting sales, probate properties present consistent opportunities, even during broader market fluctuations.

::: @figure  {Probate Real Estate Market Statistics and Projections 2025-2030}

:::

{Probate Real Estate Market Statistics and Projections 2025-2030}

:::

Historical Factors That Shape the Probate Market

Aging Population and Demographic Changes

The Baby Boomer generation plays a key role in shaping the probate market. Born between 1946 and 1964, this group owns around 32 million homes, which accounts for two out of every five homeowners in the U.S. [2]. Their collective home equity is estimated at $13.5 trillion, nearly three-quarters of the country’s annual economic output [2].

One major factor influencing when these homes enter the probate market is how long older homeowners hold onto their properties. Over the years, retention rates for homeowners aged 75–84 and 85+ have increased from 0.26 to 0.31, indicating that seniors are staying in their homes longer [2]. This trend of "aging in place" has delayed the influx of probate listings.

Looking ahead, the number of older adults leaving homeownership is expected to jump significantly between 2026 and 2036, reaching between 13.1 million and 14.6 million. That’s a 42% increase compared to the previous decade [2]. Patrick Simmons, Director of Strategic Planning at Fannie Mae, highlighted the importance of preparing for this shift:

"The coming acceleration of older adults departing homeownership adds urgency to industry and public policy efforts to facilitate a smooth handoff of housing assets from older to younger generations" [2].

Even with this increase, about 1 million homes are expected to enter the market annually over the next decade due to the death of owners [4].

A lack of estate planning further complicates matters. While 32% of U.S. adults have a will, this number rises sharply with age - 66% for those in their 70s and 80% for those 80 or older [3]. Without proper planning, more estates end up in probate court rather than being transferred through trusts or other arrangements. Adding to this, changes in estate tax policies also play a significant role in shaping the probate landscape.

Estate Tax Policy Changes and Their Effects

Federal estate tax policies have seen major shifts over the years, directly impacting probate real estate. The exemption amount has fluctuated wildly, from $600,000 in 1997 to a projected $13.99 million in 2025 [5]. These changes determine whether estates need to sell off real estate to cover taxes or can transfer properties intact to heirs.

The 2017 Tax Cuts and Jobs Act doubled the estate tax exemption, drastically reducing the number of taxable estates. By 2016, only 0.2% of estates (about 5,500) were subject to federal estate taxes [6]. This decrease meant fewer families were forced to sell inherited properties quickly to pay taxes.

However, this could soon change. Current exemption levels are set to "sunset" on December 31, 2025, lowering the exemption to an inflation-adjusted $7 million in 2026 unless Congress intervenes [5][6]. In May 2025, the U.S. House of Representatives passed the "One Big Beautiful Bill Act", which proposes raising the exemption to $15 million per individual starting in 2026 [5]. This looming uncertainty makes planning tricky for estate holders and investors preparing for shifts in probate inventory.

Another critical factor is the "step-up in basis" policy. This allows heirs to reset the cost basis of inherited property to its market value at the time of inheritance. By eliminating capital gains taxes on property appreciation during the deceased owner's lifetime, this policy has historically reduced the pressure to liquidate real estate for tax purposes.

Economic Cycles and Probate Activity

Economic cycles also influence probate market dynamics. The trusts and estates industry generated $290.1 billion in revenue by 2025, growing at a CAGR of 8.8% from 2020 to 2025 [7]. This growth persisted despite economic fluctuations, as demographic aging remains a constant driver of activity.

Probate properties often show more stability than traditional real estate because their sales are driven by legal requirements rather than personal choice. Gregg Logan, Managing Director at RCLCO, explained:

"Market fundamentals remain sound, and for disciplined investors, opportunities still exist, though the margin for error is narrower" [8].

However, not all segments of probate real estate behave the same. Luxury properties are highly sensitive to stock market trends and investor confidence. During economic downturns, affluent buyers often delay purchases, while rental properties within estates remain more stable. For example, during recessions, vacancy rate increases for rental assets are typically limited to 0.5% to 1.2% [8].

Current market conditions reflect these varying sensitivities. In April 2025, the median sales price of new single-family homes was $407,200, a 2.0% decrease from April 2024 [8]. Additionally, 20% of resale listings saw price reductions in early 2025, the highest percentage since 2016 [8]. For probate investors, these cooling market conditions can offer opportunities, as executors often need to sell properties within specific legal timeframes, regardless of broader market trends.

How to Use Historical Data to Predict Market Changes

Comparing Historical Trends and Current Market Prices

The difference between historical property values and today’s market prices can reveal lucrative opportunities. Investors often start by examining the date-of-death fair market value alongside the property's original purchase price. This comparison helps calculate the step-up in basis, a key factor in estimating potential capital gains and identifying properties with significant equity [10].

To determine current property values, seasoned investors rely on the sales-comparison method. This involves analyzing recently sold homes - typically within the past 3–6 months and within a one-mile radius. By doing so, they can spot probate properties that may be undervalued in court inventories. Often, these properties are listed at outdated assessed values, leaving room for substantial profit potential [13].

Another valuable tool is monitoring local filing volumes. For instance, Philadelphia County, Pennsylvania, generates an average of 263 new pre-probate records each month [11]. Tracking these fluctuations across various regions can help investors identify high-activity areas before competition heats up. Together, these valuation techniques provide a foundation for understanding localized probate trends and market disparities.

Regional Differences in Probate Activity

Regional dynamics play a big role in predicting market behavior. For example, as of November 2025, inventory levels in the West were 3.1% higher than pre-pandemic norms, while the Northeast lagged 48.4% below those benchmarks. Delisting rates also highlight regional stress - Miami saw 45 homes delisted for every 100 new listings in October 2025, up from 34 the previous year [14]. These elevated delisting rates suggest that some sellers are struggling to meet market expectations, creating opportunities for investors who can offer realistic cash deals.

In terms of sales speed, homes in the Northeast are selling 16 days faster than pre-pandemic averages, whereas homes in the West are taking 10 days longer to sell [14]. This contrast underscores how national trends don’t always reflect local realities. Markets like Denver and Hartford, Connecticut, can vary significantly due to factors like demographics, estate tax policies, and housing affordability.

Using Technology and AI for Data Analysis

Once regional trends are understood, technology can refine the picture even further. Modern probate professionals no longer rely on manual courthouse searches. Instead, they use AI-powered platforms that deliver real-time updates [12]. These tools consolidate data from multiple sources - court filings, property records, and tax assessments - to uncover discrepancies between court-assessed values and actual market prices [1].

AI also uses distress scoring to prioritize leads. By analyzing factors like equity levels, foreclosure overlaps, housing affordability, and trustee sale data, these platforms can rank properties based on their potential profitability. This approach helps investors focus on motivated sellers and avoid properties likely to face prolonged court delays [9] [12].

"The strategic use of [probate] data can cut search time and resource use in traditional asset search methods, leading to more efficient and profitable recovery efforts."

– Jonathan Khorsandi, ProbateData [1]

For example, Massachusetts investors can use tools like LeadList.Pro to access real-time probate data and AI-driven insights. These platforms provide weekly leads complete with property details, contact information, and distress scores in an organized CSV format. This eliminates the need to manually gather data from various county sources, making the investment process more streamlined and efficient.

Regional Probate Market Examples

High-Activity States: Florida, Texas, and New York

Florida, Texas, and New York consistently lead the way in probate activity, each shaped by its own unique factors. Florida and Texas, for instance, draw wealthy retirees and businesses thanks to their no-income-tax policies, which help fuel a steady stream of high-value estates. On the other hand, New York stands out for its complex probate work, driven by a high concentration of ultra-high-net-worth individuals and intricate international assets [15].

Texas is a standout in the housing market, accounting for 15% of permitted housing units in 2024 despite having only 9% of the U.S. population. Projections suggest it could surpass California in population by 2045 [16]. Additionally, the state's median home price is forecasted to climb above $350,000 by late 2025 [20].

Florida's probate market is influenced by similar migration patterns but also has a global dimension. Miami, in particular, has evolved into a hub for international wealth, attracting families from Latin America and Europe. The upcoming expiration of federal estate tax exemptions on December 31, 2025, has further fueled estate planning activity in the state [15].

"The impending sunset of estate tax exemptions in 2026 has created urgent planning needs for high-net-worth clients." – Harrison Barnes, BCGSearch [15]

New York, however, offers a different probate landscape. While Florida and Texas experience high transaction volumes from growing wealth, New York focuses on handling multi-billion-dollar international estates and highly complex legal matters. The state is also grappling with a shortage of experienced probate attorneys, with demand for legal expertise far outpacing the available talent [15].

Massachusetts Example: Bellingham Probate Sales (2020-2025)

Bellingham, Massachusetts, provides a snapshot of regional probate trends while showcasing its own market dynamics. By late 2025, the town's median sale price had reached $545,000 - an 8.1% increase from the previous year. The median price per square foot also surged to $378, reflecting a 37.5% rise since 2024 [17]. These spikes highlight the growing equity in probate properties.

The town's competitive housing market is evident in its Redfin Compete Score of 93 out of 100, significantly higher than nearby Boston and Newton, which scored 71/100 [17]. Homes in Bellingham are selling fast, averaging just 18.5 days on the market, with some going under contract in as few as 13 days [17]. Recent sales further illustrate this intensity, with properties closing 14% above the asking price in timeframes ranging from 29 to 84 days [17].

Statewide, Massachusetts sees about 1,700 new pre-probate listings each month, with roughly 40% of probate properties selling within the first year [19]. Bellingham's proximity to Worcester, where home prices rose 7.8% in 2025, makes it an appealing alternative for buyers priced out of Boston's average home price of $739,121 [18]. Investors can take advantage of tools like LeadList.Pro for weekly verified leads, showing how historical trends continue to shape local opportunities.

Migration patterns in Bellingham also mirror broader trends, with 79% of homebuyers opting to stay within the metropolitan area. Notably, New York has emerged as the top source of inbound buyers [17]. A 6% drop in statewide inventory has only intensified competition, as buyers seek alternatives to traditional bidding wars [18].

Probate Market Forecasts for 2025-2030

Fewer Probate Listings as Trust Usage Increases

The number of probate listings is expected to decline as more Americans turn to trust-based estate planning. Anticipated tax reforms under the OBBBA are encouraging the adoption of trusts and gifting strategies [21]. This shift is especially noticeable among higher-income individuals - 83% of upper-income adults aged 70 and older have established estate plans, compared to just 51% of their lower-income counterparts in the same age group [3].

Assets held in trusts or joint ownership bypass the probate process entirely, transferring directly to beneficiaries [23]. With an estimated $124 trillion in wealth set to change hands, financial advisors are increasingly steering clients toward trusts as a way to preserve assets and avoid the complexities of probate.

Longer homeownership trends are also playing a role. By 2025, the median expected homeownership tenure reached 15 years, a significant jump from just 6 years in the mid-2000s [24]. Additionally, 28% of homebuyers in 2025 consider their current home a "forever home." This mindset is driving more thorough estate planning, including trust creation, to simplify asset transfers in the future.

Industry Growth and Revenue Projections

Despite the decline in probate listings, the real estate market as a whole is expected to grow steadily, fueled by broader housing trends and technological advancements. Existing home sales are projected to increase from 4.15 million in 2025 to 4.9 million by 2030. During the same period, median home prices are expected to rise from $411,000 to $455,000, while 30-year fixed mortgage rates are anticipated to drop from 6.75% to 5.75% [22].

"Buyers with significant equity are making larger down payments and all-cash offers, while first-time buyers struggle."

– Jessica Lautz, Deputy Chief Economist and VP of Research, National Association of REALTORS® [24]

Artificial intelligence is revolutionizing the way pre-probate leads and trust-held assets are identified. By 2030, AI is expected to automate 30% of hours worked across the U.S. economy. Tools like LeadList.Pro are already using AI to analyze distress scores and real-time court data, enabling Massachusetts investors to spot high-value opportunities before they hit the market. As traditional probate listings become scarcer, such AI-driven tools will become essential for staying competitive in the hunt for off-market deals.

With these trends - ranging from AI advancements to evolving estate planning strategies - the future of both probate and traditional real estate markets promises to be dynamic and full of opportunities.

Using Historical Data with Modern Tools

Benefits of Real-Time Probate Court Data

Tapping into real-time probate court data offers a distinct advantage for Massachusetts investors operating in a fast-moving market. These active probate leads - where executors are legally authorized to sign contracts - often have higher conversion rates[28]. Why? Because they represent estates where sellers are ready and able to make decisions, cutting down on procedural delays.

In a competitive state like Massachusetts, timing is everything. With roughly 1,700 new pre-probate records added every month[19], staying ahead means acting quickly. Weekly updates ensure investors can reach executors before the competition heats up. Plus, real-time data allows for cross-referencing court filings with property tax records and MLS listings to confirm property availability, saving time spent chasing outdated leads[29].

Combining current filings with historical data paints a fuller picture of the market. Historical records often reveal properties with long-term ownership and significant equity - key indicators of motivated sellers[28]. Together, these insights strengthen data-driven strategies, making them even more effective.

Using AI-Driven Distress Scores to Prioritize Leads

Data-driven tools have reshaped how investors uncover opportunities, and AI-driven distress scores take this to the next level. By analyzing property details, equity levels, and engagement patterns, these tools convert raw court records into actionable insights. As Jonathan Khorsandi of ProbateData explains:

"AI analyzes historical data to identify which leads are most likely to convert based on property characteristics, timeline, and engagement patterns"[25].

This predictive approach allows investors to focus on the 40% of probate properties that typically sell within the first year[19], avoiding the inefficiency of pursuing every lead.

Modern platforms streamline this process by automating data enrichment. They cross-reference court filings with property equity, tax histories, and neighborhood trends. For instance, LeadList.Pro integrates AI-generated distress scores with manual verification and real-time Massachusetts court data, delivering organized CSV files packed with detailed property and contact information. This automation slashes research time, helping investors zero in on high-equity properties primed for discounted sales.

Skip tracing integration further sharpens targeting efforts. One of the biggest hurdles in probate investing is outdated contact information, as court filings often lack current phone numbers or email addresses for personal representatives. AI-powered tools solve this by automatically updating contact details, giving investors direct access to decision-makers[26][27]. With deals typically closing within 3 to 12 months[28], automated CRM systems support multi-channel campaigns - direct mail, follow-up calls, and emails - ensuring leads are nurtured over time without missing opportunities.

Conclusion

Gaining a deep understanding of historical trends in the probate market can give investors a real edge. With just 24% of Americans having a will [1], the flow of probate properties remains steady and predictable. Unlike traditional real estate, where economic swings can heavily influence seller behavior, probate properties follow a different rhythm - one dictated by legal processes and the motivations of heirs, largely independent of broader market fluctuations.

The expected growth in the estate administration market mirrors demographic shifts that won't reverse anytime soon. An aging population with significant wealth ensures a reliable stream of opportunities for those who can analyze the patterns. Historical data sheds light on key factors: properties with high equity, heirs under financial strain from taxes and upkeep, and timelines that signal heightened urgency.

Tools like LeadList.Pro simplify the process by combining Massachusetts probate data with AI-driven distress scores and manual verification. By turning raw court records into actionable insights, they provide ready-to-use CSV files with complete property and contact details, enabling professionals to act quickly and efficiently.

Smart investors rely on data-driven strategies to turn historical insights into real opportunities. By pinpointing properties with overlapping motivation factors and reaching out to decision-makers before competitors do, they position themselves for success where timelines are predictable, and conversion rates are high. These strategies allow investors to move confidently in a market that's constantly shifting.

As probate expert Bill Gross wisely says:

"If you just did the work three hours a day to generate business, you'll make more money than you know what to do with, and you'll be helping people and feel good about yourself doing it" [30].

Historical trends act as the map, and modern tools serve as the vehicle. Together, they open doors for those who can see opportunities where others might not.

FAQs

::: faq

How do aging Baby Boomers influence the probate real estate market?

The aging Baby Boomer generation is leaving a noticeable mark on the probate real estate market. As the largest group of homeowners in the United States, Boomers hold a significant share of residential properties. However, as individuals age past 75, homeownership often declines. This is largely due to factors like mortality or transitions into senior living facilities or rental housing. As this trend continues, the number of homes entering probate is expected to grow in the coming years.

This shift could lead to an increase in probate property inventory, which might put downward pressure on home prices - especially for older or distressed properties. For real estate investors and agents, this creates opportunities to purchase properties at discounted rates. However, it’s important to note that probate sales often come with longer timelines and legal hurdles. Having access to reliable and up-to-date probate leads, such as those offered by LeadList.Pro, can give professionals the edge they need to navigate this changing market efficiently. :::

::: faq

How do estate tax policies influence trends in the probate market?

Estate tax policies heavily influence the probate market by determining how many estates surpass the tax exemption threshold and require court-supervised settlement. For instance, the federal estate tax exemption, currently at $12.92 million per individual, is set to drop to $5 million (adjusted for inflation) on January 1, 2026. This reduction is likely to increase the number of taxable estates, which in turn could lead to a rise in probate filings.

These tax adjustments ripple through the probate real estate market in various ways. When heirs face higher tax obligations, they often choose to sell inherited properties quickly, which boosts the number of motivated sellers in the market. Additionally, changes in exemption levels can influence the scale and type of properties entering probate, as larger estates tend to include more real estate assets. By keeping an eye on these patterns, investors and agents can better predict market shifts and fine-tune their strategies. Tools like LeadList.Pro, which offer timely, AI-powered probate leads, equip professionals to stay ahead of these tax-driven market changes and capitalize on new opportunities. :::

::: faq

How can investors use AI to find valuable probate properties?

AI plays a crucial role in helping investors pinpoint probate properties with high potential value by sifting through court records. These records often include details like filing dates, property specifics, and outstanding debts. With this information, machine learning models can crunch numbers to determine important metrics such as equity-to-debt ratios, vacancy status, and estimated repair costs. Each property is then given a distress score, which helps identify those most likely to sell quickly and at a lower price.

Beyond analysis, AI simplifies the entire process by prioritizing leads and automating communication. Investors can quickly filter for properties with strong equity and high distress scores, then rely on AI tools to connect with heirs more efficiently. This streamlined approach not only saves time but also boosts the likelihood of closing profitable deals before others step in. :::