How Machine Learning Finds Distressed Properties

Machine learning is transforming how real estate investors identify profitable preforeclosure deals. Instead of relying on slow, manual methods like public records or physical inspections, AI models analyze vast datasets to predict foreclosure risks up to 90 days earlier. These tools boast 85%–92% accuracy, scanning financial, legal, and physical property details to uncover high-potential leads before competition heats up.

Here’s what you need to know:

- Distressed properties are homes facing financial or physical challenges, often selling 20%–30% below market value.

- AI analyzes indicators like tax liens, missed payments, and code violations alongside aerial imagery and listing descriptions.

- Machine learning tools can evaluate 19,800 loans in under 19 minutes, saving hundreds of hours compared to manual reviews.

- By combining data sources like public records, MLS data, and geospatial imagery, AI assigns "distress scores" to rank properties by foreclosure risk.

- Investors using these tools are 35% more likely to secure profitable deals and often pay 20% below market value.

AI-powered platforms like LeadList.Pro deliver weekly preforeclosure and probate leads with distress scores, helping investors act early and minimize competition. Pricing starts at $99/month, making these tools accessible for investors at any level.

Machine learning enables faster, data-driven decisions, giving you a competitive edge in the growing $40 billion distressed property market.

How To Find Distressed Properties Fast With AI Vision Builder | Tutorial

What Are Distressed Properties?

Distressed properties are homes or buildings facing serious financial or physical challenges - often caused by missed mortgage payments or neglect over time [6]. These properties stand out from typical listings because they’re usually available at lower prices - often 20% to 30% below market value. However, they come with their own set of risks, including repair needs and complex legal issues [11, 6].

There are several financial warning signs to watch for: foreclosure filings, short sales (where the property sells for less than the remaining mortgage balance), bank-owned status (REO properties), and bankruptcy proceedings all point to financial trouble [6]. Other red flags include tax delinquency - unpaid property taxes for 12 to 36 months - and probate filings, which often suggest the heirs see the property as a liability. Eviction filings can also indicate landlord fatigue [7]. On the physical side, signs of distress might include overgrown lawns, broken windows, structural damage, or piles of trash - all of which are often tied to code violations [7].

The distressed property market is huge. Every year, about 324,000 families lose their homes to foreclosure, wiping out $22 billion in family wealth annually [4]. And this market is growing. With 2.2 million adjustable-rate mortgages expected to reset over a 24-month period, the number of defaults could rise even further [1].

"Distressed properties can be bought at lower prices, they usually require substantial additional investments for repairs and come with higher risks, necessitating careful due diligence." – HelloData [6]

Recognizing these signs is essential as we explore how machine learning helps identify such properties.

Common Signs of Property Distress

Key indicators of property distress are critical for investors and are also the data points used by machine learning models. Legal notices like a Notice of Default or Lis Pendens, combined with tax delinquency lasting 12–36 months, often indicate a property is on the brink of financial trouble. These early signals give investors time to negotiate directly with owners [9, 12]. Code violations - such as boarded-up windows, tarps on roofs, or utility shut-offs - often go hand in hand with financial struggles, revealing an owner’s inability to maintain the property [4, 9].

Another opportunity lies in probate filings. When property owners pass away, their heirs may see the inherited property as more of a liability than an asset, especially if it requires maintenance or has legal complications [7]. For instance, in February 2026, a real estate agent in Cook County, IL, tracked probate records and discovered a vacant house with no mortgage. By reaching out to the heirs with a personalized letter, the agent secured a listing agreement within a week [7].

Eviction filings can also signal landlord fatigue. In February 2026, a real estate professional in Hillsborough County, FL, monitored an eviction filing and found that the landlord - who had inherited the property - was overwhelmed by managing it remotely. The agent facilitated the sale and helped the landlord complete a 1031 exchange into a new-build duplex [7].

"Behind every code violation, probate filing, or eviction notice is a human being going through something difficult." – GoliathData [7]

How Machine Learning Finds Distressed Properties

Machine learning takes traditional indicators of property distress and transforms them into powerful early-warning tools. By analyzing massive datasets, these models can spot discounted or foreclosure-prone properties up to 90 days earlier than conventional methods [2][4]. Instead of waiting for foreclosure notices, these algorithms dig into financial records, property details, and owner information to flag potential issues. The outcome? Predictive models can reach 85% to 92% accuracy in forecasting mortgage defaults [4].

This shift from reactive to predictive detection is reshaping how investors uncover opportunities. Previously, investors relied on public "Notice of Default" filings. Now, predictive models analyze payment trends and economic factors, identifying distressed properties months in advance [4]. This head start allows investors to connect with homeowners before competition intensifies.

"Predictive AI analyzes historical data to find patterns and make predictions... on a much larger scale, with billions of data points and in just a few seconds." – PropStream [2]

These models rely on three main data categories: financial indicators (like liens, bankruptcies, or late mortgage payments), property characteristics (such as condition, age, and zoning), and owner demographics [2][9]. By layering this information with foreclosure risk scores and historical records, machine learning creates a complete distress profile for each property. Investors using these enriched datasets are 35% more likely to find profitable foreclosure deals compared to those who stick to public listings [9].

Data Sources for Machine Learning Models

Machine learning models pull from a wide range of data to get a full picture of property distress. Public records provide the foundation, including foreclosure filings, tax liens, bankruptcies, and code violations, gathered from over 3,000 U.S. counties [7]. These records are standardized to ensure consistency - turning varied labels like "Delinquent Property Tax Notice" or "Tax Lien Certificate" into a unified format for analysis.

In addition to public records, models incorporate Multiple Listing Service (MLS) data and proprietary sources, such as bank feeds and utility shutoff notices [2][9][4]. These proprietary signals often reveal financial distress long before it’s reflected in public databases. For example, a utility shutoff notice might indicate trouble months ahead of a foreclosure filing.

Geospatial AI adds another layer by extracting structured data from images. High-resolution aerial photos (with resolutions as fine as 7 cm) can reveal physical signs of distress, such as damaged roofs, overgrown yards, or abandoned vehicles [3]. While it might take a human analyst 300 hours to evaluate the condition of 19,800 loans, computer vision can handle the same task in under 19 minutes [3]. This speed enables real-time market monitoring on a massive scale.

By combining financial, legal, and visual data, machine learning creates what’s known as "multi-layered signal analysis." For instance, a property with both a tax lien (financial indicator) and visible roof damage (physical indicator) would score higher for distress than one with just a single issue [7][5]. These models assign scores - like "Motivation Scores" or "Propensity to Default" - to rank properties based on their likelihood of going into foreclosure within the next year [5][7].

Natural Language Processing for Property Listings

Natural Language Processing (NLP) algorithms analyze property descriptions to uncover distress signals that structured data might miss. By performing keyword extraction and sentiment analysis, NLP identifies phrases like "motivated seller", "needs TLC", or "investor special", which suggest urgency or disrepair [2]. While less talked about than computer vision, NLP plays an important role in spotting properties where the listing text hints at distress.

The challenge is that real estate descriptions are often vague or overly optimistic. For example, a listing might say "a great opportunity for the right buyer" without explicitly mentioning distress. NLP models trained on thousands of listings learn to recognize these subtle clues and factor them into the overall distress score.

When combined with other data sources, NLP helps fill in gaps. For instance, if a property has no recorded liens or violations but the description includes terms like "as-is sale" or "cash only", the NLP algorithm flags it as potentially distressed. This layered approach ensures that properties overlooked by traditional methods are still identified.

Image Recognition for Property Assessment

Image recognition takes distress detection a step further by identifying physical signs of neglect. Convolutional Neural Networks (CNNs) analyze property images to detect boarded-up windows, overgrown lawns, roof damage, driveway cracks, and other markers of abandonment [3][10]. These models process aerial images, satellite photos, and even Street View data to assess a property’s condition.

In one study from May 2021, researchers used Google Street View to identify abandoned homes in Detroit, MI. By combining global scene analysis (e.g., building facades) with detailed local features (e.g., broken eaves, overgrown lawns), the model achieved an F-score of 0.84 [10]. This dual approach enhances accuracy by balancing broad context with fine details.

Cape Analytics validated their Roof Condition Rating (RCR) technology by analyzing 443,274 properties. Their findings showed that homes flagged with "severe" roof conditions had loss ratios three times higher for insurance providers and were twice as likely to default on mortgages [3]. This clear link between physical condition and financial risk has made image recognition a cornerstone of distress detection.

| Imagery Source | Resolution | Best Use | Speed |

|---|---|---|---|

| Satellite | 30 cm - 80 cm | Neighborhood layout | Instant (stored) |

| Aerial (Plane) | 7 cm or better | Specific property condition | Instant (stored) |

| Drive-By | Below 1 cm | Curb appeal/BPO | Days to weeks |

"The detection of negative condition elements early in the process allows analysts to make more informed bids and focus diligence efforts where they are most impactful." – CAPE Property Intelligence [3]

Instant property condition assessments mean investors can make decisions quickly, avoiding the delays and costs of manual inspections [3]. By flagging physical distress early, these models help investors avoid overpaying for properties that may require significant repairs.

Machine Learning Algorithms for Distress Detection

Supervised Learning Models for Classification

To identify distressed properties effectively, machine learning relies heavily on supervised learning models trained on historical data with known outcomes. Among the most commonly used methods are Classification Trees (Decision Trees), Support Vector Machines (SVM), and Genetic Programming. These tools have proven to be highly reliable, with studies showing classification accuracies exceeding 75% [11]. Notably, Genetic Programming can sometimes push accuracy into the upper 90% range by creating equations that capture intricate property relationships [11].

Ensemble models take this a step further by combining several specialized sub-models into one cohesive prediction framework. A standout example comes from researchers at the University of Pennsylvania, who designed an ensemble of three logistic regression models for Philadelphia Legal Assistance. Their system achieved an impressive 93.68% accuracy rate and a 99.16% true negative rate across a dataset of 458,000 residential parcels [12]. This method reduces overfitting by separating highly specific data sources from broader indicators, ensuring more balanced predictions.

"The task of the machine learning techniques was to identify a function that well approximates the relationship between these explanatory variables and the binary outcome of interest." – Dexter Randell Brown, Nova Southeastern University [11]

In addition to these, Random Forest models - which use ensembles of decision trees - are particularly effective at handling the messy, inconsistent data often found in real estate. They balance predictive accuracy with transparency. Meanwhile, Artificial Neural Networks (ANN) excel at capturing complex, nonlinear relationships. Tools like SHapley Additive exPlanations (SHAP) are often integrated with ANNs to shed light on which features most influence a property's distress score [13]. Together, these models lay the groundwork for generating precise distress scores using comprehensive property data.

How Distress Scores Are Generated

Using these advanced classification techniques, machine learning algorithms transform diverse property signals into clear, actionable distress scores. These scores, typically normalized on a scale from 0 to 100, represent the likelihood that a property will default or enter foreclosure within the next 12 months [5]. The models analyze a wide array of features simultaneously, including:

- Financial indicators like liens, bankruptcies, and tax delinquency.

- Physical condition markers such as roof quality or yard maintenance.

- Locational factors like neighborhood socioeconomic trends and proximity to public transportation [2][13].

Incorporating computer vision, these models also extract structured data from high-resolution aerial images. For instance, visible roof damage combined with a tax lien would result in a higher distress score than a property showing only one of these indicators [5].

This streamlined scoring system allows investors to monitor entire markets in real time, focusing on analyzing preforeclosure leads most likely to face distress. Tools like LeadList.Pro utilize these AI-driven scores to deliver preforeclosure and probate leads directly to investors in Massachusetts, providing them with actionable insights to guide their decisions effectively.

Using Machine Learning in Real Estate Investing

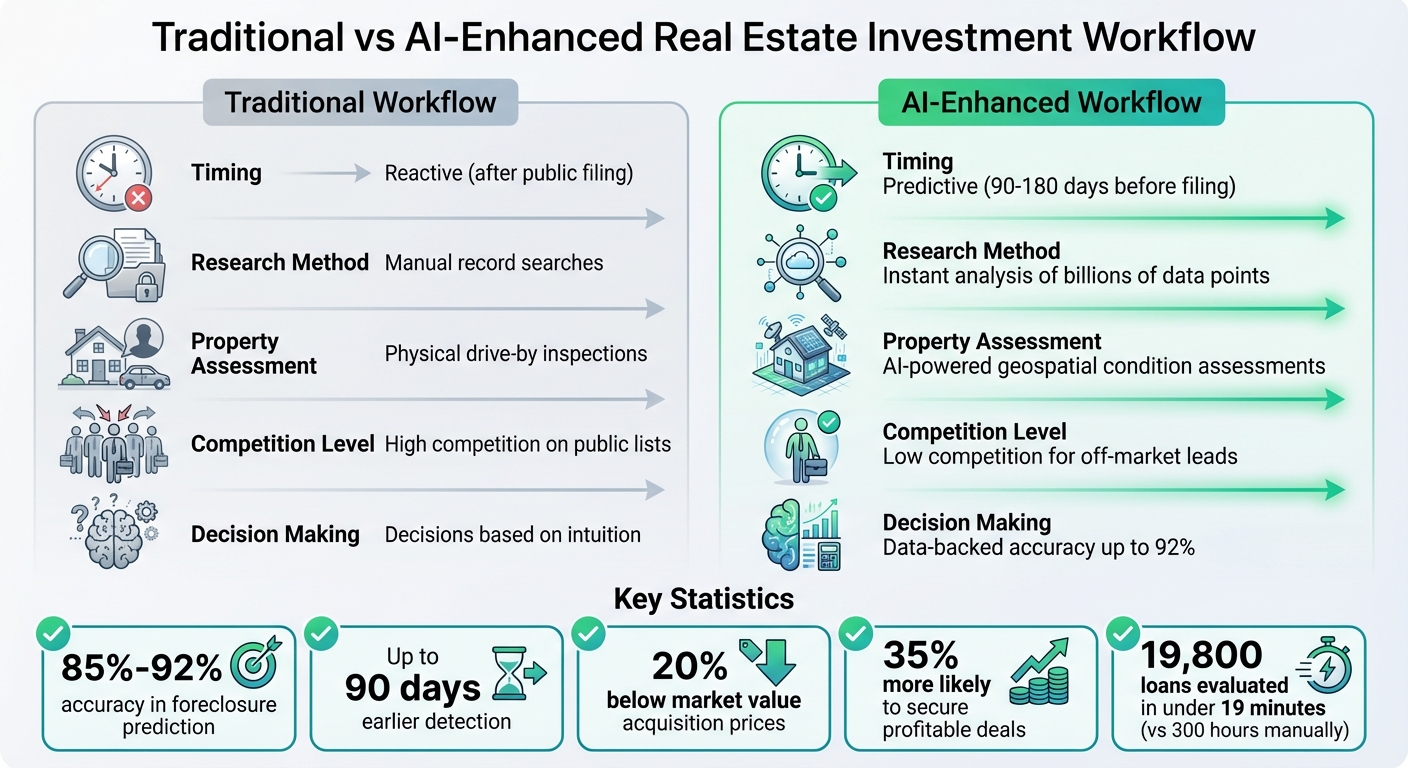

::: @figure  {Traditional vs AI-Powered Real Estate Investment: Speed, Accuracy & Competition Comparison}

:::

{Traditional vs AI-Powered Real Estate Investment: Speed, Accuracy & Competition Comparison}

:::

AI-Powered Lead Generation

Machine learning has reshaped how real estate investors identify distressed properties, making lead generation more precise and efficient. Instead of combing through public records manually, AI systems now scan over 155 million properties daily, uncovering subtle distress patterns that might otherwise go unnoticed [4]. These platforms pull data from various sources - like liens, bankruptcy filings, tax delinquency records, and even aerial imagery - to predict which homeowners might sell at a discount before their homes hit the market.

This predictive capability gives investors a competitive edge, allowing them to acquire properties with minimal competition and often at prices averaging 20% below market value [4]. Some investment firms leveraging this technology have reported doubling their pre-market property acquisitions [14].

"By the time others see a foreclosure notice, we've already created a solution." – Foreclose.ai [4]

For investors in Massachusetts, tools like LeadList.Pro bring this AI-driven approach to life. They offer weekly leads on probate and preforeclosure properties, complete with distress scores based on real-time court data, AI-driven property condition assessments, and verified contact details. Everything is delivered in a neatly organized CSV file. Pricing starts at $99/month for smaller counties and goes up to $249/month for areas with higher lead volumes.

Using these predictive tools as a foundation, integrating additional machine learning capabilities into your workflow can further streamline your investment strategy.

Adding Machine Learning Tools to Your Workflow

Once you’ve secured accurate leads, incorporating AI tools into your workflow can amplify efficiency and improve deal flow. You don’t need any technical expertise to get started - just use AI insights to guide your decisions. For example, set clear KPIs, such as generating 5–10 new distressed leads weekly and presenting 1–2 offers. This steady approach helps you avoid the feast-or-famine cycles that can disrupt your pipeline [16].

One of the most effective strategies is combining multiple distress signals. For instance, filter properties with physical issues - like severe roof damage or neglected landscaping - alongside financial red flags like tax liens or bankruptcy filings [2][3]. Properties that show both types of distress are 3–10 times more likely to convert than standard leads [17]. Once you’ve identified high-priority leads, sync them with your CRM to automate your outreach efforts. Use multi-channel communication methods, including cold calls, SMS, and direct mail. Interestingly, handwritten letters often yield the highest response rates from distressed homeowners [15][16]. These AI-driven insights allow you to tailor your outreach strategy and keep your pipeline consistent.

| Traditional Workflow | AI-Enhanced Workflow |

|---|---|

| Reactive (after public filing) | Predictive (90–180 days before filing) [4] |

| Manual record searches | Instant analysis of billions of data points [2] |

| Physical drive-by inspections | AI-powered geospatial condition assessments [3] |

| High competition on public lists | Low competition for off-market leads [2][4] |

| Decisions based on intuition | Data-backed accuracy up to 92% [4] |

While AI tools provide powerful insights, it’s essential to verify leads before investing heavily in marketing. Cross-check predictions with public records, and when possible, perform a quick visual inspection [15][8]. Additionally, consult a title company to uncover hidden liens or ownership disputes before closing any deals. While machine learning can offer precise data and predictions, successful real estate investing still relies on human judgment, empathetic negotiations, and crafting solutions that address the needs of distressed homeowners [2][4].

Conclusion

Machine learning has reshaped how real estate investors find distressed properties. What used to take countless hours of manually sifting through public records can now be done in minutes. AI models analyze millions of properties swiftly, giving investors a head start - up to 90 days before public foreclosure notices are filed - and reducing competition significantly [4].

These modern tools boast 85% to 92% accuracy in predicting foreclosures by examining over 50 factors, including payment history and property condition [4]. The result? Investors get precise, data-driven insights, allowing them to allocate marketing budgets more effectively by targeting high-potential leads instead of relying on broad, less-focused strategies.

For local investors, this means actionable opportunities are more accessible than ever. Even in Massachusetts, where budgets and expertise might vary, platforms like LeadList.Pro make AI-driven insights available to all. This service provides weekly probate and preforeclosure leads enriched with AI-powered distress scores, up-to-date court data, and verified contact details, all delivered in a simple CSV format. Pricing is straightforward: $99/month for smaller counties like Dukes and Franklin, and $249/month for larger, high-activity areas like Middlesex and Suffolk. This makes advanced AI tools affordable for investors at any level.

The move from reactive to proactive investing is undeniable. While many traditional investors wait for public auction lists, those using machine learning are already engaging with homeowners, often securing properties at 20% below market value [4]. The technology does the heavy lifting - evaluating street views, analyzing liens, and scoring distress levels - so you can focus on building connections and closing deals. By incorporating these tools into your process, you shift from chasing opportunities to strategically acquiring them through data-backed decisions.

FAQs

::: faq

What data sources make a distress score reliable?

A distress score's effectiveness hinges on the quality and diversity of the data it draws from. Key data sources include foreclosure records, mortgage details, ownership information, tax liens, financial activity, and property characteristics. When this data is paired with real-time updates, historical records, and market trends, it becomes far more reliable. Machine learning models then process this enriched dataset to provide precise and actionable insights, making it easier to pinpoint distressed properties. :::

::: faq

How early can AI spot foreclosure risk before it’s public?

AI has the ability to identify foreclosure risks immediately after the first legal action is taken. This could be a Notice of Default in non-judicial states or a Lis Pendens or foreclosure complaint in judicial states. These timestamped filings serve as the true starting point - or "day zero" - of pre-foreclosure. By pinpointing this moment, AI provides an early and dependable signal, well before this information becomes broadly accessible through other sources. :::

::: faq

How should I verify an AI “distressed” lead before outreach?

To confirm if an AI-generated distressed lead is accurate, start by comparing the distress score with publicly available records and other data sources. You can use techniques like skip tracing to locate additional information about the individual or property. Also, check county records for indicators like tax liens, notices of default, or other red flags. By blending AI-driven insights with these tried-and-true methods, you can get a clearer picture before making contact. :::