State-by-State Guide to Probate Bond Laws

Probate bonds are court-required financial guarantees ensuring estate managers (executors) fulfill their legal responsibilities. They protect beneficiaries, creditors, and heirs from fraud or mismanagement. Here’s a quick breakdown:

- When Required: Often needed when there’s no will, the executor lives out of state, or the estate has significant debt.

- How Amounts Are Set: Based on the estate’s personal property value and annual income. Real estate may be included if it’s sold.

- Waivers: Bonds can sometimes be waived if the will states so, all beneficiaries agree, or the estate is small.

- State Variations: Probate bond rules differ by state. Some require them for all estates, while others leave it up to the court.

For real estate professionals, understanding probate bonds is critical since they can impact property transactions. Executors usually secure bonds within 1–3 days, with costs ranging from 0.5% to 1% of the bond amount.

Quick Comparison

| State | Bond Requirement | Waiver Options | Calculation Basis |

|---|---|---|---|

| California | Typically required | Will states no bond; all beneficiaries consent | Personal property + annual income + real estate proceeds |

| Florida | Required for most representatives | Court discretion for small estates | Estate inventory + projected income |

| Texas | Case-dependent | Will waives; all distributees agree | Estate value |

| New York | Usually required | Will waives; all beneficiaries consent | Estate assets |

| Delaware | Required unless waived | Will waives; court order | Personal estate value |

Understanding your state’s rules and planning ahead can help avoid delays in estate management or property sales.

Factors That Determine Probate Bond Requirements

How Courts Calculate Bond Amounts

Courts determine probate bond amounts based on the estate's personal property value and its anticipated annual gross income [12][1]. Real estate is typically excluded unless the executor is tasked with managing or selling it. In such cases, an additional bond is required to cover the proceeds from the sale [12][1].

To lower bond requirements, courts often consider assets placed in blocked accounts. These are court-restricted accounts where funds cannot be accessed without judicial approval [9][11][13]. By using blocked accounts, both the bond amount and premium costs can be reduced.

In California, individual guarantors must provide double the standard bond amount [12][1]. The National Probate Court Standards suggest that probate bonds should cover the estate's liquid assets plus its annual income [4]. These calculations establish the framework for when courts may choose to waive bond requirements.

When Probate Bonds Can Be Waived

There are specific circumstances where probate bonds may not be required. A common example is when the decedent's will explicitly states that no bond is necessary [14][15]. While courts usually respect such provisions, they reserve the right to impose a bond if special circumstances arise.

"Even if a will expressly waives bond, the court may still require an executor to have one if they reside outside California or for other good cause."

- Brittany Doyle, Attorney, Doyle Quane [18]

Another situation for a waiver occurs when all heirs and beneficiaries provide written consent to proceed without a bond [14][16]. Executors who are banks or professional trust companies are also generally exempt, as their operations are heavily regulated [14][15]. Additionally, many states waive bond requirements for small estates. For instance, in California, estates valued under $166,250 are exempt [15][17].

Even when a bond is mandated, placing liquid assets in blocked accounts can reduce the required bond amount.

State laws further complicate these requirements, as detailed below.

How State Laws Differ

State-specific laws add another layer of complexity to probate bond requirements. In 34 states, statutory formulas dictate bond calculations, while others leave it to the court's discretion [4]. Around 20 states require bonds for all personal representatives, while 12 states give judges full authority to decide whether a bond is necessary [4].

Real estate is treated differently across states. For example, California includes real estate values when independent administration is granted [12], while Massachusetts focuses mainly on personal property [9]. In states like Delaware and Nebraska, any creditor or interested party with a claim exceeding $2,000 can petition the court to require or increase a bond if they believe estate assets are at risk [10][8].

Small estate thresholds also vary widely, impacting whether a bond is required. These thresholds range from $15,000 in some states to $208,850 in California [20][21]. As a result, the need for a bond can depend heavily on the estate's location, underscoring the importance of understanding state-specific probate rules.

Probate Bond Laws by State

State Bond Requirements Table

Probate bond laws differ significantly across the United States, creating varying obligations for real estate professionals handling estate properties. About 20 states mandate bonds by law, while 12 states leave the decision entirely up to the courts, allowing them to require or waive bonds as they see fit [4].

Here’s a quick look at the bond requirements in some key states:

| State | Bond Requirement | Waiver Options | Basis for Bond Amount Calculation |

|---|---|---|---|

| California | Typically required [7] | Waived if specified in the will and all interested parties consent [5] | Value of personal property plus annual income from all estate assets [5] |

| Delaware | Required unless exceptions apply [8] | Waived if the will excuses it or by Court of Chancery order [8] | Not less than the estimated value of the decedent's personal estate [8] |

| Florida | Required for most representatives [5] | Court may waive at its discretion [5] | Total estate inventory value plus projected annual income [5] |

| New York | Usually required [5] | Waived if the will states otherwise and all beneficiaries consent [5][7] | Based on the value of the estate assets [7] |

| Texas | Case-dependent [5] | Often waived if the will explicitly states no bond is required [5] | Generally set at the total value of the estate [7] |

Key detail: In Delaware, creditors or interested parties with claims exceeding $2,000 can request a bond, even if the will waives it, highlighting the court's authority in such cases [8].

How to Research Your State's Requirements

Knowing the probate bond rules in your state is essential, but understanding how to confirm these requirements is just as important.

Start by reviewing the court order or letters of administration, where judges specify the bond amount required [5]. For state-specific rules, check your probate statutes, often labeled as "Probate Code", "Administration of Estates", or "Decedents' Estates" [22][23]. For instance, Delaware’s rules are found in Title 12, Chapter 15, while California references the California Probate Code [8][22].

However, don’t stop at state statutes. Local court rules frequently provide more detailed guidance than state laws, and actual practices may not always align with statutory language [4]. Contacting the local Register of Wills or probate court clerk is a smart way to confirm court-specific rules and bonding procedures [8][5]. Many counties have unique processes not explicitly mentioned in state legislation.

For additional help, professional surety agencies can clarify state-specific requirements and typically provide bond quotes within 24 to 72 hours [5]. By doing this groundwork, you’ll be better prepared to navigate the specific practices discussed in the next section.

What is a Probate Bond and how do you secure this surety bond?

Probate Bond Rules for 5 Major States

::: @figure  {Probate Bond Requirements Comparison: 5 Major US States}

:::

{Probate Bond Requirements Comparison: 5 Major US States}

:::

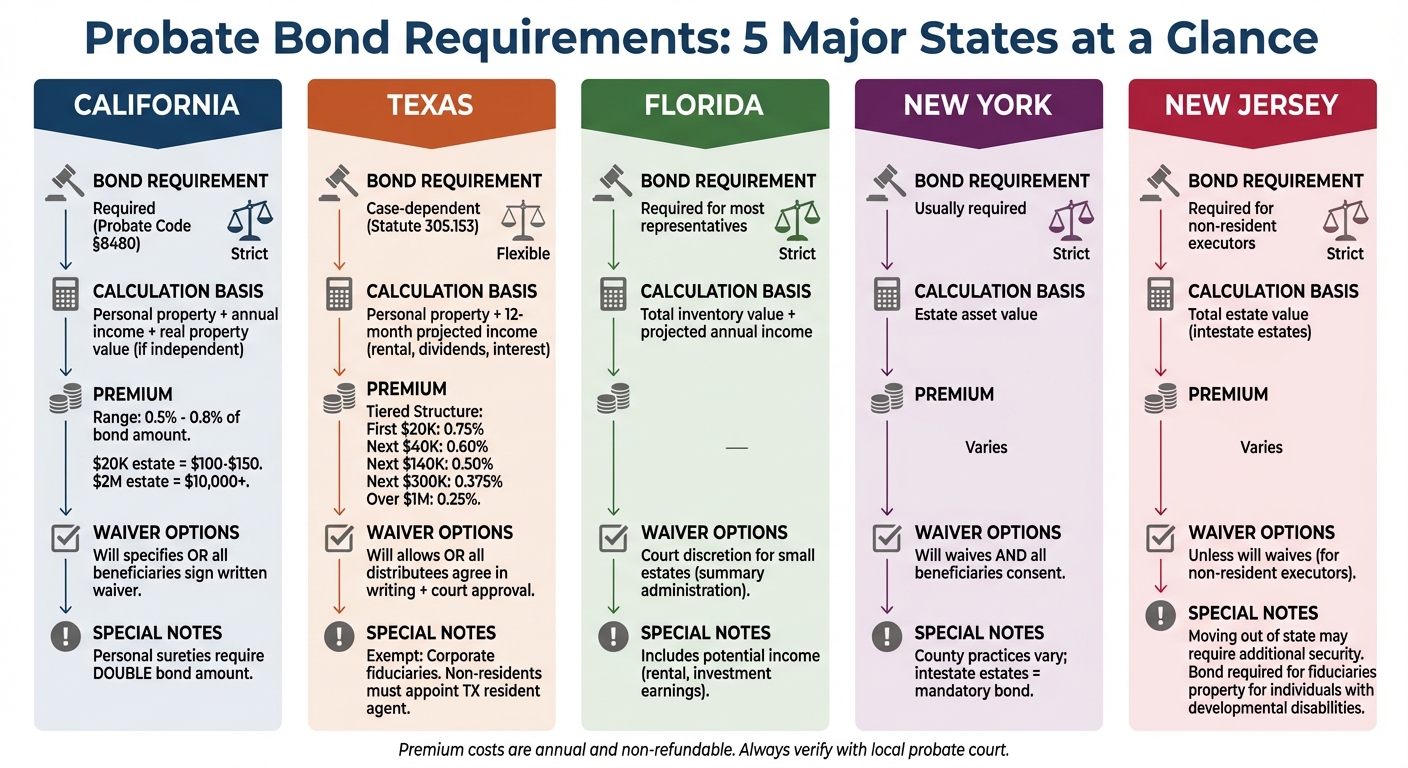

Here’s a breakdown of how probate bond requirements vary across five key states, emphasizing how local laws influence these obligations.

California Probate Bond Requirements

Under California Probate Code §8480, personal representatives must secure a court-approved bond before receiving "letters" granting them authority to act. The bond amount is calculated based on the estate's estimated personal property value, probable annual income, and, if independent administration is allowed, the decedent's real property interest value[12].

When selling real property, the court mandates an additional bond to cover the anticipated sale proceeds, treating these as personal property[12]. Bond premiums typically range from 0.5% to 0.8% of the bond amount. For smaller estates worth $20,000 or less, premiums are generally between $100 and $150. However, for larger estates - such as those valued around $2 million - premiums can exceed $10,000[24]. Personal representatives can usually reclaim these costs from the estate.

A bond may be waived if specified in the will or if all beneficiaries sign a written waiver attached to the appointment petition. However, the court can still require a bond for "good cause." If personal sureties are used instead of an admitted surety insurer, the bond amount must be double the court-determined amount[12].

Texas Probate Bond Requirements

Texas law, under Statute 305.153, sets the bond amount based on the estate's personal property value plus projected income over the following 12 months, including rental income, dividends, and interest. Depositing funds in a Texas financial institution can reduce the bond amount.

Surety companies in Texas follow a tiered premium structure: 0.75% for the first $20,000, 0.60% for the next $40,000, 0.50% for the following $140,000, 0.375% for the next $300,000, and 0.25% for amounts exceeding $1,000,000[25]. Corporate fiduciaries, like banks and trust companies, are usually exempt from bond requirements. Individual executors may also bypass this requirement if the will allows or if all distributees agree in writing and the court approves. Non-resident executors must appoint a Texas resident agent to handle legal matters.

Florida Probate Bond Requirements

In Florida, most personal representatives are required to post a bond based on the estate's total inventory value and projected annual income[5]. Courts may waive this requirement for smaller estates undergoing summary administration. Florida courts also consider potential income, such as rental or investment earnings, when determining bond amounts.

New York Probate Bond Requirements

New York generally requires probate bonds unless the will explicitly waives the requirement and all beneficiaries consent[5][7]. The bond amount is tied to the estate's asset value, but practices vary by county since Surrogate's Court judges have discretion. For intestate estates, bonds are mandatory. Executors named in a will can avoid this requirement if the will specifies a waiver and beneficiaries agree.

New Jersey Probate Bond Requirements

New Jersey has stringent rules for non-resident executors, requiring them to post a bond unless the will specifically waives it[26]. If a fiduciary moves out of New Jersey after their appointment, the court may demand additional security, even if none was initially required[26]. For intestate estates, the bond amount typically equals the estate's total value. Additionally, fiduciaries managing property for individuals with developmental disabilities must provide a bond.

How to Get a Probate Bond

Getting a probate bond is a crucial step in managing estate transactions. Here's a straightforward guide to help you navigate the process, understand the costs, and address potential challenges.

The Application Process

The first step is to determine the bond amount required by your court order. Once you have this information, choose a licensed surety provider and gather essential documents like the estate's asset and liability schedule, appointment papers, and, if available, a copy of the will [27][5][28][3].

Next, submit your application. This typically involves providing personal financial disclosures and undergoing a credit check. Most bonds are issued within 24–72 hours [5][6]. After approval, pay the premium and file the bond documents with the probate court [27][2][5].

"A probate bond protects the estate and its beneficiaries from losses caused by improper actions or negligence of the court-appointed fiduciary." - Erin Cruz, Surety Bond Associate, Surety Bond Authority [5]

Once you’ve secured your bond, it’s time to consider the costs and plan accordingly.

What Probate Bonds Cost

The cost of a probate bond depends on the bond amount and your financial profile. Annual premiums typically range from 0.5% to 1% of the bond amount [29][5]. For example, a $100,000 bond would cost around $500, while a $250,000 bond would be approximately $1,250 [2][29].

For estates exceeding $250,000, many surety companies use a sliding scale, reducing the percentage rate as the bond amount increases [5][6]. However, your credit score plays a significant role in determining your rate. If your credit is poor, you might face premiums ranging from 2% to 10%, meaning a $100,000 bond could cost between $2,000 and $10,000 [29][2].

In cases where the bond exceeds $25,000, having a probate attorney involved can improve underwriting terms and is often a requirement [6]. Keep in mind that premiums are non-refundable, even if the estate is settled earlier than expected [29][5].

Understanding these cost factors is essential, but it’s equally important to prepare for potential challenges.

Common Problems and How to Solve Them

Credit issues are one of the most common obstacles. To address this, work with a surety provider that offers specialized "bad credit" programs. For bonds under $25,000, many companies even waive credit checks [29][6].

Other potential hurdles include prior convictions, disputes among beneficiaries, or complications involving ongoing business interests. These can increase the perceived risk for the bond provider [6]. Engaging a probate attorney can significantly improve your chances of approval and may even help you secure better rates [6].

To streamline the process, gather all necessary documents early. This includes your Social Security number, a detailed inventory of the estate’s assets, your net worth, and a list of beneficiaries [6][27][3]. Preparing in advance can save time and help avoid unnecessary delays.

Conclusion

Why You Need to Know About Probate Bonds

Probate bonds play a key role in real estate transactions, ensuring smooth processes and avoiding unnecessary delays. Real estate often impacts the bond amount significantly, sometimes requiring coverage of 100–200% of the estate’s property value. For instance, in Ohio, probate bonds must cover twice the asset value [30]. Understanding these requirements early allows you to anticipate potential obstacles and guide clients through the process with confidence.

Craig Parker explains, "The bond protects the estate and its heirs, creating a financial incentive to prevent misappropriation" [19].

This safeguard ensures that funds from property sales are managed responsibly and ethically, providing peace of mind for all parties involved.

What to Do Next

Start by researching your state’s probate codes, as rules can vary widely. Confirm specific requirements with your local probate court [7].

It’s also a good idea to establish connections with probate bond agents and estate attorneys who can assist with more complex cases [31]. Encourage fiduciaries to secure bonds early in the process, as last-minute applications can face delays due to credit or background checks [31].

For real estate professionals, tools like LeadList.Pro can simplify the process. This platform delivers weekly probate leads and real-time court data, helping you focus on leads that are ready for transactions. By staying informed and proactive, you can navigate the probate market more effectively and keep your transactions running smoothly.

FAQs

::: faq

What determines the cost of a probate bond?

The cost of a probate bond depends on several factors, with the bond amount being one of the most important. This amount is tied to the value of the estate or the level of fiduciary responsibility involved. Larger estates or higher potential liabilities usually lead to higher bond costs.

Other influences include the type of bond needed - corporate surety bonds (the most common), cash bonds, or personal surety bonds. The financial history and stability of the fiduciary also matter; individuals with a riskier financial profile may face higher premiums. Finally, state-specific laws and regulations come into play, as requirements and rates can vary depending on the jurisdiction. Together, these factors determine the overall cost of the bond. :::

::: faq

Can an executor have the probate bond requirement waived?

In some situations, an executor may not need to post a probate bond, but this largely depends on state laws and the unique details of the estate. For instance, a bond might not be required if all heirs or beneficiaries agree to waive it or if the will clearly specifies that no bond is necessary. Certain states also allow waivers when the executor is a trusted institution, like a bank or trust company, or if the estate qualifies as a small estate under local regulations.

Courts can also waive the bond under specific conditions, such as when the executor is the sole beneficiary, the estate's value falls below a particular threshold, or if a formal waiver request is submitted and approved. Since the rules and processes vary from state to state, it’s a good idea to consult a legal expert or review the applicable probate laws in your area. :::

::: faq

Why do probate bond requirements differ from state to state?

Probate bond requirements can vary widely because each state has its own set of probate laws and guidelines. These rules dictate when a bond is necessary, the type of bond required, and the amount. For example, some states require probate bonds in most cases unless a court specifically waives them. Others might only require them under certain conditions, like when the estate exceeds a particular value or when specific exemptions don't apply.

The main goal of a probate bond is to protect estate assets, creditors, and heirs from potential mismanagement by fiduciaries. However, how states prioritize this protection depends on several factors. These include local legal traditions, the complexity of estate proceedings, and the level of financial risk courts are willing to tolerate. This mix of considerations leads to the differing probate bond regulations across jurisdictions. :::