How Massachusetts Courts Handle Sale Irregularities

In Massachusetts, foreclosure sales must strictly follow legal procedures and mortgage terms. Any errors - like notice defects, improper title chains, or standing issues - can void the sale entirely. This means the buyer may lose ownership, even if they acted in good faith. Key points include:

- Notice Defects: Misleading or incorrect default notices can invalidate a foreclosure. Example: Pinti v. Emigrant Mortgage Co. (2015).

- Chain of Title: Foreclosures require proper mortgage assignments before notices are issued. Example: U.S. Bank Nat'l Ass'n v. Ibanez (2011).

- Auction Conduct: Lenders must act in good faith and aim for fair property valuation during auctions.

Massachusetts courts enforce strict compliance with foreclosure laws, making thorough document reviews essential for buyers and investors.

Legal Framework for Foreclosure Sale Irregularities

Statutes and Legal Doctrines

Massachusetts foreclosure law is built around G.L. c. 183, § 21, which allows nonjudicial foreclosures if lenders comply with mortgage terms and state laws, and G.L. c. 244, §§ 11–17C, which outline the technical requirements for foreclosure.

Under G.L. c. 244, § 14, lenders must follow specific procedural steps. These include publishing sale notices for three consecutive weeks, with the first notice appearing at least 21 days before the sale, and sending notice to the property owner via registered mail at least 14 days before the sale. If the mortgage has been assigned, the assignment must be recorded at the registry of deeds before the notice is mailed.

Massachusetts courts demand strict compliance with the power of sale provisions. This means even minor procedural errors can void the sale entirely, making it legally nonexistent rather than just voidable. This principle applies to both statutory requirements and the terms of the mortgage. For example, in the 2015 case Pinti v. Emigrant Mortgage Co., the Supreme Judicial Court ruled that lenders must strictly adhere to Paragraph 22 of standard mortgages, which requires notifying borrowers of their "right to bring a court action" to dispute a default. Justice Botsford emphasized:

"Strict compliance with the notice of default provisions in paragraph 22 of the mortgage was required as a condition of a valid foreclosure sale."

The court differentiated this from G.L. c. 244, § 35A, a consumer protection statute that does not require strict compliance, as it is not directly part of the foreclosure process [3].

Since the 2012 Eaton v. Federal National Mortgage Association decision, courts have also required foreclosing parties to hold both the mortgage and the promissory note - or to act as the authorized agent of the note holder - when initiating foreclosure [4]. This clarified that the chain of title involves more than just recording mortgage assignments at the registry of deeds.

Massachusetts Court Levels and Case Selection

The most influential rulings on foreclosure irregularities come from the Supreme Judicial Court (SJC), the highest court in Massachusetts. The SJC often steps in to resolve cases of public importance by transferring them from the Appeals Court, providing definitive guidance on real estate law. Landmark cases like Ibanez (2011), Eaton (2012), and Pinti (2015) have set binding precedents that all lower courts must follow.

These appellate rulings shape how trial courts handle foreclosure disputes. When the SJC declares a foreclosure sale void due to notice defects or standing issues, it establishes a framework for evaluating similar cases in the future. These decisions also affect how lenders structure their foreclosure processes and how real estate professionals assess risks tied to foreclosed properties. The court's precedents provide a foundation for analyzing specific foreclosure irregularities in subsequent cases.

How Courts Rule on Different Types of Sale Irregularities

::: @figure  {Massachusetts Foreclosure Irregularities: Types, Standards, and Outcomes}

:::

{Massachusetts Foreclosure Irregularities: Types, Standards, and Outcomes}

:::

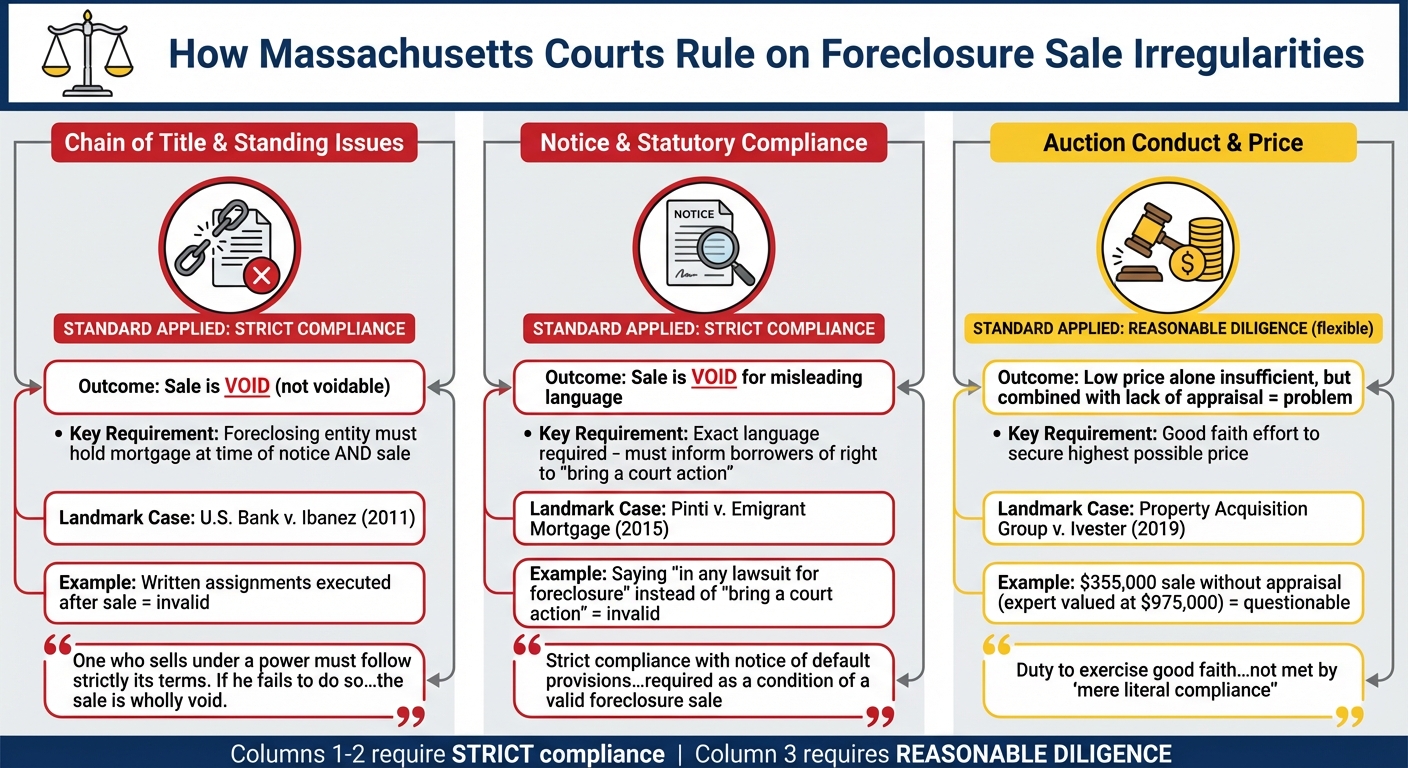

In Massachusetts, courts apply distinct, non-overlapping standards to address various irregularities in foreclosure sales. These standards are rooted in a strict legal framework that ensures compliance with established laws.

Chain of Title and Standing Issues

Massachusetts courts are unwavering when it comes to standing requirements. They mandate that the entity conducting a foreclosure must hold the mortgage both at the time of the foreclosure notice and the sale itself. If the foreclosing party lacks proper ownership, the foreclosure sale is deemed void - not just voidable - which means it holds no legal validity.

A landmark case, U.S. Bank Nat'l Ass'n v. Ibanez, decided by the Supreme Judicial Court in January 2011, illustrates this principle. The court ruled that two foreclosure sales from July 2007 were void because the written assignments of the mortgages were executed more than a year after the sales occurred. Although the banks argued that securitization documents, like Private Placement Memoranda, demonstrated ownership, the court rejected this claim due to their failure to produce the actual loan schedules identifying the specific mortgages. Justice Ralph Gants emphasized:

"One who sells under a power [of sale] must follow strictly its terms. If he fails to do so there is no valid execution of the power, and the sale is wholly void."

The court further clarified that executing an assignment after the sale cannot retroactively establish title. According to Massachusetts law, a foreclosing entity that isn't the original mortgagee must provide either a complete chain of assignments or a single assignment from the record holder, executed before the first publication of the foreclosure notice.

This strict scrutiny of title extends to other aspects of the foreclosure process, such as notice and compliance with statutory requirements.

Notice and Statutory Compliance Errors

Courts also demand strict adherence to notice requirements, where even minor errors can render a foreclosure sale void if they fail to accurately inform borrowers of their rights.

In Pinti v. Emigrant Mortgage Co., decided in July 2015, the Supreme Judicial Court reinforced this principle. The court voided a foreclosure sale because the notice incorrectly stated that borrowers could assert defenses "in any lawsuit for foreclosure" rather than informing them of their right to "bring a court action." This distinction is critical in nonjudicial foreclosure states like Massachusetts, where borrowers must take the initiative to challenge foreclosures. Justice Margot Botsford underscored this point:

"Strict compliance with the notice of default provisions in paragraph 22 of the mortgage was required as a condition of a valid foreclosure sale."

This decision set a clear precedent for future foreclosures, emphasizing that any misleading language in notices can deprive borrowers of essential information about their legal options.

While standing and notice issues focus on strict compliance, courts also evaluate the conduct and pricing strategies used during foreclosure auctions.

Auction Conduct and Price Adequacy

When it comes to auction conduct and sale price, courts shift their focus to whether the mortgagee exercised reasonable diligence. Lenders are expected to take reasonable steps to secure the highest possible price for the property.

A case in point is Property Acquisition Group, LLC v. Ivester, decided by the Massachusetts Appeals Court in April 2019. In this case, Fannie Mae sold a 4.57-acre property in Lynnfield at auction for $355,000. Although Fannie Mae complied with statutory requirements under G.L. c. 244, §§ 11-17B, it failed to obtain appraisals or expert opinions to determine the property's actual value before the sale. The mortgagors presented an expert appraisal valuing the property at $975,000, citing its development potential. The court reversed summary judgment, with Justice Henry stating:

"The duty to exercise good faith and reasonable diligence is not met by 'a mere literal compliance with the terms of the power [of sale]' or with the requirements of G. L. c. 244, § 14.'"

This ruling highlights that strict statutory compliance alone is not enough. Mortgagees must also act in good faith and exercise reasonable diligence to maximize the property's value. While a low sale price alone isn't sufficient to invalidate a sale, it can, when combined with other factors - such as failure to appraise the property or consider its potential - support a finding that the lender acted unreasonably.

Patterns in Court Outcomes and Evidence Requirements

Massachusetts courts approach foreclosure challenges with a case-specific lens, tailoring outcomes based on the particular irregularities involved. These decisions highlight when courts demand precision and when they allow some leeway.

Strict vs. Flexible Compliance

When it comes to conditions that must be met before a valid foreclosure sale, courts enforce strict compliance. This includes requirements like the exact language of notices, proper chain of title documentation, and standing. These elements must align perfectly with the mortgage contract and state laws. Even minor deviations can render a foreclosure sale invalid.

However, courts take a more flexible stance when reviewing the conduct of foreclosure auctions. While procedural requirements demand exactness, the auction itself is assessed based on whether it was conducted in good faith and with due diligence. This distinction between strict and flexible standards plays a significant role in determining the burden of proof for challenges to foreclosure sales.

Burden of Proof in Sale Challenges

The burden of proof in foreclosure disputes is clearly defined and depends on strict adherence to procedural rules. This clarity helps outline the responsibilities of each party in such cases.

In post-foreclosure eviction cases, the foreclosing party must present an attested foreclosure deed along with an affidavit of sale, as required by G.L. c. 244, § 15 [6]. Once these documents are submitted, the burden shifts to the borrower to prove any irregularities. For example, in Federal National Mortgage Ass'n v. Hendricks, the absence of an affidavit showing improper notice led to summary judgment in favor of the foreclosing party [6].

For third-party buyers who purchase foreclosed properties in arms-length transactions, G.L. c. 244, § 35C provides additional protections. A creditor’s certification confirming compliance with foreclosure requirements acts as conclusive evidence, shielding these buyers from most challenges to the foreclosure’s validity [7]. It's essential that this compliance affidavit is recorded alongside the foreclosure deed [7].

What This Means for Real Estate Professionals

Assessing Risk in Foreclosure Opportunities

Back in January 2011, the Massachusetts Supreme Judicial Court made headlines by voiding two foreclosure sales due to improper mortgage assignments. Let’s break it down: in the Ibanez case involving 20 Crosby Street (sale price: $94,350), the bank's written assignment didn’t show up until more than a year after the foreclosure. Similarly, in the LaRace case, Wells Fargo’s foreclosure of 6 Brookburn Street for $120,397.03 was voided because key documents - like the Pooling and Servicing Agreement and loan schedule - were missing[2].

What does this mean for real estate professionals? It’s a clear warning that properties sold below market value can carry serious title risks if the foreclosure process wasn’t properly handled. To minimize these risks, professionals should ensure the following before pursuing foreclosure opportunities:

- The foreclosing entity actually held the mortgage when the first notice was published.

- All assignments were completed before the foreclosure process even started.

- The default notice language matches the exact wording required under Paragraph 22.

Even the smallest mistake can derail a foreclosure. For instance, in the 2015 Pinti case, a single word error in the default notice was enough to void the foreclosure[1]. This highlights the need for a meticulous review of every document in the chain - not just relying on the foreclosure deed. These risks make it clear why having access to reliable data tools isn’t just helpful - it’s essential.

Using Data Solutions to Identify Risks

Massachusetts, as a nonjudicial foreclosure state, places the burden of due diligence squarely on investors. The problem? Manually combing through deeds and court filings can easily miss critical timing issues - like assignments recorded suspiciously close to or even after the foreclosure date.

That’s where LeadList.Pro steps in. This tool pulls real-time data directly from Massachusetts probate courts and preforeclosure filings. By combining AI-powered analysis with manual checks, it flags potential red flags in key areas - whether it’s the timing of assignments, errors in notice language, or issues with the chain of title. For securitized loans, the platform can even indicate when to request specific Pooling and Servicing Agreement schedules, ensuring that the property was legally transferred into the trust before foreclosure proceedings began.

With tools like these, real estate professionals can make smarter, safer decisions, avoiding properties that might otherwise lead to costly legal headaches.

Conclusion

Massachusetts courts enforce strict compliance with every term outlined in the power of sale. The Supreme Judicial Court has repeatedly emphasized that mortgagees must adhere to these terms without deviation. As stated in Moore v. Dick and cited in U.S. Bank National Association v. Ibanez:

"One who sells under a power [of sale] must follow strictly its terms. If he fails to do so there is no valid execution of the power, and the sale is wholly void." [5]

This means that any failure to meet these requirements renders a foreclosure invalid, even for a third-party buyer acting in good faith, leaving them without valid title.

Given this high standard, careful scrutiny of foreclosure documents is critical. Real estate professionals must ensure that the foreclosing party held both the mortgage and the note before publishing notices, verify that default notices comply with Paragraph 22, and confirm that the chain of assignments is complete. Even minor errors, such as a missing document or an incorrect phrase, can nullify a foreclosure, as shown in the 2015 Pinti case [1]. This level of precision demands a thorough and systematic approach.

To further protect investments, modern technology offers powerful tools for identifying potential issues early. Real-time court data and AI-driven analysis can flag problems like improper assignment timing or non-compliant notices. In a state where foreclosures are nonjudicial, access to verified and detailed data can mean the difference between a secure investment and a costly legal entanglement. For instance, platforms like LeadList.Pro provide weekly preforeclosure leads that combine AI insights with verified court records, giving investors the information they need to minimize risks effectively.

FAQs

::: faq

What happens if there’s an error in a foreclosure sale notice?

Errors in a foreclosure sale notice can lead to serious legal complications. In Massachusetts, something as simple as an incorrect property description in the notice can render the foreclosure sale invalid. This means the foreclosing party might not be able to secure legal ownership of the property. Courts are often reluctant to grant summary judgment in cases where such errors are evident.

That said, the Massachusetts Supreme Judicial Court has made it clear that not every issue with a foreclosure notice automatically nullifies the sale. For instance, failing to strictly adhere to the statutory 35A notice requirement - informing the borrower of their right to cure - doesn’t always invalidate the foreclosure. Courts take a closer look at the specifics of each case, weighing the nature of the error and its overall impact. :::

::: faq

How does a chain of title impact foreclosure validity in Massachusetts?

In Massachusetts, the chain of title plays a crucial role in determining whether a foreclosure sale is legally valid. Courts require that the lender conducting the foreclosure is either the recorded mortgage holder when the first notice of sale is published or has an unrecorded assignment available for inspection during the sale. If the lender’s ownership of the mortgage cannot be clearly traced through the chain of title at the time of the notice, the foreclosure is deemed invalid, and any subsequent transfer of the property is void.

Key court decisions, such as U.S. Bank Nat’l Ass’n v. Ibanez and Bevilacqua v. Rodriguez, highlight this principle. These rulings reinforce the idea that a flawed chain of title leads to “bad foreclosure = bad title.” This makes it essential to thoroughly verify title documents before moving forward with a sale.

For investors and attorneys, staying ahead requires access to reliable and current title information. LeadList.Pro simplifies this process by providing weekly Massachusetts probate and pre-foreclosure leads. These leads include detailed chain-of-title data and real-time court updates, equipping users to spot potential title issues early and avoid costly complications. :::

::: faq

How can real estate professionals reduce risks when purchasing foreclosed properties in Massachusetts?

When buying foreclosed properties, real estate professionals can take several important steps to reduce potential risks. Start by verifying that the lender has the legal right to sell the property. This means confirming the complete chain of mortgage assignments to ensure the lender actually owns the mortgage at the time of the sale.

Next, review foreclosure notices to make sure they comply with Massachusetts laws, particularly those requiring proper notification to borrowers. It's also a good idea to inspect auction records for any irregularities, such as missing bidder lists or procedural mistakes, as these could lead to the sale being overturned.

Conducting a detailed title search is another crucial step. This helps uncover any gaps in ownership or unresolved liens. To further protect against potential issues, securing title insurance is highly recommended. Finally, working with seasoned foreclosure attorneys can be invaluable. They can help address legal challenges, question problematic sales, and include protective clauses in purchase agreements.

By taking these precautions, professionals can better avoid title disputes and other hidden complications after the purchase. :::