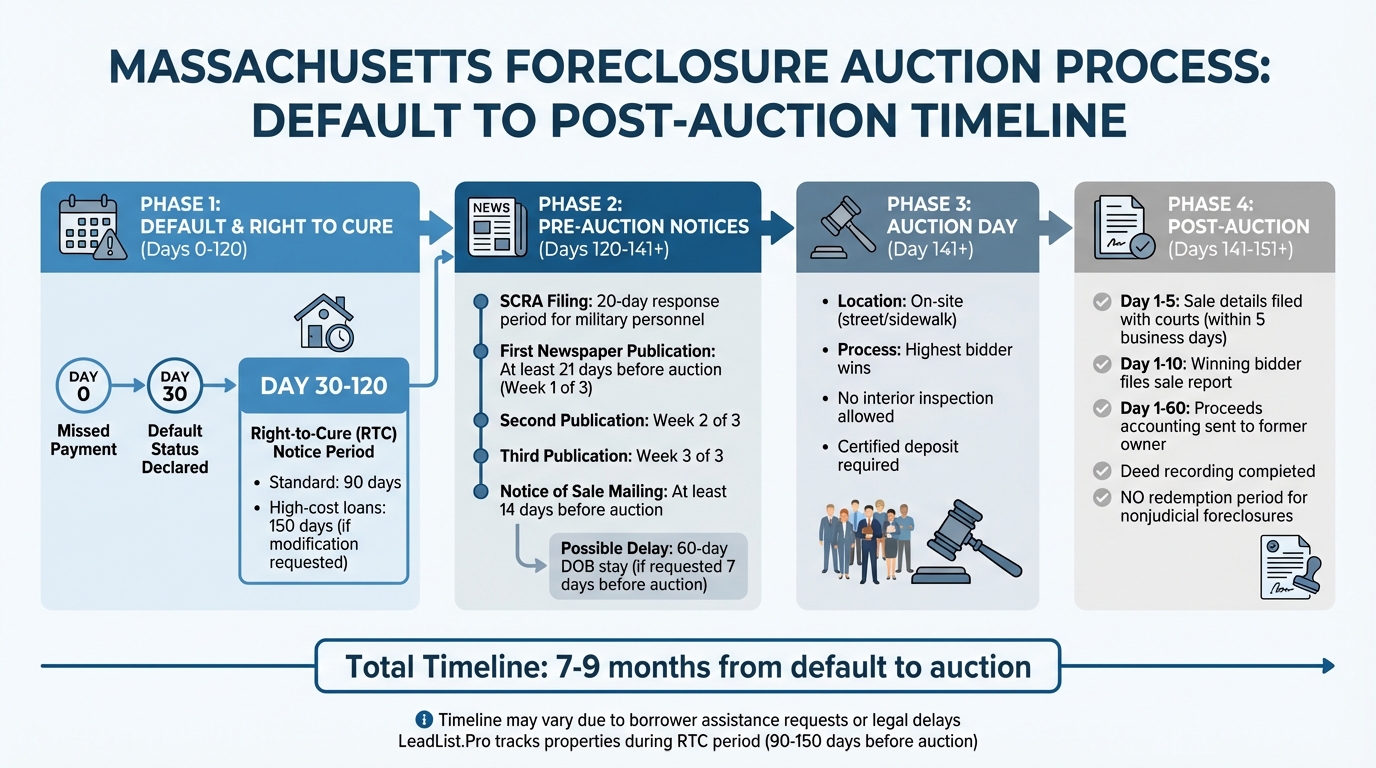

Massachusetts Foreclosure Auction Timeline

In Massachusetts, foreclosure auctions are a structured process where properties are sold to recover unpaid loans. Here's the quick breakdown:

- Foreclosure Type: Nonjudicial foreclosures dominate, using a "power of sale" clause.

- Right to Cure: Borrowers have 90 days (or 150 days for certain loans) to resolve defaults before the lender can proceed.

- Auction Notice: Must be published weekly for 3 weeks and mailed 14 days before the sale.

- Auction Day: Held on-site, usually on the street, with bidders relying on exterior inspections and public records.

- Post-Auction: Winning bidders must finalize payment and record the deed. Borrowers lose redemption rights immediately after nonjudicial sales.

For investors, tracking timelines, legal requirements, and potential delays is key. Tools like LeadList.Pro provide preforeclosure leads and updates to help navigate this process efficiently.

::: @figure  {Massachusetts Foreclosure Auction Timeline: From Default to Sale}

:::

{Massachusetts Foreclosure Auction Timeline: From Default to Sale}

:::

How Long Does A Foreclosure Take In Massachusetts? - CountyOffice.org

Pre-Auction Timeline and Key Deadlines

This phase highlights the critical deadlines and milestones that shape the pre-auction process in foreclosure cases.

Notice of Default and What It Means

A loan enters default 30 days after a missed payment [2]. At this point, the lender issues a Right-to-Cure (RTC) notice, which gives the borrower 90 days to bring the loan current before the lender accelerates the entire balance [4][2]. This notice is mandatory for owner-occupied properties with four or fewer units and officially begins the pre-foreclosure timeline.

If the borrower doesn’t resolve the default within the 90-day window, the lender can move forward with acceleration [2]. For investors, receiving an RTC notice is a clear signal that an auction may be at least three to five months away, creating an opportunity to conduct research and prepare. In cases involving certain high-cost loans, the RTC period may extend to 150 days if the borrower submits a timely loan modification request [2][4].

Here’s a quick overview of the key deadlines in the pre-auction timeline:

| Pre-Auction Step | Legal Deadline / Timing |

|---|---|

| Default Status | 30 days after missed payment [2] |

| Right-to-Cure (RTC) Notice | 90 days (standard) or 150 days (for some loans) [4][2] |

| SCRA Response Period | 20 days for active-duty military personnel [2] |

| First Newspaper Publication | At least 21 days before auction date [3] |

| Notice of Sale (Mailing) | At least 14 days before auction date [4][3] |

Once the RTC period ends, lenders must comply with strict publication and notification requirements.

Publication and Posting Requirements

After the RTC period expires, lenders are required to follow specific publication and posting rules before proceeding with the auction. For example, the Notice of Sale must be published in a local newspaper once a week for three consecutive weeks [4][3]. The first publication must appear no less than 21 days before the scheduled auction date [3]. This gives investors a reliable way to track upcoming auctions by keeping an eye on local newspapers.

In addition to publication, the lender must send a Notice of Sale via registered mail to the homeowner and any junior lienholders at least 14 days before the auction [4][3]. Before scheduling the auction, lenders also need to file a request in Land Court to confirm that the borrower is not on active military duty, as outlined by the Servicemembers Civil Relief Act (SCRA). Active-duty borrowers have 20 days to respond to this notice [2].

Borrower Assistance Options and Delays

Borrowers may sometimes delay the auction process by requesting assistance. The Massachusetts Division of Banks (DOB) offers a 60-day stay for primary residences if the borrower submits the request within 7 business days of the auction date [4][6]. However, this option is only available if the borrower has not previously requested a stay.

"At the borrower's request, DOB representatives will ask for 60 day delays on imminent auctions, if the borrower has never requested a stay previously, and the property is the borrower's primary residence." - Division of Banks [4]

For investors, these potential delays mean auction dates can shift unexpectedly. Staying informed about Land Court filings for SCRA compliance and monitoring for DOB interventions can help investors adjust their plans as needed. Borrowers seeking a stay can contact the Division of Banks at 956-1501 [4][6].

Auction Scheduling and Execution

When Auctions Are Scheduled

After the 90-day Right-to-Cure period ends without payment, the lender moves to accelerate the loan, requiring the borrower to pay the entire balance immediately [1]. In Massachusetts, the residential foreclosure process typically spans 7 to 9 months from the point of default to the auction sale [1].

Before scheduling the auction, lenders must ensure compliance with the Servicemembers Civil Relief Act (SCRA). Once SCRA compliance is verified and the loan is accelerated, the auction is scheduled, and all required pre-auction notifications are completed. Afterward, the auction's details are made public, following the protocols outlined below.

Publication in Local Newspapers

To meet legal requirements, the auction notice must be published in a local newspaper in the city or town where the property is located. This notice must appear once a week for three consecutive weeks, with the first publication occurring at least 21 days before the auction date [3]. If a local newspaper is unavailable, the notice can be published in a newspaper with general circulation within the area or county.

What Happens on Auction Day

On the day of the auction, the process is straightforward and quick. In Massachusetts, foreclosure auctions are usually held on-site, often on the street or sidewalk directly in front of the property [9]. A professional auctioneer oversees the sale, and the property goes to the highest bidder [9].

"The auction typically takes place on the street or sidewalk in front of the property, and purchasers are not allowed into the home."

- Christopher Brine, Attorney at Law, Brine Consumer Law [2]

Bidders are required to register on-site and provide a certified deposit [8]. Since bidders are not allowed inside the property, they must rely on the exterior appearance and public records for their evaluations [2]. It's worth noting that the foreclosing bank often participates in the bidding and may even purchase the property [9]. The final sale details, including the price and buyer's identity, must be updated in the state's foreclosure system within five business days of filing with the courts [10].

sbb-itb-fc184bb

Post-Auction Procedures and Investor Considerations

Winning Bidder Payment Requirements

The Terms of Sale, published weekly before the auction in the foreclosure notice, outline the specific payment requirements for the winning bidder [3]. This document is crucial because it specifies how much cash is needed at the auction and when the remaining balance must be paid. Investors should pay close attention to these details, as they are legally binding.

Within 10 days of the auction, the winning bidder must file a sale report under oath with the clerk's office [11]. This report acts as the official record of the transaction.

For tax lien foreclosures, the timeline differs significantly. A private buyer cannot take immediate possession of the property. Instead, they must wait either 6 or 12 months, depending on when the tax taking or sale occurred, before filing a complaint in Land Court to begin the final foreclosure process [5][12]. During this waiting period, the property owner can reclaim their property by paying off all debts, interest, and legal fees. This delay can affect an investor’s liquidity and overall planning.

The final steps in the process include transferring a clear title and ensuring the proper distribution of sale proceeds.

Deed Recording and Proceeds Distribution

The next step for registered titles involves filing a foreclosure affidavit (MGL c. 244, § 15) with the assistant recorder, followed by submitting the deed to obtain a new certificate of title [13]. For unregistered land, the deed is recorded at the Registry of Deeds using the standard process.

The mortgage holder is required to provide a detailed accounting of the sale proceeds. This includes the sale price, legal fees, and auctioneer costs, and they are entitled to retain the secured amount along with associated expenses (MGL c. 183, § 27) [14]. The former owner must receive this itemized accounting within 60 days of the funds being received [14]. Any surplus from the sale must be returned to the mortgagor or their heirs [14].

"The holder of a mortgage of real estate... shall provide to the mortgagor... a written notice containing an itemized accounting of the disposition of the proceeds arising from a sale under the power of sale... within 60 days after the receipt of such funds." - MGL c. 183, § 27 [14]

Starting November 1, 2024, Massachusetts law grants former property owners the right to claim "excess equity" - the remaining value after unpaid taxes, interest, fees, and foreclosure costs are deducted [12]. Those who lost properties to tax foreclosure between May 25, 2021, and October 31, 2024, can file a claim for this excess equity in Superior Court [12].

Equity of Redemption and Legal Considerations

Once the deed recording is complete, it’s essential to understand the legal implications regarding redemption rights.

In nonjudicial mortgage foreclosures, there is no post-sale redemption period [15]. The borrower’s right to redeem the property by paying off the full loan amount ends at the foreclosure sale [15]. This means the winning bidder gains immediate equitable title.

"Massachusetts law, however, doesn't provide a post-sale redemption period when it comes to nonjudicial foreclosures." - Amy Loftsgordon, Attorney, Nolo [15]

For tax lien foreclosures, the rules are different. The property owner retains the right to redeem the property by paying all taxes, interest, and fees until the Land Court issues a final judgment of foreclosure [5]. Once the judgment is entered, the right of redemption ends, and the plaintiff gains full ownership [12]. However, a foreclosure judgment can be challenged within one year of entry under "extraordinary circumstances." That said, if the property has already been sold to a third party, overturning the judgment becomes far more challenging [12].

It’s also important to note that the foreclosure deed transfers the property subject to all prior encumbrances. This includes restrictions, easements, tax titles, and municipal liens created before the foreclosed mortgage [3]. Since these liens remain attached to the property, investors should conduct thorough title searches before bidding. These legal constraints should be factored into any bidding strategy.

| Foreclosure Type | Redemption Deadline | Post-Sale Redemption Period |

|---|---|---|

| Nonjudicial Mortgage | Before the foreclosure sale occurs | None [15] |

| Tax Lien Foreclosure | Until Land Court enters final judgment | None (ends at judgment) [5] |

| Judicial Mortgage | Before the court-ordered sale | Generally none [15] |

How LeadList.Pro Helps Track Preforeclosure Properties

LeadList.Pro simplifies the process of tracking preforeclosure properties by offering county-specific leads, real-time court updates, and AI-based insights, ensuring investors can plan and act with precision.

County-Specific Preforeclosure Leads

LeadList.Pro provides preforeclosure leads for all 14 counties in Massachusetts, with subscription plans ranging from $99 to $249 per month. These leads include detailed property information, contact data, and AI-generated distress scores, giving investors an edge [4][3]. The platform compiles properties during the Right-to-Cure period, which allows investors to act before public auction notices are released - typically just 21 days before the sale [4][3]. To ensure accuracy, all data is manually verified, confirming ownership and other key details. This localized approach positions investors to make the most of real-time court data for better auction planning.

Real-Time Court Data for Auction Planning

LeadList.Pro keeps a close watch on Land Court filings, such as "servicemember's cases" under the Servicemembers Civil Relief Act (SCRA), which often indicate that foreclosure sale scheduling is underway [15][1][2]. It also tracks the Land Court’s Order of Notice, a critical document granting homeowners 30 days to confirm their military status [16]. Additionally, the platform monitors Registry of Deeds recordings to ensure that the required chain of assignments is properly documented. This step is crucial, as a missing or incorrect chain can invalidate a foreclosure sale [15][7]. LeadList.Pro also identifies potential delays, such as when the Division of Banks requests a 30- to 60-day auction stay, provided the request is made within 7 days of the scheduled auction date [6].

AI-Driven Insights for Better Decisions

Beyond tracking legal and procedural details, LeadList.Pro leverages AI to help investors make smarter decisions. Features like AI-generated distress scores and AI Street View Analysis highlight properties with the highest likelihood of sale. This allows investors to focus their time and resources on the most promising opportunities, streamlining their outreach efforts.

Conclusion

Summary of the Foreclosure Auction Timeline

The foreclosure process in Massachusetts follows a structured timeline that real estate investors need to grasp. After a borrower misses a payment, they enter a 90-day Right to Cure period, which, combined with the initial 30-day default period, totals 120 days before foreclosure proceedings can formally begin [1]. Once this phase concludes, lenders are required to publish a Notice of Sale in a local newspaper for three consecutive weeks and mail a notice to the property owner at least 14 days before the auction, adhering to strict statutory deadlines [2][3].

Foreclosure auctions are typically held on the street or sidewalk in front of the property. Once the auction concludes, the borrower loses the right to reclaim the property [1]. Winning bidders have 30 days to finalize the sale and may need to initiate eviction proceedings if the property is still occupied [2]. These deadlines play a critical role in shaping investment strategies and timing decisions.

Tips for Real Estate Investors

For investors, understanding these timelines opens the door to several strategic opportunities. The 90-day Right to Cure period is an ideal time to approach homeowners with cash offers, potentially avoiding the competition of a public auction [2]. Keeping track of the three-week newspaper publication requirement can also provide early notice of upcoming auctions. Additionally, verifying that the foreclosing lender has recorded a complete chain of assignments at the Registry of Deeds is crucial, as missing documentation could disrupt the sale [3].

Investors should also account for eviction timelines and holding costs - such as mortgage payments, taxes, insurance, and maintenance - when calculating potential returns. As Devon Wayne, Founder of ASAP Cash Offer, notes:

"Holding costs are the silent equity killer. Waiting 90 days for a 'higher price' often nets you less money once you factor in mortgage payments, insurance, taxes, and maintenance." [17]

To streamline the process, tools like LeadList.Pro can be invaluable. This platform tracks properties during the Right to Cure period, monitors Land Court filings for SCRA cases, and uses AI-generated distress scores to prioritize opportunities. With preforeclosure leads specific to counties starting at $99 per month and real-time court data, investors can act quickly and decisively before auction details become widely available. Staying on top of these timelines allows for smarter investment decisions and better positioning in Massachusetts' foreclosure market.

FAQs

::: faq

What are the important deadlines in the Massachusetts foreclosure auction process?

In Massachusetts, the foreclosure auction process includes specific deadlines aimed at giving homeowners a fair chance to address their situation. Once a homeowner falls 30 days behind on mortgage payments, the lender typically considers the loan to be in default. At this stage, the lender is required to send a Notice of Right to Cure, which explains the overdue amount and provides a deadline for catching up on payments.

If the homeowner doesn’t resolve the default, the lender can proceed with foreclosure. For foreclosures under power of sale, the law mandates that the auction be publicly announced in a local newspaper for three consecutive weeks, with the first notice published at least 21 days before the auction date. In addition, the lender must notify the property owner via registered mail at least 14 days before the sale. These measures are designed to give homeowners time to respond, seek solutions, or take action to stop the foreclosure if possible. :::

::: faq

What steps can investors take to track and prepare for foreclosure auctions in Massachusetts?

To keep up with foreclosure auctions in Massachusetts, investors need to understand the foreclosure timeline and pay attention to essential legal notices. The process kicks off with a notice of default, marking the beginning of foreclosure proceedings. To stay informed, investors can check court filings and use official foreclosure databases, such as those managed by the Massachusetts Division of Banks, which provide regularly updated information on auction dates and sale specifics.

Massachusetts law requires that sale notices are published in newspapers at least 21 days before the auction date. Additionally, property owners must receive mailed notices at least 14 days prior to the sale. Knowing these deadlines allows investors to stay ahead of the curve and prepare for upcoming auctions. For those interested in spotting preforeclosure opportunities, services like LeadList.Pro provide verified data and insights to make well-informed decisions. :::

::: faq

What can homeowners in Massachusetts do to delay or stop a foreclosure auction?

Homeowners in Massachusetts have a few ways to delay or stop a foreclosure auction. One option is to request a delay through the Department of Banks (DOB). If the auction is imminent and the property serves as the homeowner's primary residence, the DOB may grant a stay of 30 to 60 days. This can provide some breathing room.

Filing for bankruptcy, such as Chapter 7, is another way to temporarily halt the foreclosure process. This step can give homeowners additional time to consider their options and work toward a solution.

Pursuing loss mitigation is also worth exploring. For example, applying for a loan modification could pause foreclosure proceedings, as Massachusetts law prevents lenders from moving forward while a loss mitigation application is under review. Homeowners might also negotiate directly with their lender or seek legal assistance to explore other possible resolutions.

Acting quickly is key. Consulting with a housing counselor or legal professional can provide valuable guidance and potentially help prevent foreclosure altogether. :::