Massachusetts Probate Asset Distribution Rules

In Massachusetts, probate ensures that a deceased person's assets are distributed according to their will or state law. This process also protects creditors' rights and ensures legal transfers of property. Not all assets require probate - some, like jointly owned property or accounts with named beneficiaries, transfer automatically. Here's what you need to know:

- Probate Assets: Solely-owned property or assets without designated beneficiaries (e.g., single-name bank accounts, personal property).

- Non-Probate Assets: Automatically transfer via contracts or joint ownership (e.g., life insurance, joint accounts, trusts).

- Probate Types: Informal (simpler), Formal (court-supervised), and Late & Limited (restricted after 3 years).

- Key Deadlines: Probate must begin within 3 years of death; creditors have 12 months to file claims.

- Spousal Shares: Distribution depends on family structure (e.g., blended families follow specific rules).

- Real Estate: Requires careful handling, especially for probate properties.

For real estate professionals, understanding probate timelines and asset types is crucial when navigating property sales tied to estates. Massachusetts law prioritizes creditor claims and taxes before heirs receive distributions, and estate taxes apply to assets over $2 million. Always verify property titles and the Personal Representative's authority to manage sales.

Protect Your Estate! The CRITICAL Role of ASSET Titling Explained! ⚖️💼

How the Massachusetts Probate Process Works

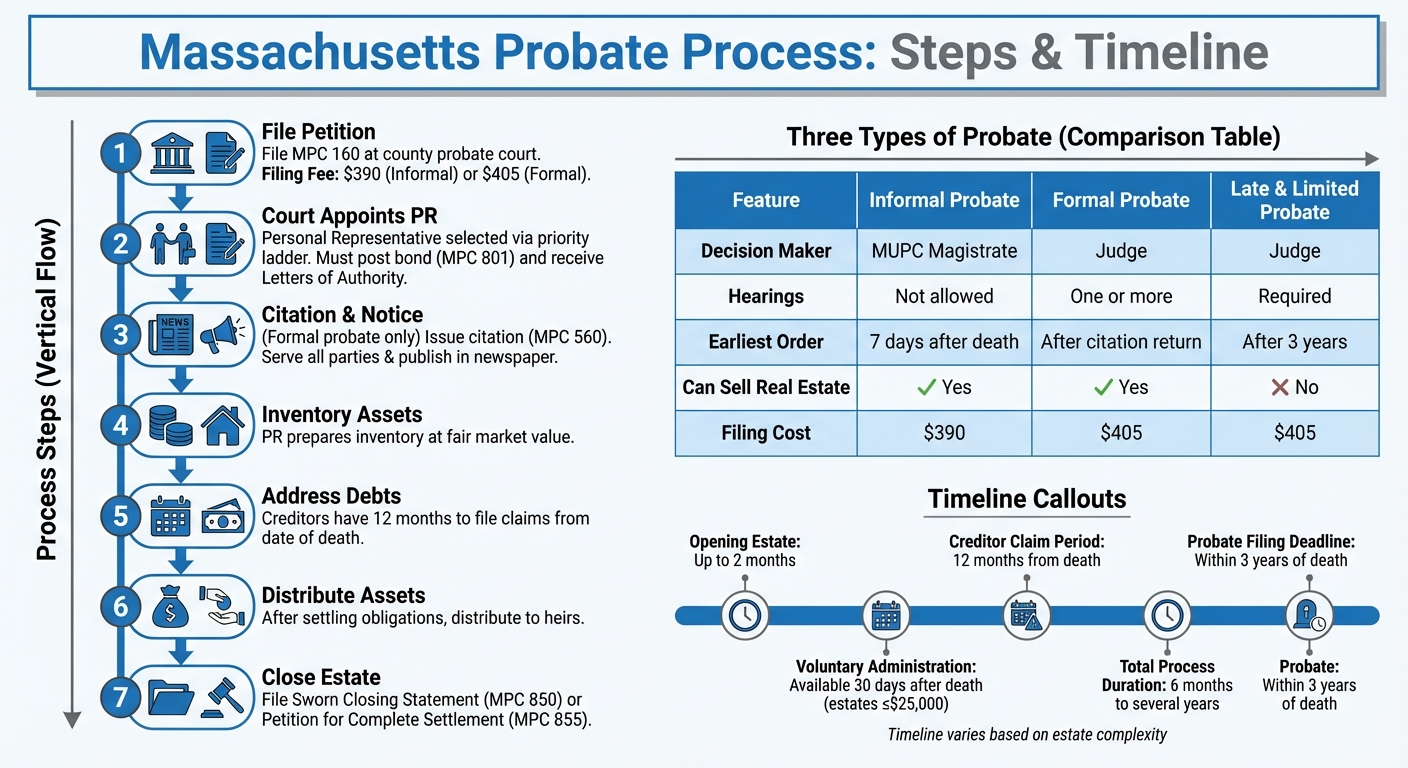

::: @figure  {Massachusetts Probate Process Timeline and Steps}

:::

{Massachusetts Probate Process Timeline and Steps}

:::

Understanding the Massachusetts probate process involves navigating several key steps, each designed to ensure the proper administration of an estate.

Steps in Probate Administration

The process begins with filing a petition (MPC 160) at the appropriate county probate court. Filing fees total $390, though formal probate adds a $15 citation fee, bringing the total to $405 [4][6].

Once the petition is filed, the court appoints a Personal Representative (PR) to oversee the estate. The Massachusetts Uniform Probate Code (MUPC) outlines a "priority ladder" for PR selection, starting with the person named in the will, followed by the surviving spouse, and then other heirs [3]. Before acting, the PR must post a bond (MPC 801) and receive Letters of Authority.

In formal probate cases, the court issues a citation (MPC 560), which must be served to all interested parties and published in a local newspaper [4]. This step allows time for objections. The PR is also responsible for preparing an inventory of the estate's probate assets at fair market value [3].

The next phase involves addressing debts and claims. Creditors have 12 months from the date of death to file claims against the estate. If a claim is denied, creditors have an additional year to pursue legal action [7]. Only after settling these obligations can the PR distribute the remaining assets to heirs or beneficiaries [3].

Finally, the estate is closed using either a Sworn Closing Statement (MPC 850) or a Petition for Order of Complete Settlement (MPC 855) [3].

Types of Probate: Informal, Formal, and Late

Massachusetts offers three probate options, each with its own procedures and timelines.

-

Informal probate is a quicker, more straightforward process managed by a MUPC Magistrate. No court hearings are involved, and an order can be issued as soon as 7 days after death [5]. This option works well when the original will is available, all heirs are known, and there’s no conflict.

-

Formal probate is a court-supervised process overseen by a judge. It’s necessary when the will is a copy, contains handwritten edits, has ambiguous terms, or if disputes arise. While slower due to court schedules, it provides greater oversight.

-

Late and Limited probate applies when probate isn’t initiated within three years of death. Under this option, the PR’s authority is limited - they cannot sell real estate, but they can confirm title for successors and pay administrative expenses [3][5].

| Feature | Informal Probate | Formal Probate | Late and Limited Probate |

|---|---|---|---|

| Decision Maker | MUPC Magistrate | Judge | Judge |

| Hearings | Not allowed | One or more hearings | Required for appointment |

| Earliest Order | 7 days after death | After citation return date | After 3 years from death |

| Real Estate Sale | PR can sell with authority | PR can sell with authority | Cannot sell real estate |

| Base Filing Cost | $390 | $405 | $405 |

For small estates without real estate and personal property valued at $25,000 or less (excluding one car), Voluntary Administration offers a simplified option that can begin 30 days after death [5].

Distribution Timeline

The probate process in Massachusetts can take anywhere from 6 months to several years, depending on the estate’s complexity [7]. Opening the estate alone may take up to two months, accounting for the time required to file the petition, validate the will, and notify interested parties [7].

A key factor in the timeline is the creditor claim period. Creditors have 12 months from the date of death to file claims, and if denied, they can take legal action for an additional year. This means assets generally cannot be fully distributed until at least one year after the decedent’s death [7].

Probate must be initiated within three years of death [3]. Missing this deadline results in late and limited probate, which restricts the PR’s authority, particularly regarding the sale of real estate.

Other factors can further delay the process, such as disputes among beneficiaries, unexpected heirs, assets located in multiple states, hard-to-value assets, or ongoing creditor lawsuits [7]. In some cases, the court may require supervised administration, where every PR action needs court approval [5].

Intestate Succession Rules in Massachusetts

In Massachusetts, when someone passes away without a will, the distribution of their probate assets is determined by state law. This process is outlined in the Massachusetts Uniform Probate Code (MUPC) and applies strictly to probate assets. Non-probate assets - like life insurance policies, 401(k) accounts, or jointly owned property - are not affected by these rules and pass directly to the designated beneficiaries or co-owners [9]. The intestacy rules play a key role in deciding how the estate is divided after the probate process.

Spousal and Descendants' Shares

The share inherited by a surviving spouse depends on the family structure. If the spouse and the deceased share all their children together, the spouse inherits the entire estate [8]. However, in blended families, the estate is divided differently.

If the deceased has children from another relationship, or if the surviving spouse has children from a prior relationship, the spouse is entitled to the first $100,000 of the estate plus half of the remaining balance. The other half is then divided among the deceased's children [12,13].

For example, if Bill died with $400,000 in probate assets and his spouse, Karen, had a child from a previous marriage, Karen would receive $250,000. This includes the first $100,000 plus half of the remaining $300,000. Bill’s biological children would split the remaining $150,000 [9].

If there are no children but the deceased's parents are still alive, the spouse receives the first $200,000 and three-quarters of the remaining balance. The parents inherit the remaining quarter [12,13]. For instance, when Gerry passed away leaving $500,000 in probate assets, his spouse, Joe, inherited $425,000, and Gerry's father received $75,000 [9].

Adopted children are treated the same as biological children under Massachusetts law, inheriting equally. However, stepchildren and foster children only inherit if they were legally adopted [9]. Children born outside of marriage can inherit from their father if paternity has been legally established [4,13]. Additionally, heirs must survive the deceased by at least 120 hours to receive their inheritance [9].

Order of Heirship Beyond Spouse and Descendants

When there is no surviving spouse or descendants, Massachusetts law follows a specific order to determine who inherits the estate.

First in line are the deceased’s parents. If both are alive, they split the estate equally. If only one parent survives, they inherit the entire estate [10].

If no parents are alive, the estate goes to the deceased’s siblings and their descendants. The distribution follows a per capita method at each generational level, ensuring that relatives of the same generation receive equal shares. Half-siblings are treated the same as full siblings when it comes to inheritance [13,14].

If there are no siblings or their descendants, the estate passes to the next closest relatives, determined by their degree of kinship. If two relatives are equally distant but trace their claim through different ancestors, the one connected through the nearest ancestor takes precedence [10]. If no heirs can be identified, the estate is transferred to the Commonwealth of Massachusetts [8].

There is one notable exception: if a veteran dies without heirs while residing in a state-operated veterans’ home, their property goes to the legacy fund for that home [12,13].

Finally, inheritance rights are not impacted by immigration status. Relatives are entitled to their share of the estate regardless of whether they are U.S. citizens or legally present in the country [9].

Distribution Under a Valid Will

In Massachusetts, when someone passes away leaving a valid will, their probate assets are distributed according to the will's instructions, as outlined by the Massachusetts Uniform Probate Code (MUPC). The will governs the transfer of all property owned by the deceased at the time of death, along with any property acquired by the estate later on [11]. However, complications arise if the estate lacks sufficient assets to fulfill all bequests, triggering rules that proportionally reduce gifts. This system provides clarity and ensures the testator's wishes are followed, offering a clear contrast to the rules of intestate succession.

Priority of Bequests

Massachusetts law sets a specific order for reducing or "abating" bequests when estate assets are insufficient:

- Intestate property: Assets not specifically addressed in the will are reduced first.

- Residuary devises: The remaining estate, after specific and general gifts, is the next to be reduced proportionally.

- General devises: Monetary gifts from the general estate are then proportionally reduced.

- Specific devises: Finally, identifiable assets like a named property are reduced proportionally.

This order can be overridden if the will explicitly states a different arrangement or if following the standard order would contradict the testator's clear intent. Under the MUPC, real estate and personal property are treated equally, ensuring that even limited resources are allocated according to the will's terms.

| Bequest Type | Priority in Abatement | Description |

|---|---|---|

| Intestate Property | 1st to be reduced | Assets not covered by the will or its residuary clause |

| Residuary Devises | 2nd to be reduced | The remainder of the estate after specific and general gifts are satisfied |

| General Devises | 3rd to be reduced | Monetary gifts from the general estate |

| Specific Devises | 4th to be reduced | Identifiable assets, such as a named piece of real estate |

Handling Real Estate in the Will

Real estate often adds a layer of complexity to estate distribution. Under the MUPC, real estate gifts are distributed as outlined in the will. If the designated beneficiary for a real estate gift dies before the testator, the gift may lapse and become part of the residuary estate - unless the anti-lapse statute applies or an alternate beneficiary is named. If the residuary gift also fails, the property passes through intestate succession.

A notable case highlighted this issue when a lapsed real estate gift, without alternate provisions, defaulted to intestate distribution [2].

Typically, real estate is transferred "in kind", meaning the property itself is passed to the beneficiary rather than being sold for cash. However, if the will directs a sale or if selling the property is necessary to settle debts, the property may be liquidated. According to MUPC § 3-814, real estate transfers include any attached mortgages or liens, passing both the asset and its associated debt to the beneficiary.

One significant limitation to a will's provisions is the spousal elective share. A surviving spouse can waive the terms of the will and claim a statutory share under MGL c. 191, § 15. In the 2019 case Ciani v. MacGrath, the Massachusetts Supreme Judicial Court ruled that if a surviving spouse's elective share exceeds $25,000, their interest in real property is reduced to a life estate rather than outright ownership [2].

sbb-itb-fc184bb

Creditor Claims and Tax Obligations

Once the probate asset inventory is completed and creditors are notified, Massachusetts law requires that all claims and taxes be resolved before any assets can be distributed to heirs. In fact, under the Massachusetts Uniform Probate Code, creditors and estate administration costs take precedence over the rights of heirs and devisees to receive property [1].

Creditor Claim Priority

Massachusetts law enforces a strict order for paying estate debts, as outlined in MGL c. 190B, § 3-805. If an estate doesn’t have enough assets to cover all obligations, the personal representative must follow this hierarchy:

| Priority Class | Type of Claim |

|---|---|

| Class 1 | Costs and expenses of estate administration |

| Class 2 | Reasonable funeral expenses |

| Class 3 | Debts and taxes prioritized under federal law |

| Class 4 | Medical and hospital expenses from the last illness |

| Class 5 | Debts and taxes prioritized under Massachusetts laws |

| Class 6 | Debts owed to the Division of Medical Assistance (MassHealth) |

| Class 7 | All other claims |

If there aren’t enough assets for all claims within a class, payments are divided proportionally among those claims [1]. Importantly, a claim due immediately doesn’t outrank another claim in the same class that’s due later.

General creditors must file claims within one year of the decedent’s death, while MassHealth has a longer, three-year window [15]. Massachusetts doesn’t require personal representatives to notify creditors individually. Instead, they must publish a notice in a local newspaper at least seven days before the court’s return date [15].

Beyond creditor claims, the estate must also address tax obligations.

Massachusetts Estate Tax Considerations

The Massachusetts estate tax adds another layer of financial responsibility, further reducing what heirs ultimately receive. For individuals who pass away on or after January 1, 2023, estates valued up to $2,000,000 are exempt from this tax [12][13]. Recent tax reforms have removed the prior "cliff" effect, meaning only the portion of the estate exceeding $2,000,000 is taxed - not the entire estate value [12].

To determine if an estate exceeds the exemption threshold, personal representatives must include "adjusted taxable gifts" - lifetime gifts over the annual federal exclusion amount of $17,000 (as of 2023) - in the estate's gross value [12][13]. For example, an estate worth $2,100,000 would owe approximately $7,200 in taxes after applying the $99,600 credit available for deaths in 2023 or later [12][13].

An estate tax lien automatically attaches to all real estate owned by the decedent [13][14]. This lien must be cleared before the property can be sold or transferred with a clear title. For estates under the $2,000,000 threshold, the personal representative can record an affidavit with the Registry of Deeds to confirm no estate tax return is required [13][14]. For estates needing a quick resolution, Form M-4422 can be filed to request a faster lien release [13][14].

To qualify for an automatic six-month filing extension, personal representatives must pay at least 80% of the estimated tax due within nine months of the decedent’s death [13][14]. Late filing and payment penalties accrue at 1% per month of the outstanding balance, up to a maximum of 25% [13][14].

Real Estate and Title Transfers in Probate

When it comes to probate, transferring real estate involves meticulous attention to title and deed documentation. Once creditor claims and taxes are settled, the personal representative handles the transfer of property to the rightful heirs. This step ties the financial resolution of the estate to the legal transfer of ownership, marking a critical phase in the probate process.

Probate vs. Non-Probate Real Estate

Real estate ownership determines whether a property enters probate. If the property is solely in the decedent's name or held as tenants in common, it must go through probate. On the other hand, property held as joint tenants or as tenants by the entirety bypasses probate and automatically transfers to the surviving co-owner[2].

For real estate professionals or investors, verifying the type of deed at the Registry of Deeds is essential before pursuing probate opportunities. For example, a property listed under "joint tenants" likely won't require probate, while one owned as "tenants in common" will need to go through the probate process.

Deeds of Distribution

For properties subject to probate, a specific legal document - called a deed of distribution - formalizes the transfer. This document applies exclusively to probate real estate, as outlined above. The personal representative uses the deed of distribution to transfer the title to heirs or beneficiaries. According to MGL 190B, §3-907, the deed serves as proof that the distributee has inherited the estate's interest in the property[16].

"If distribution in kind is made, the personal representative shall execute an instrument or deed of distribution assigning, transferring or releasing the assets to the distributee as evidence of the distributee's title to the property." - MGL 190B, §3-907[16]

However, a deed of distribution does not guarantee complete protection against future claims. Title remains vulnerable to creditor claims for one year and estate expenses for up to six years[16]. This means buyers acquiring property transferred via a deed of distribution could encounter unexpected liens if unresolved estate debts emerge later.

For properties registered with the Massachusetts Land Court, an additional petition is needed to confirm heirs-at-law[16]. In such cases, personal representatives often request a license to sell from the Probate Court. This license ensures the title is free from estate claims, but it is only valid for one year after issuance[16].

To fully settle the title and close the estate, personal representatives can either file a Closing Statement (which is subject to a one-year challenge period) or submit a Petition for Order of Complete Settlement. The latter permanently resolves the estate, barring instances of fraud[16].

Opportunities for Real Estate Professionals in Probate Leads

Massachusetts probate laws provide a unique opportunity for real estate professionals by making key property records accessible. These public records reveal crucial details such as the decedent's assets, debts, and heirs[17]. For those in real estate, this transparency opens the door to identifying properties during probate - a time when families are often more inclined to sell.

The focus should be on properties titled solely in the decedent's name or as "tenants in common", as these must go through probate and require a Personal Representative (PR) to manage the sale[17][18]. In contrast, properties held jointly or in trusts typically avoid the probate process. Since probate cases in Massachusetts remain open for at least 12 months to allow creditor claims[18], real estate professionals who track these cases early can establish relationships with families, paving the way for future opportunities.

Timing Real Estate Sales in Probate

The appointment of the Personal Representative is a critical milestone for real estate professionals. This court-approved individual is the only one legally authorized to manage the estate's assets, pay off debts, and sell or distribute real property[18]. Until this appointment, no one can negotiate a property sale on the estate's behalf.

Timing is everything. Massachusetts imposes a three-year rule: if probate is filed more than three years after the decedent's death, the PR cannot obtain a license to sell real estate[3]. This restriction makes it essential to act within the window when properties are viable for sale.

PRs often delay property sales until all creditor claims are resolved, as they could face personal liability for unpaid debts. While simpler estates might distribute inheritances within six months, those involving real estate often take a year or more to settle. Real estate professionals should monitor the PR's appointment date and plan outreach around the one-year mark, when families are likely to have a clearer understanding of debts and are ready to consider selling. By leveraging these timing insights, professionals can enhance their strategies for connecting with families at the right moment.

Using LeadList.Pro for Probate Opportunities

To streamline the probate prospecting process, LeadList.Pro offers a powerful solution. The platform provides weekly probate leads sourced directly from Massachusetts Probate and Family Courts, removing the hassle of manually searching through records across 14 counties. Delivered in CSV format, these leads include AI-generated distress scores along with detailed property and contact information.

The AI-generated distress scores are particularly valuable, helping professionals prioritize outreach by identifying estates most likely to result in property sales. Combined with manual verification of property ownership, this ensures that efforts are focused on properties requiring probate and overseen by a PR with the authority to sell.

With real-time data, you can reach out to families shortly after the PR receives their Letters of Authority, positioning yourself as a helpful resource before they are inundated with offers. Since probate cases are handled in the county where the decedent lived - such as Plymouth Probate and Family Court for residents of the South Shore[18] - LeadList.Pro's county-based subscriptions allow you to target specific geographic areas effectively.

The platform also flags potential complications early. For example, it identifies properties with MassHealth liens for long-term care recovery or estates involving multiple properties titled solely in the decedent's name[19][20]. This level of detail ensures you can set accurate expectations and provide families with informed guidance as they navigate the probate process.

Conclusion

Key Takeaways

Understanding Massachusetts probate rules is essential for real estate professionals involved in asset transfers. Properties held in joint tenancy or trusts typically bypass probate, while those titled solely in the decedent's name require full probate proceedings. This distinction underscores the critical role of the Personal Representative (PR) in the process.

The Personal Representative's authority is central to any probate transaction. According to Massachusetts General Laws c. 190B, § 3-703, "A personal representative is a fiduciary who shall observe the standards of care applicable to trustees... [and] shall have the duty to settle and distribute the estate of the decedent... as expeditiously and efficiently as is consistent with the best interests of the estate."[21] Without Letters of Authority, no individual can legally manage or sell estate property. In cases where probate is initiated more than three years after death, the PR's authority becomes even more restricted, especially when handling real estate transactions.

For instance, estates held in trust can move swiftly - one trust estate sold four properties within a month of the decedent's death. In contrast, an intestate estate (without a will) took four months just to list its properties, significantly increasing holding costs and reducing overall value.

To navigate these challenges effectively, real estate professionals should always verify title details and confirm whether a will grants sale authority. For intestate estates, anticipate a minimum four-month lead time to address legal formalities and creditor claims.

Tools like LeadList.Pro can streamline access to probate leads, helping professionals act promptly once the PR secures authority. By leveraging such resources, complex probate rules can be transformed into actionable strategies for real estate transactions.

FAQs

::: faq

What is the difference between informal and formal probate in Massachusetts?

In Massachusetts, probate can take one of two primary routes: informal probate or formal probate.

Informal probate is a faster, more administrative process managed by a magistrate rather than a judge. It skips court hearings and can begin as soon as seven days after the individual’s death, as long as all necessary documents - like the original will and death certificate - are in order, and all heirs and beneficiaries are identified.

Formal probate, by contrast, is overseen by a judge and involves court hearings. This route is typically required for more complicated situations, such as when the will is missing or contested, heirs are not clearly identified, or disagreements arise about the personal representative. While formal probate is more time-consuming and involves greater court involvement, it provides a structured process to resolve disputes or uncertainties surrounding the estate.

The key distinctions between these two paths come down to the degree of court oversight, the time required, and the complexity of the estate being managed. :::

::: faq

How are probate assets distributed to a spouse in blended families under Massachusetts law?

In Massachusetts, the portion of a decedent's estate that a surviving spouse receives during probate depends on several factors, including whether the family includes children from previous relationships. These rules are outlined in Massachusetts General Laws Chapter 190B, Section 2-102.

If the decedent leaves no surviving children or parents, the spouse inherits the entire estate. However, things are more complex in blended families - where either the decedent or the spouse has children from prior relationships. In such cases, the spouse typically receives $100,000 plus half of the remaining estate balance, while the rest is distributed to the decedent’s children or other heirs according to state law.

For professionals handling probate cases in Massachusetts, understanding these details is essential. Tools like LeadList.Pro can simplify the process by offering weekly, AI-enhanced probate leads that include detailed property and contact information, making it easier to manage estates with these intricate distribution rules. :::

::: faq

What happens if probate isn’t filed within three years of someone’s death in Massachusetts?

If probate isn’t filed within three years of the individual’s death, most types of probate - like informal probate or formal testacy - can no longer be initiated. Massachusetts law does, however, provide a few exceptions for certain situations. Acting quickly is crucial to prevent delays or issues in settling the estate. :::