Top 5 Probate Seller Objections Answered

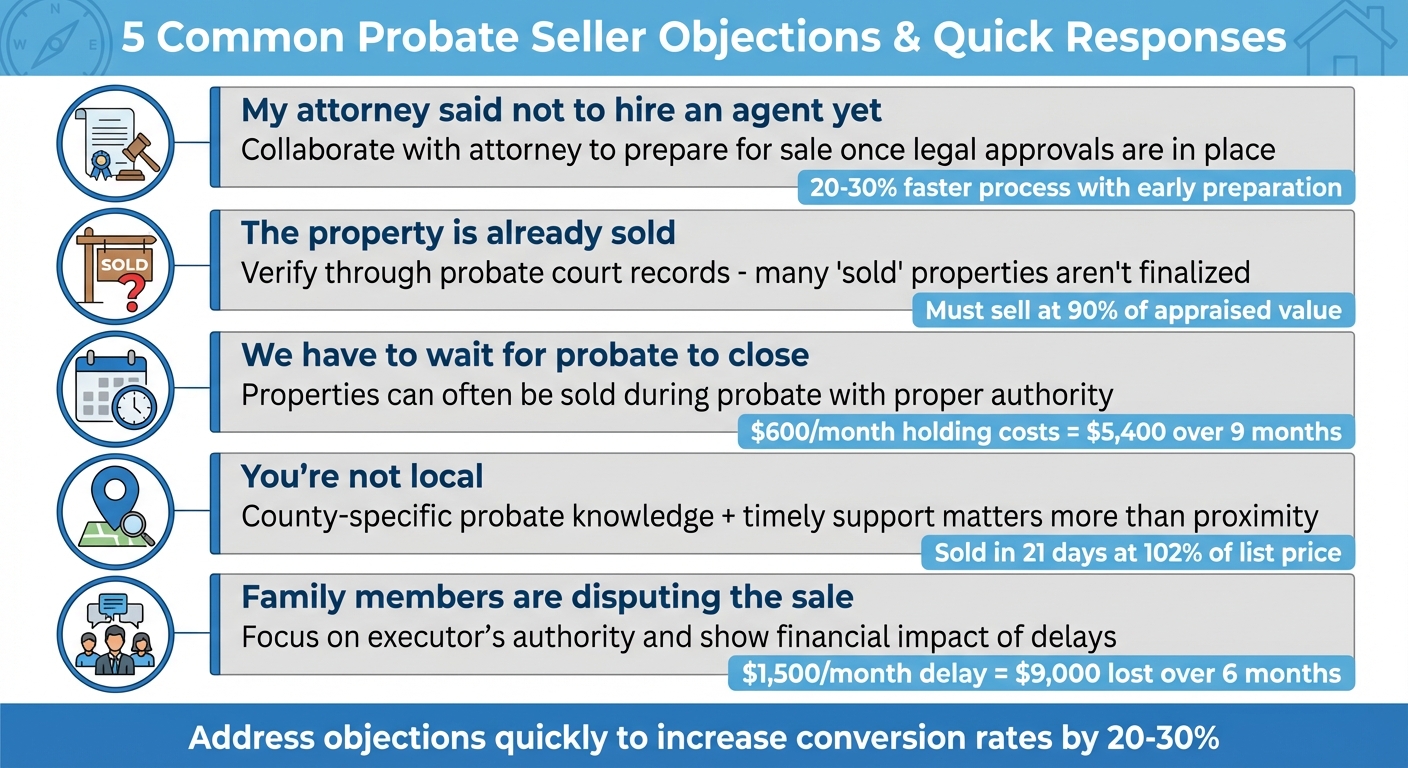

When dealing with probate sellers, you'll often face objections rooted in legal concerns, emotional stress, or misconceptions about the process. Here's a quick breakdown of the five most common objections and how to address them:

- "My attorney said not to hire an agent yet." Acknowledge their attorney's advice and offer to collaborate with them to prepare for a sale once legal approvals are in place.

- "The property is already sold." Verify the property's status through probate court records and clarify if the sale is truly finalized.

- "We have to wait for probate to close." Explain that properties can often be sold during probate, depending on the executor’s authority, which can save time and reduce holding costs.

- "You're not local." Highlight your knowledge of the county's probate process and your ability to provide timely support, even from a distance.

- "Family members are disputing the sale." Focus on the executor's authority, explain the financial impact of delays, and provide clear, neutral guidance to help resolve conflicts.

Probate sales can be complex, but addressing these concerns with clear information and empathy helps build trust and streamline the process. Tools like LeadList.Pro can provide verified probate leads, allowing you to stay informed and better navigate these challenges.

::: @figure  {5 Common Probate Seller Objections and How to Address Them}

:::

{5 Common Probate Seller Objections and How to Address Them}

:::

Handling Probate Objections (Live Roleplay)

Objection 1: My attorney said not to hire a real estate agent yet

It’s not uncommon for attorneys to advise against hiring a real estate agent early in the probate process. This advice often stems from the need to address legal matters first - like validating the will, identifying heirs, and obtaining necessary court approvals. These steps help avoid complications, especially if the personal representative doesn’t yet have court-confirmed authority to sell the property. In many states, a court order is required before listing a home, and the probate process can stretch from 6 to 12 months or even longer if disputes arise [2].

To address this concern, start by acknowledging the attorney’s cautious approach: “I completely understand your attorney’s advice to ensure everything is handled properly.” Then, highlight how you can work alongside the attorney: “I’d be happy to collaborate with your attorney to provide a market analysis and develop a sales strategy that aligns with the probate timeline. We would only proceed once all legal approvals are in place” [2].

This teamwork can actually benefit the estate in measurable ways. While the attorney focuses on the legal aspects, a real estate agent can prepare the property for sale, offering insights on market trends and recommending small repairs that could significantly increase the property’s value. For example, investing $5,000 in minor updates could potentially raise the sale price by $20,000 [2][8]. On the other hand, delaying too long can lead to a 5–10% annual loss in property value, making early preparation critical [2][8].

You might also suggest a joint consultation with the attorney. During this meeting, you could present a customized probate sales timeline and share comparable sales data. This information could help the attorney support court petitions for sale approval. By taking a proactive yet respectful approach, you could help streamline the process, potentially reducing the overall timeline by 20–30% [2][8]. When attorneys see you as a helpful resource rather than someone rushing the process, they’re more likely to support early involvement.

Objection 2: The property is already taken care of or sold

When someone says, "the property is already taken care of or sold", it often signals incomplete details about the probate process. The property might be under contract but not yet closed, family disagreements could have paused the sale, or the executor might feel overwhelmed and unsure of the actual status [9]. To navigate probate effectively, it's crucial to confirm the property's true status.

Start by independently verifying the situation through local probate court records. Look for essential documents like Letters Testamentary, Inventory and Appraisal, Petition to Sell, and the Court Order Confirming Sale. If these documents aren’t on file, it’s a strong sign the property hasn’t been officially sold through probate.

If you suspect the sale isn’t finalized, ask directly but respectfully: "That’s great progress. Could you confirm if the property is under contract or if the sale has officially closed?" This question can help clarify whether the executor plans to sell privately or if heirs have intervened, potentially requiring court oversight.

To go a step further, use tools that provide regular updates on local court data. For instance, LeadList.Pro offers real-time probate data from Massachusetts courts, complete with AI-driven distress scores and manual ownership verification, all in a convenient CSV format [1]. Rechecking "already sold" leads after a few weeks can uncover new opportunities when initial plans fall through.

Demonstrating expertise in resolving common probate challenges can also make a difference. Probate properties often need to sell at close to 90% of their appraised value or require court approval [9][5]. Consider offering a practical, data-driven solution like this:

"Even if you’re working with a buyer, probate sales often need court approval. I’d be happy to provide a free market analysis showing recent comparable sales - homes in your ZIP code have sold between $430,000 and $460,000 in the last 90 days. I can also prepare a net sheet that breaks down your estimated proceeds after repairs, closing costs, and commissions. This way, you’ll know exactly what the estate stands to receive."

Objection 3: Probate must close before we can sell

Many people believe that selling a property during probate is impossible until the process is fully closed. But that's not the case. In many situations, properties can be sold while probate is ongoing, depending on whether the executor has independent authority or needs court approval.

Here’s how it works: Executors can sell estate property in two main ways. The first is through a court-supervised sale, which involves filing a petition, accepting an offer, and obtaining court confirmation (often using an overbid process to ensure the property sells for fair market value) [10]. The second method is by using independent authority, which allows the executor to choose a buyer, set a price, and proceed with the sale after providing notice - assuming no objections arise [9].

To avoid unnecessary delays, it’s a good idea to ask your probate attorney if the estate has full selling authority. In many cases, waiting for probate to fully close isn’t required [2]. Getting clarity on this upfront can save both time and money.

Delays in selling can lead to significant holding costs. For example, if a property incurs $600 in monthly expenses over nine months, that adds up to $5,400. On top of that, properties left vacant for too long are at risk of vandalism or deterioration. Acting quickly not only reduces these costs but also helps maintain the property’s value, making it more appealing when it’s time to market.

If you're looking for opportunities to connect with estates ready to sell during probate, tools like LeadList.Pro can help. Their weekly probate leads in Massachusetts include estates with appointed representatives, and their AI-powered distress scores and real-time court data highlight mid-probate opportunities that require prompt action [1].

sbb-itb-fc184bb

Objection 4: You're not local to our county

When a probate seller expresses concern about working with someone who isn’t local, they’re usually worried about three things: whether you understand their county’s probate court processes, if you can be available when needed, and if you truly grasp the local market dynamics. These are reasonable concerns, but distance doesn’t have to mean a lack of expertise.

To address this, showcase your knowledge of the specific probate processes in their county. For instance, if you’re handling an estate in Middlesex County, explain how the Middlesex Probate and Family Court manages case assignments, the typical timeline for issuing letters of authority, and whether court confirmation is commonly required for real estate transactions. Highlight any hands-on experience you’ve had with that county’s procedures, such as navigating court confirmations or managing publication requirements. This demonstrates that your expertise goes beyond theory and is grounded in practical, local experience.

Accurate and timely information is another way to bridge the gap. By using real-time court data to track case progress, verify filings, and monitor when letters of authority are issued, you can stay ahead of status changes. Tools like LeadList.Pro, which provides weekly probate leads across counties like Suffolk, Worcester, and Essex, offer detailed case information and AI-driven distress scores, ensuring you’re always informed and ready to act [2].

Beyond process knowledge, emphasize your commitment to being accessible and engaged. Rapid responses, scheduled visits, and partnerships with trusted local vendors can all help ease concerns. For example, working with local lockbox providers and probate attorneys ensures that any on-the-ground emergencies are handled promptly, while you remain the seller’s primary point of contact.

Lastly, share success stories that highlight your ability to deliver results, even from a distance. Testimonials from previous clients can be incredibly persuasive. For example, a probate case in Middlesex County sold in just 21 days at 102% of the list price - proof that effective communication and results often matter more than physical proximity [2].

Objection 5: Heirs or family are disputing the sale

Family disputes during probate sales often bring together a mix of emotional attachment, mistrust, and disagreements over pricing, making the process more complex [2][4]. When a probate seller mentions family conflicts, it’s usually a sign that grief, financial concerns, and control issues are at play. Your role is to guide them through this challenging situation - without taking sides or offering legal advice.

Start by acknowledging the emotional weight of the situation with a simple statement like, "This must be overwhelming after a loss." Follow up with open-ended questions such as, "What’s your biggest concern about selling right now?" or "What outcome do you think would feel fair to everyone?" These questions not only uncover objections early but also help you understand the priorities of everyone involved. For instance, in one case, a surviving spouse acting as executrix faced delays when her step-son initiated probate proceedings before the will was located [2]. The agent in that scenario helped by clearly outlining steps to resolve the conflict, which ultimately moved the process forward.

To ensure clarity, request a copy of the Letters Testamentary or Administration to confirm the court-appointed decision-maker [2][4]. This document identifies the executor or administrator who has the authority to sign listing agreements and sales paperwork, even if not all heirs are in agreement. While you should leave legal advice to the estate attorney, you can explain the basics: "The court assigns one person to make decisions, but they’re required to act in the estate’s best interest and account for all funds to the beneficiaries."

Another way to help is by illustrating the financial impact of delays. Create a simple timeline that highlights key dates - like when probate opened, the expected issuance of letters, the creditor claim period, and the anticipated closing window [2][4]. Then, calculate carrying costs such as mortgage payments, insurance, taxes, utilities, and maintenance. For example, if holding the property costs $1,500 per month and disputes delay the sale by six months, that’s $9,000 in lost proceeds for the heirs. A side-by-side comparison of listing now versus delaying can make the financial consequences clear and encourage cooperation.

To minimize future conflicts, use data to bring clarity early in the process. Tools like LeadList.Pro can provide verified probate leads, distress scores, contact details for all decision-makers, and real-time court updates in an organized format [2]. By identifying potential risks - like multiple out-of-state heirs or looming preforeclosure - you can address issues before they escalate. Consistently sharing information with all heirs, summarizing the court’s status, and presenting a clear sales plan aligned with legal timelines can reduce misunderstandings and prevent last-minute surprises that might derail the sale.

Conclusion

Probate transactions often come with a set of predictable challenges - attorney warnings, claims of a completed sale, timing misunderstandings, concerns about non-local agents, and family disagreements. These issues can derail a deal if not handled quickly and effectively. The key to closing these deals often lies in how promptly and empathetically you address these concerns with accurate information. By showcasing your expertise in probate transactions and understanding the unique hurdles sellers face, you position yourself as a trusted advisor, not just another real estate agent.

Swiftly addressing objections does more than secure the deal - it also helps protect the estate from mounting costs. Expenses like taxes, insurance, and utilities can add up quickly, eating away at the property’s value. Acting promptly is crucial to avoid these pitfalls.

Research shows that taking a proactive approach to handling objections can increase conversion rates and speed up sales by 20–30% [3][11][6][7].

Having access to reliable, data-driven tools strengthens your ability to address objections effectively. For example, LeadList.Pro offers weekly, manually verified probate leads in Massachusetts, complete with AI-driven distress scores, real-time court updates, and detailed property and contact information. This kind of verified data allows you to anticipate objections before they arise. As Devon T. from Telegraph Hill Home Buyers shared:

"Looking back at the last 12 months, my number one source of opportunity has been, without a doubt, deals I've found from probate lists. The added AI-insights is the cherry on top" [1].

FAQs

::: faq

Can I sell a property that's in probate before the process is finalized?

Yes, it’s possible to sell a property during probate, but the process typically requires court approval and adherence to specific legal guidelines. The executor or administrator of the estate is responsible for ensuring that the sale aligns with the probate laws and procedures specific to their state.

Since court oversight is designed to safeguard the interests of heirs and creditors, the process can take longer than a standard property sale. Working with an attorney experienced in probate matters can help ensure the transaction is managed properly and without unnecessary delays. :::

::: faq

What’s the best way to manage family disagreements during a probate sale?

Managing family disagreements during a probate sale can be tough, but open and honest communication can make a big difference. Start by making sure everyone involved understands the process and the decisions that need to be made. It's important to stay impartial and focus on what's best for the estate as a whole.

If conflicts escalate, bringing in a neutral third party, like a mediator or an attorney, can help smooth things over. Keeping the process transparent and emphasizing fairness can help reduce tensions and ensure things move forward without unnecessary delays. :::

::: faq

What should I do if my attorney recommends waiting to hire a real estate agent during probate?

If your attorney recommends delaying the hiring of a real estate agent during the probate process, it's probably because of legal factors unique to your situation. Attorneys are familiar with the intricacies of probate laws and might suggest waiting to prevent any potential issues.

While you wait, take the time to familiarize yourself with the legal requirements and start organizing the necessary paperwork. If you're uncertain about when to bring in a real estate agent, ask your attorney for clarity on the best timing. Their advice can help keep the process smooth and safeguard your interests. :::